EUR/GBP

The dollar traded mixed against its G10 counterparts during the European morning Wednesday. It was higher against GBP and EUR, in that order, while it was lower vs NOK, AUD, SEK and JPY. The greenback was unchanged vs CAD, CHF and NZD.

EUR traded lower even after the Eurozone’s final service-sector PMI for April was revised up to 54.1 from the preliminary reading of 53.7. The flash PMIs from France, Spain and Italy were all revised up, while the figure from the bloc’s core economy, Germany, was revised down. Added to that, Eurozone’s retail sales for March dropped more than expected, pushing EUR/USD towards 1.1200 again. With the US ADP report to be released later in the day, a strong figure could push the pair somewhat lower, perhaps for another test of our 1.1170 support line.

GBP/USD started weakening ahead of the UK service-sector PMI, and in the event, following the strong figure, it bounced a bit. However, it gave back the gains in the following hour. With just a day to go before the UK general election, the opinion polls still show the Conservative and Labour parties neck-and-neck and neither likely to gain majority to govern on its own. The 1M GBP/USD option implied volatility remains elevated as the uncertainty over the shape of the government may not be known for weeks after the election finishes. This uncertainty is likely to keep GBP/USD under increased selling pressure, in our view.

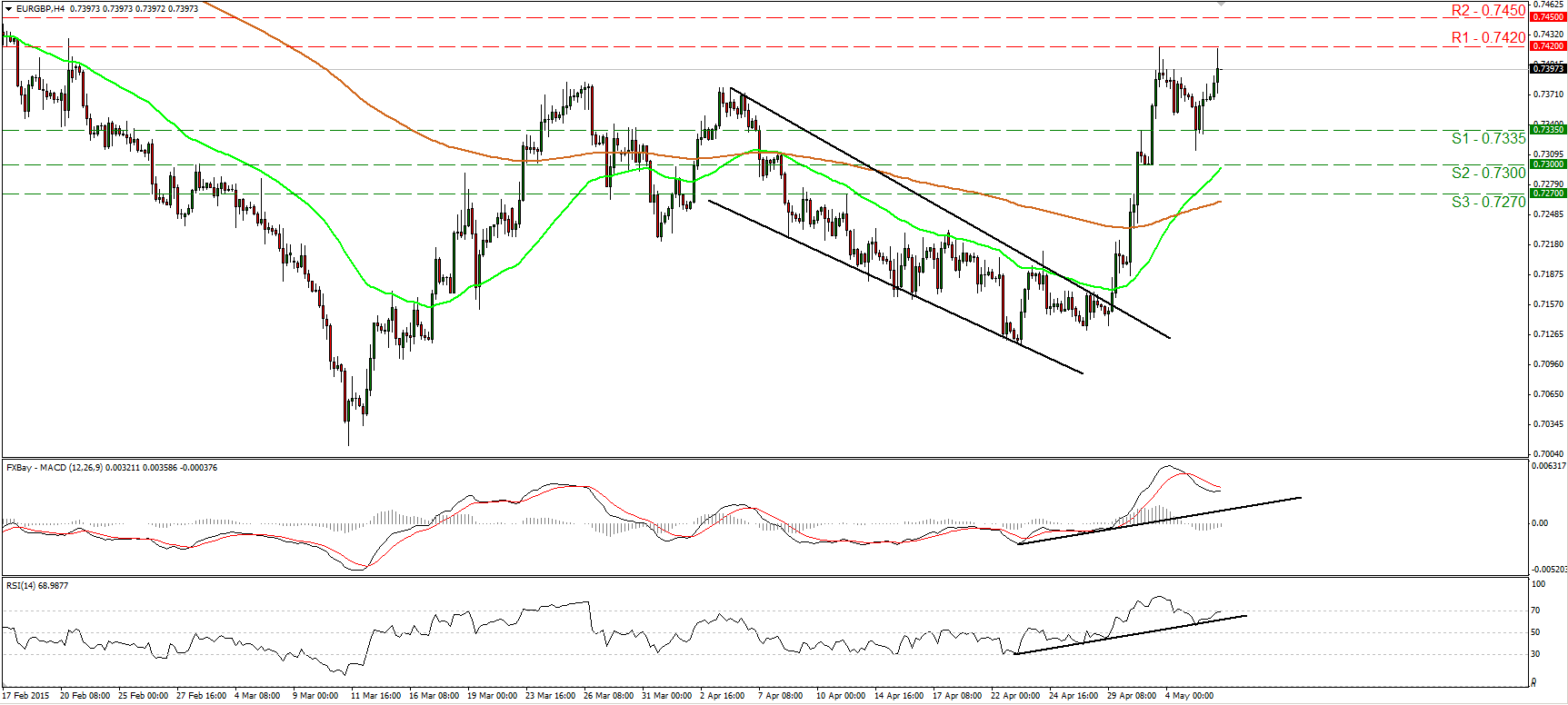

EUR/GBP traded higher during the European morning Wednesday, but the advance was halted by our resistance line of 0.7420 (R1), defined by the peak of the 1st of May. After the break above the downside resistance line on the 29th of April, the price structure has been higher highs and higher lows, and therefore I would maintain the view that the short-term picture is positive. A move above 0.7420 (R1) could be the trigger for a test at our next resistance of 0.7450 (R2). Nevertheless, our short-term oscillators detect slowing momentum, and as a result I would be careful that further pullback could be on the cards before the next positive leg. The RSI hit its 70 line and turned down, while the MACD, although positive, stands below its trigger line. On the daily chart, the recent rally brings into question the continuation of the larger downtrend. Moreover, the fact that the rate broke above 0.7380, which stands very close to the 38.2% retracement level of the 16th of December – 11th of March decline, signaled the completion of a possible double bottom formation, something that could bring a medium-term trend reversal.

Support: 0.7335 (S1), 0.7300 (S2), 0.7270 (S3).

Resistance: 0.7420 (R1), 0.7450 (R2), 0.7500 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.