Today at 21:00 GMT the Reserve Bank of New Zealand will announce its interest rate decision, followed by a press conference and monetary policy statement. Consensus is that rates will be left unchanged at 3.5%. That being said, market pricing suggests around a 50% chance that we will see a rate cut of 0.25% to 3.25%.

In Australia, more important data regarding the employment situation will be released at 01:30 GMT tomorrow. Expectations are for the unemployment rate of 6.2% to remain steady and for a rise of 11K employees.

Earlier today during the Asia session, the AUD/USD has traded to lows of 0.7636 following comments from the Reserve Bank of Australia’s chief Stevens on a further weakening AUD and the possibility of more easing if necessary. Not long after, the pair has bounced back and exceeded the 0.77 mark due to positive comments from Bank of Japan that drove the USD/JPY strongly lower. This had a broad effect on the USD. AUD/USD is now trading near session highs at 0.77625, levels seen previously June 4th.

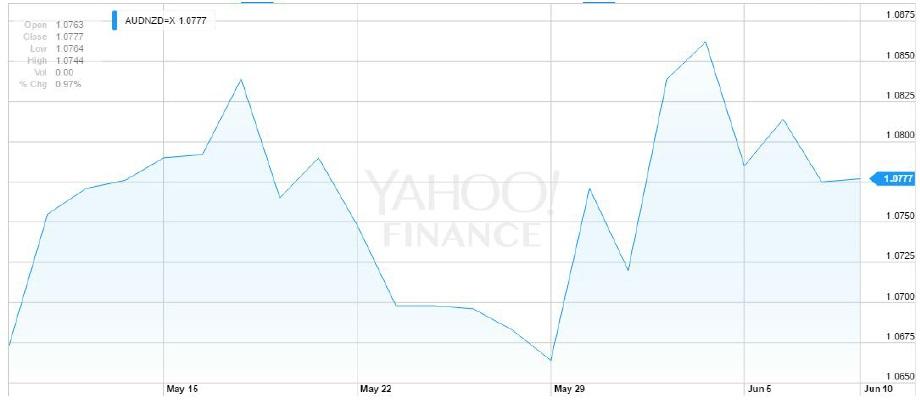

Below is the AUD/NZD trading chart in the past month. Its range was 200pips between 1.0664 may 29th and 1.0862 on June 4th. The volatility expected between now and Friday June 12th is 24.5%, indicating over 1.5% daily move.

This level of volatility in any pair, is considered high. When trading options, a trader can decide in advance to risk the amount invested in the position without risking anything beyond the cost of the option. Similar to buying a stock, if you pay $20, you can lose only that amount as it cannot go below the price of 0. Buying a Call or Put option will give you the right to buy or sell (respectively) the chosen pair, in this case AUD/NZD, at the strike rate defined within the time frame of the option’s duration.

