The EUR/GBP is worth another look this week as several market announcements affecting the crosspair are released. As the pair is trading around 0.7200, it will be interesting to see if announcements out of Europe this week will have an impact, driving the rate either up or down.

Europe’s economy recovery plan is starting to gain momentum, but Greece is still a major concern for the European Union and its creditors. The market is waiting to see if Greece will default next week to the International Monetary Fund (IMF) and, until then, this will affect the euro’s upward mobility.

As of the last week, the Bank of England (BoE) cut the UK’s annual growth forecasts for the next three years. The BoE is also not expected to raise Sterling rates until mid-2016.

In EUR/GBP market news:

Monday’s UK Markit Manufacturing (Purchasing Managers Index) PMI was just short of its target at 52.0 versus 52.5 expected. This lackluster showing led to a rally in the EUR/GBP on the Sterling’s weakness.

Tuesday had the release of EU’s Unemployment Change for Germany and Spain, which came in lower and higher than expected, and EU Consumer Price Index numbers which had a high reading but was offset by a low reading in the EU Producer Price Index.

Wednesday is packed with UK and EU data. Keep an eye on the ECB Interest Rate Decision and policy statement and press conference afterwards.

While the BoE will likely not adjust interest rates on Thursday, the announcement and Asset Purchase Facility are considered big announcements out of the UK and should be monitored closely in case they do not come in at consensus.

Friday has the release of the EU’s Gross Domestic Product (GDP) numbers, which along with the UK’s Consumer Inflation Expectations may cause a large move before the weekend.

Long (buy) Call

If you expect as an option trader the EUR/GBP to take an upward trend this week, you may open a EUR/GBP Call option position because a Call option increases in value as EUR/GBP price rises Your strike choice depends on your outlook; if you are bullish and expect a large upward move you may want to choose a strike further away from the current underlying EUR/GBP price. See lesson on Determining a Buy Call Option’s Moneyness if you would like to understand strikes.

