The US Dollar extended its rally against the Euro yesterday after stronger than expected ISM Manufacturing data. This data is an indicator of economic activity; the forecast had been for 48.5 while the actual number was 49.5.

To add to the bullish cause for the US Dollar the Euro area Consumer Price Index, a measure of inflationary pressure, was released Monday morning at -0.2%, which was lower than expected at 0.0% and lower still than last month’s data at 0.3%.

The reduced inflationary pressure in the Euro area and increase in economic activity in the US has helped the EURUSD fall from 1.10161 on Monday morning to current levels below 1.09000.

Interbank deposit rates for the Euro have reached negative levels as far out as the 1-year maturity. The European Central Bank (ECB), official interest rate for refinancing operations, is at 0.05%. However, there may be further loosening of official interest rates into negative territory. Even though the President of the ECB has suggested that interest rates hit the lower boundary when the deposit facility rate of the ECB was lowered to -0.30%.

The rest of the week ahead will see the release of some critical data from the US. Thursday at 15:00 GMT sees the release of ISM non-manufacturing PMI and Factory Orders. Both pieces of data are indicators of economic activity, and there is an increase expected in factory orders over last month's data which was -2.9%. Forecasts are for 53.2 and 2.0% respectively.

On Friday, we will see what may be the most important data of the month, Non-Farm Payrolls (NFP). Data is expected at 13:30 GMT, the forecast is an increase of 190k jobs, whereas last month’s NFP was 151K. There may be some surprises, as often happens with this data. Last month’s NFP number was forecast at 200k and released at a much lower level, sending the US Dollar lower sharply.

If you think there is going to be an increase in volatility for the EURUSD over the next week, then you mayBuy a Straddle. This consists of simultaneously buying a Call and a Put option with the same strike, expiry and for the same amount.

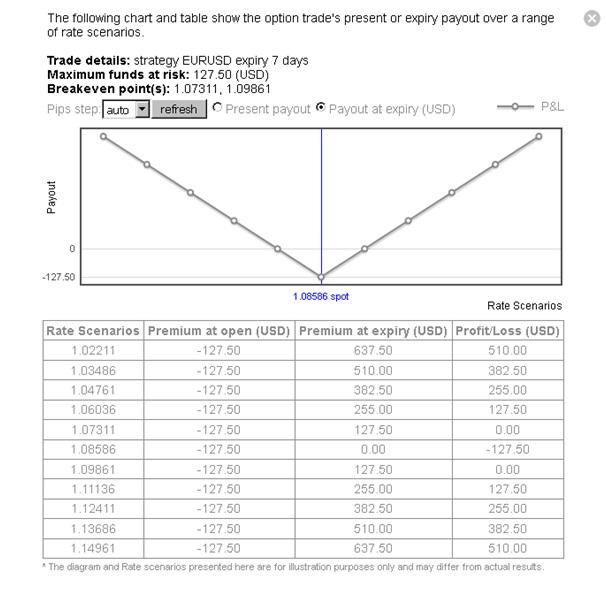

The screenshot below shows that a Buy Straddle strategy with strike 1.08576, 7-day expiry and for €10,000 would cost $127.49, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Buy Straddle strategy, just click the Scenarios button.

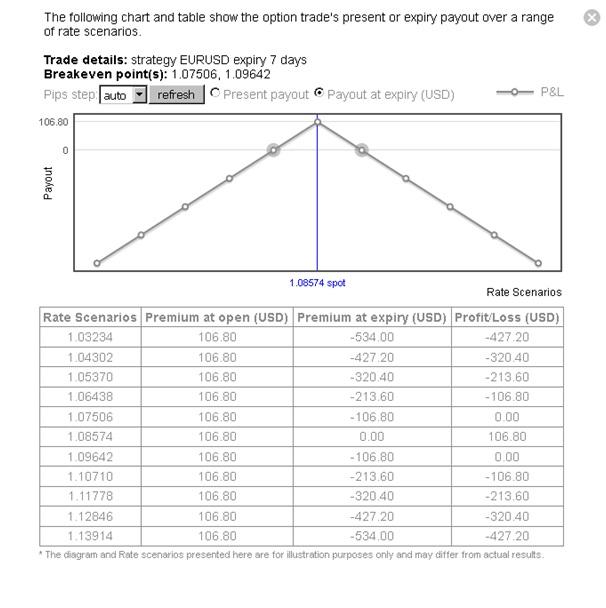

On the other hand, if you feel that the market will remain flat, and volatility will decrease then you maysell a Straddle. This consists of simultaneously selling a Call and a Put option with the same strike, expiry and for the same amount.

The screenshot below shows a Sell Straddle strategy with strike 1.08551, 7-day expiry and for €10,000 would generate $106.79 in revenue, for a total risk of $328.89.

This screenshot shows the profit and loss profile of the above Sell Straddle strategy.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.