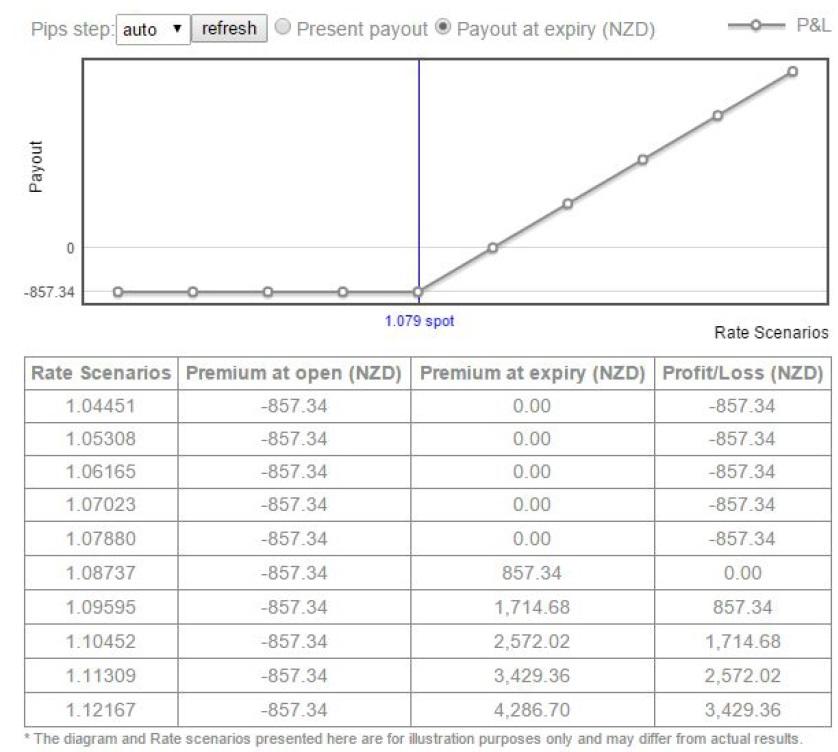

At the time of writing, the AUD/NZD Call with an at‐the‐money strike (strike = spot = 1.079) to expire post the news on June 12th , costs 857 NZD. You can view its payout scenario table and graph below.

Notice that is the pair will trade to 1.09595, you will profit 100% of the premium paid. Note that if the pair trades higher and/or volatility in the pair rises, the value of your option will rise as well, prior to its expiry date. You can then chose to close your position for profit before the option expires.

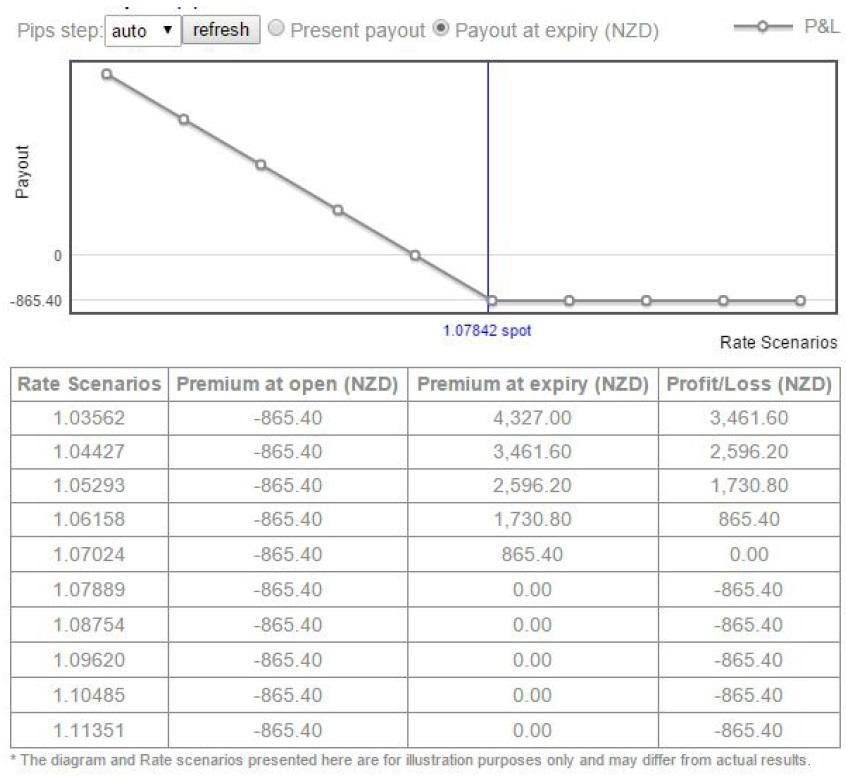

If you have a negative outlook as to the data effecting the pair and its direction, you may choose to buy a Put option.

The AUD/NZD ATM (now at 1.07842) Put with same date expiry as the Call, costs 865 NZD. On expiry, if the pair will trade down to 1.0616, you will profit 100% on the premium paid to purchase this Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.