The CPI data announcement takes place at 13:30 GMT and is expected to be -0.1%.

The CPI is one of the most important data figures in the US. As it indicates the inflation rate, many investors depend on this data to adjust their cash flow and investments. The effect on currencies paired with the USD is usually strong. For example, when interest rates rise, foreign and local investors want to invest their money with higher rates on their investment, this may cause higher demand for the USD resulting in a stronger USD versus other currencies.

One way to employ options is to hedge on your existing portfolio as insurance. For example, if you are long the EURUSD spot and fear short term spot fluctuations which might stop out your positions, you can buy a PUT option on the EURUSD. There are a few elements in an option that affect its price. One being the strike of the option. The further the strike will be from the current spot rate, the cheaper the option. This is because there is less probability of the spot expiring below the strike and giving returns on the investment (opposite of a call option where the spot needs to expire above the strike in order to be of value).

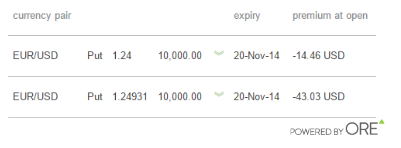

If towards this CPI, you want to be hedged against a move of the spot below the 1.24 strike, because above it you will not risk a stop out and/or do not mind a relatively small loss before 1.24, you can buy a put with 1.24 as a strike. You will pay less than if you bought a put that is at the money, where the strike equals the current spot at 1.24931. These two options are identical except their strike. You can view the difference in the premium at open where the out-of-the-money option is drastically cheaper than the at–the-money option:

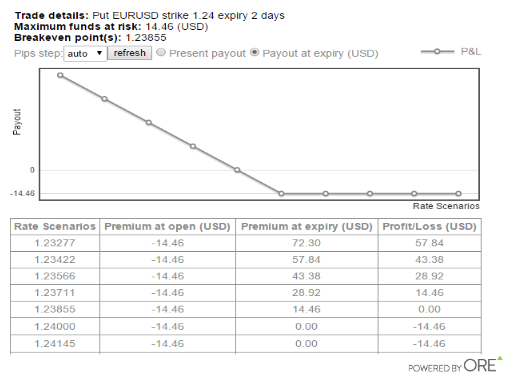

Below you can view the example (this is not a recommendation to trade) of the payout of an out-of-the-money EURUSD put. Notice you are not at risk of losing more than the option price and with potential to profit much more than invested.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.