The British Pound is looking increasingly weak with each passing day. The UK data continue to disappoint, while Fed moving away from the lift-off is also reducing the BOE rate hike bets.

The inverted head and shoulder on the EUR/GBP chart and the possibility of the BOE tilting towards a rate cut was discussed here (Macro Scan Sep 29 2015). Since then, matters only complicated further for the Sterling bulls and the Bank of England.

The US non-farm payrolls report for September was horrible and threw 2015 Fed rate hike bets out of the window. The drop in the Fed rate hike bets has been well received by the markets so far. However, the drop in the Fed rate hike bets also means a less probability of the BOE lift-off next year.

Furthermore, the UK manufacturing and service PMI weakened to multi-month lows in September. The Sterling exchange rate remained a drag on export growth with new orders hitting multi-year lows. Given the sequential drop in the PMIs and the sequential drop in the exports, the industrial production figures for August due tomorrow are likely to disappoint market expectations as well.

The Bank of England, thus, has very a little room left to stay hawkish. The rates are likely to be held steady on Thursday, and the markets must be ready for a dovish surprise via minutes. A unanimous vote in favor of keeping rates unchanged (not surprising) would kill the Pound.

On the charts, Sterling appears extremely weak, especially against the EUR, USD and the JPY.

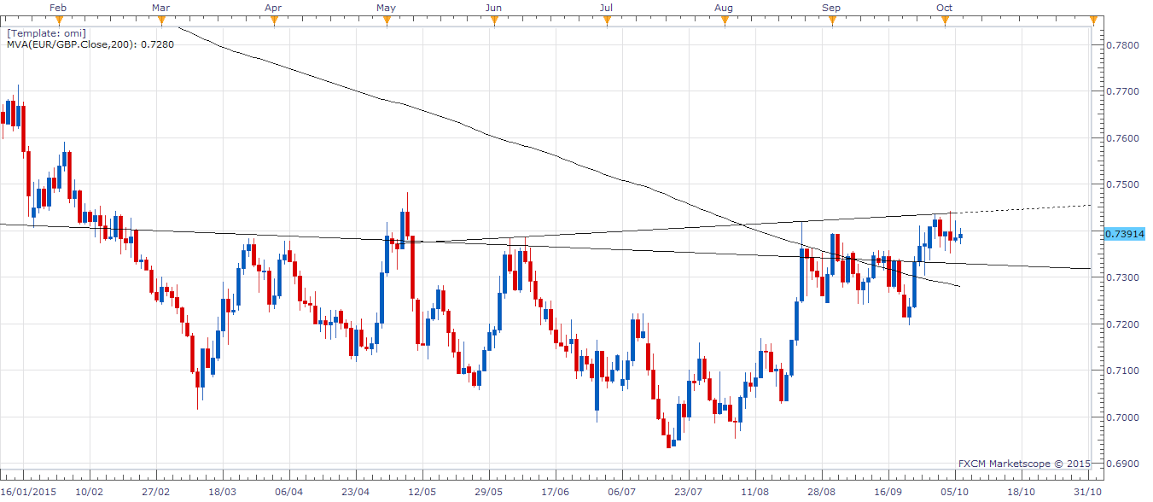

EUR/GBP – Sideways action followed by inverted head and shoulder breakout

EUR/GBP likely to consolidate in the range of 07270 (trendline support on the monthly chart) -0.7440 (in head and shoulder neckline), before witnessing an inverted head and shoulder breakout and a rise towards 0.7950 levels.

Only a weekly close below 0.7270 could turn the outlook bearish.

GBP/JPY – Sell-off could be violent, Eyes 200-month MA at 175.75

The cross could drop sharply to its 200-month MA at 175.75. The southward move would gain momentum once the USD/JPY pair confirms a bearish breakout from its symmetrical triangle formation.

The Bank of Japan (BOJ) is widely expected to do more (easing) in Octover. However, with interest rates already at record lows, and ongoing QE, it is likely the bank would resort only to verbal intervention. Furthermore, the risk-on rally in the stocks is unlikely to last long. Cheap money is unlikely to fuel asset price inflation anymore; at least in the short-run. Consequently, the USD/JPY pair is expected to see a bearish break from the symmetrical triangle formation.

With this, the GBP/JPY could see a sudden drop to below 180 levels. A dovish BOE would ensure the sell-off is extended to 175.75 levels.

Bears to remain on sidelines in case the pair breaks above 184.04 (50% retracement of July 2007 to Oct 2011plunge).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.