USD/CAD

In a quiet European morning session for currencies Wednesday, the dollar was unchanged or lower against most of its major peers. It was slightly lower against CHF, EUR and GBP, in that order, while it was higher only against NOK. The dollar could reverse its early losses later in the day when US initial jobless claims come out later today. The market consensus is for the number to remain more or less unchanged, which would be consistent with a firming labor market. The 4 week moving average, considered a better measure of underlying labor market conditions, is expected to decline a bit, supporting the idea of broader strength of the US economy.

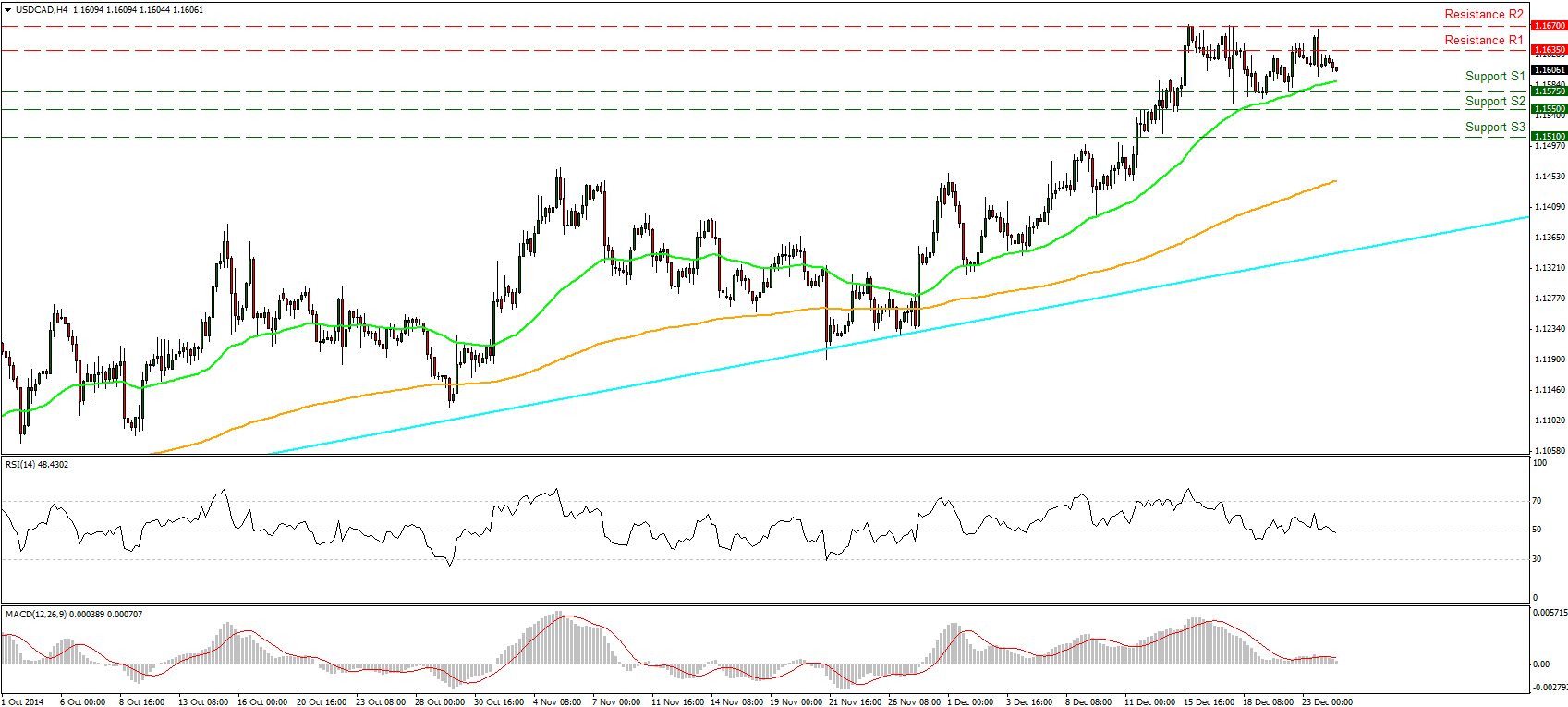

USD/CAD declined somewhat during the European morning Wednesday after finding resistance near the 1.1635 (R1) line. Bearing in mind our short-term momentum indicators, I would expect for the decline to continue at least until the 50-period moving average that provided a good support to the price action recently. A break below that moving average could extend the decline until our 1.1575 (S1) support level. The RSI stands just below its 50 line pointing down, while the MACD lies below its trigger line and seems willing to enter its negative territory. This signals accelerating bearish momentum, thus amplifying the case for a decline, at least temporarily. However, on the daily chart, the pair is still trading above both the 50- and the 200-day moving averages, and above the light blue uptrend line drawn from back at the low of the 11th of July. Hence, I still see a longer-term uptrend and I would expect any possible future setbacks to provide renewed buying opportunities.

Support: 1.1575 (S1), 1.1550 (S2), 1.1510 (S3)

Resistance: 1.1635 (R1), 1.1670 (R2), 1.1715 (R3)

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.