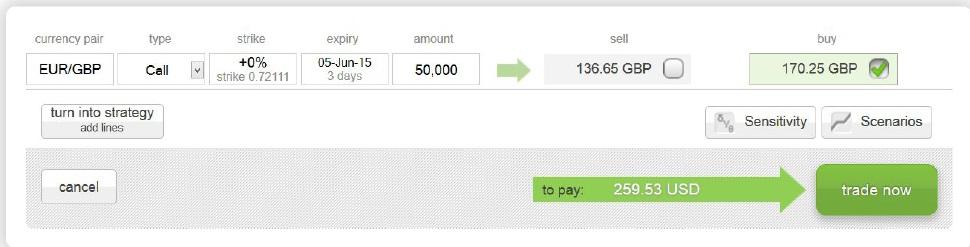

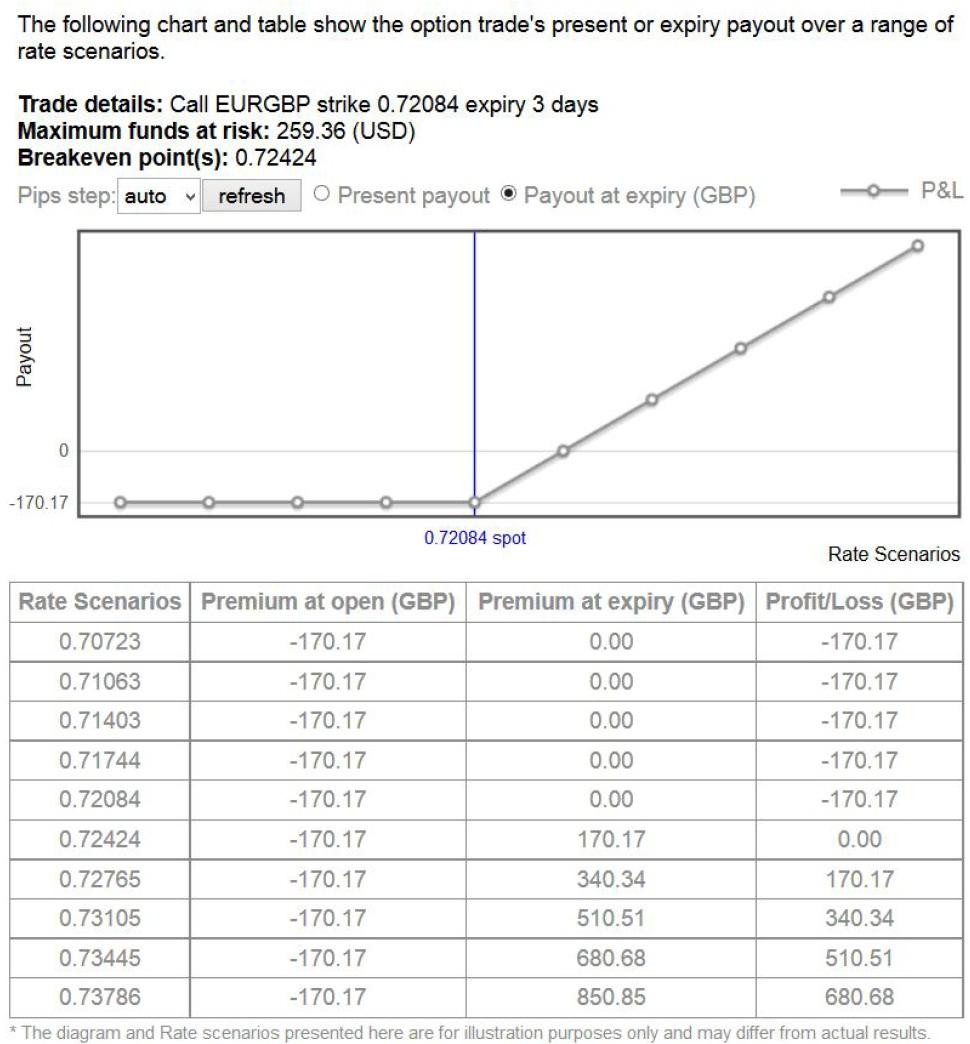

Below is an example in the optionsReasy web-platform. It is a EUR/GBP Call option with 0% strike (matching the current underlying price), to expire in 3 days and for an amount of 50,000 EURs. The risk is limited and profit is unlimited in this position.

Long (buy) Put

If you expect as an option trader the EUR/GBP to take a downward trend this week, you may open a EUR/GBP Put option because a Put option increases in value as EUR/GBP price falls.

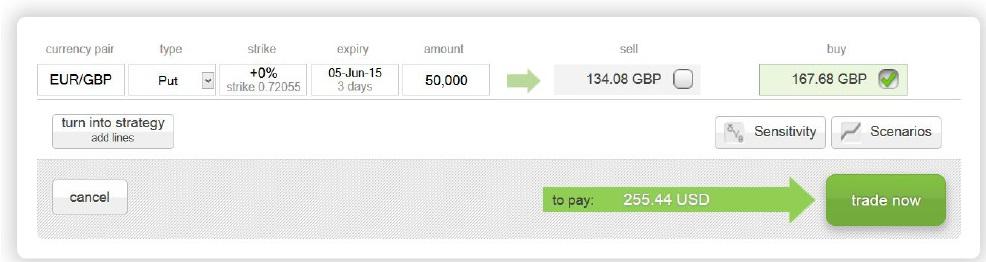

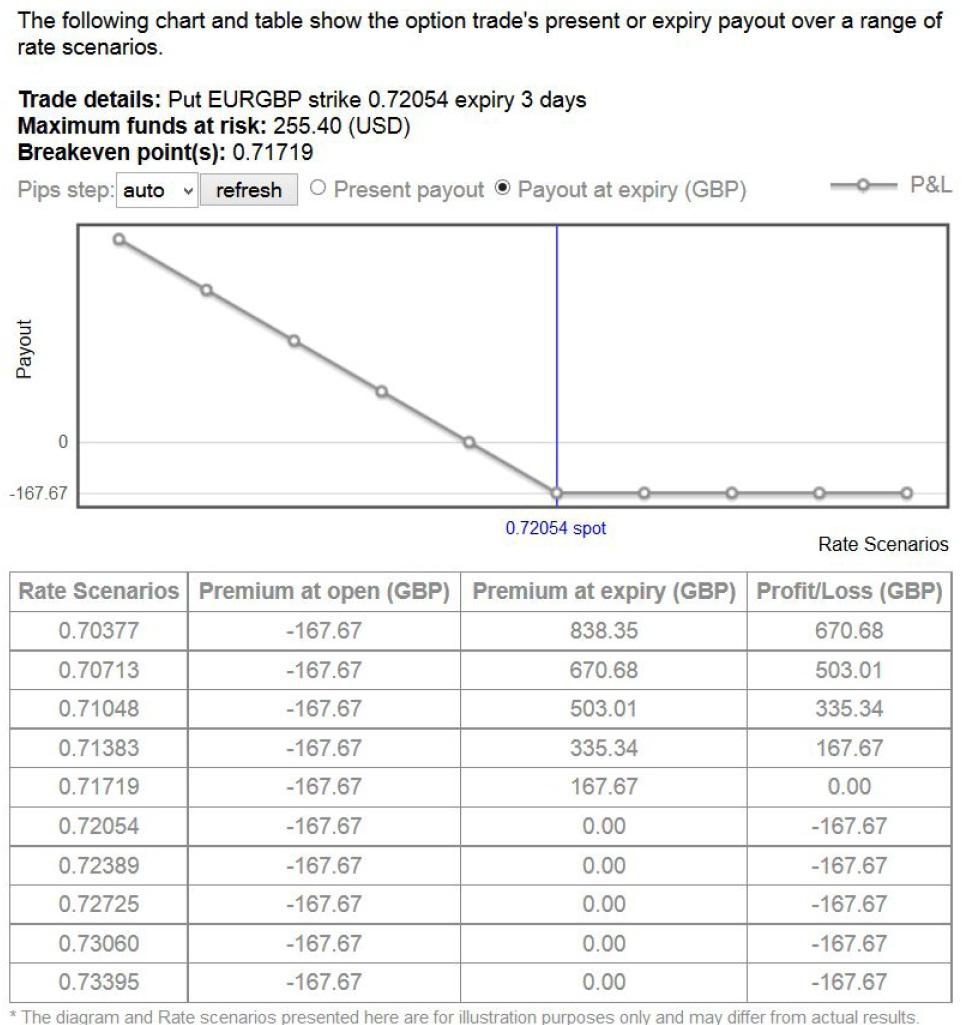

Below is an example in the optionsReasy web-platform. It is a EUR/GBP Put option with 0% strike (matching the current underlying price), to expire in 3 days and for an amount of 50,000 EURs. The risk is limited in this position.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.