Market Commentary

The final EU services PMI for July came in at 54.2 vs. prev. 54.4. On a country by country basis, services PMIs came in stronger for Spain and Germany, remained unchanged for Spain and declined for Italy. UK Services PMI for July came in at 59.1 vs. prev. 57.9.

EU Retail Sales for Jun came in at 0.4% vs. prev. 0.3%.

The flow of macroeconomic data will pick up in the afternoon session, with ISM Non-Manufacturing being a key data release for the day.

Intraday Strategy: E-mini S&P

The E-mini S&P spent the majority of yesterday’s session in a phase of consolidation before extending the day’s trading range post cash equity open. While the price has remained accepted in the upper boundary of yesterday’s trading range in overnight trade, weaker Chinese and EU Services PMI data prompted a mild de-cline in tandem with European equity indexes.

For today’s session we aim to sell into a pullback to 1942.50. The main caveat for our approach is the event risk posed by the upcom-ing US data releases.

Intraday Strategy: DAX

The Dax continues to trade within a consolidation range, having extended the low briefly in yesterday’s session. A strong final revi-sion for the German Services PMI has been keeping the Dax rela-tively buoyant throughout the session so far.

Our strategy for the day entails selling into a pullback to R1, target-ing the pivot and yesterday’s low.

Intraday Strategy: EUR/USD

The EUR/USD has been declining sharply from the highs of the session so far today, with the onset of weakness in the currency pair coinciding with the release of weaker EU Services PMI.

Broad USD strength is evident in the FX space and this is exacer-bating the scale of the move lower in the EUR/USD.

For today’s session our approach is to sell into a pullback to S1, targeting S3 and last week’s low.

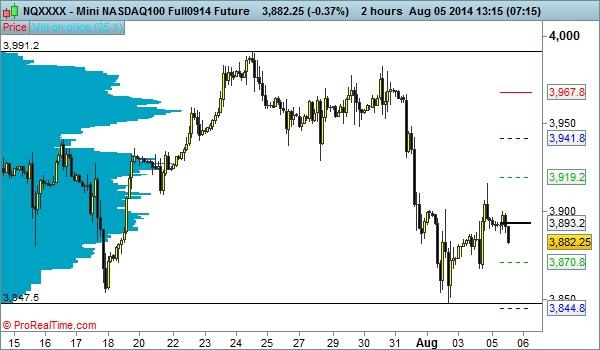

Technical Analysis: Nasdaq and DJIA

Nasdaq and DJIA continue receding from yesterday’s highs.

Technical Analysis: Bund and US 10-year T-note Futures

Bunds and US 10-year treasurys are paring some of yesterday’s gains.

Technical Analysis: GBP/USD and USD/JPY

GBP briefly strengthened against the dollar, but pared those gains following the emergence of broad USD strength.

City Trading & Investment Ltd are an incorporated entity registered in England & Wales. Company registration number is 08677745. Registered address: 37th Floor, One Canada Square, Canary Wharf, London, E14 5AB. Trading futures contracts on margin carries a high level of risk and may not be suitable for all investors. This excessive leverage can work against you at a significant capital cost. Before deciding to trade futures products you should carefully consider your investment objectives, level of experience and risk appetite. It is possible that you may lose some or all of your initial capital/investment and, there-fore, you should not invest money or financial assets that you cannot afford to lose. You should be aware of all of the risks associated with futures trading and trading financial instruments in general. You should seek advice from an independent financial advisor.

Any opinions, news, research, analyses, prices or other information contained in these reports is provided as general market commentary and is for educational purposes only. The content does not constitute investment advice in any shape or form. City Trading & Investment will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The content of this report do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments. Furthermore, the content of this report does not constitute advice or a recommendation with respect to such securities or other financial instruments or investments.

The content on this report is subject to change at any time without notice, and is provided for the sole purpose of assisting the educational appetite of traders. City Trading & Investment has taken reasonable measures to ensure the accuracy of the information within this report; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content of the report or from your inability to access the report, or for any delay in or failure of the transmission or the receipt of this report. Furthermore, no part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of City Trading & Investment Ltd.

This report is not intended for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation. None of the services or investments referred to in this report are available to persons residing in any country where the provision of such services or investments would be contrary to local law or regulation. It is the responsibility of the readers of this report to ascertain the terms of and comply with any local law or regulation to which they are subject.

Investment asset valuations and pricing can go up and down. Investment price fluctuations can be violent and can result in the loss of some or all of your initial investment/capital. The financial assets referred to in this research and the potential income or losses from them may also fluctuate violently as described. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.