AUD/NZD

The dollar traded lower against almost all of its G10 peers during the European morning Tuesday. It was stable only vs EUR.

JPY gained the most against the dollar after the Japanese Prime Minister Shinzo Abe said that the weaker yen burdens households and small firms by pushing up their fuel cost. On top of that, Bank of Japan Governor Haruhiko Kuroda said there was no need to adjust monetary policy. Since the Bank believes that the inflation target of 2% can be achieved, its massive stimulus program will remain in place but there is no intention to expand it soon.

UK industrial production was unchanged mom in August in line with market expectations. On the other hand, the yoy rate accelerated and the previous figure was revised up, adding somewhat to Cable’s recent advance. However, given the other recent soft data coming from the UK, I would see the minor bounce as a renewed selling opportunity.

The Reserve Bank of Australia held its cash rate unchanged at 2.5% as expected and removed the sentence where it said that the rate “remains above most estimates of its fundamental value.” The Bank attributed the recent decline in the currency in a large part to USD strengthening and reiterated that the exchange rate “remains high by historical standards”. RBA Governor Glenn Stevens made no new attempts to talk down the AUD/USD, in contrast to the Reserve Bank of New Zealand’s recent verbal intervention calling for a “significant downward adjustment” to NZD. Both Governors want their countries’ currencies to weaken, nevertheless only the RBNZ has actually intervened in the market to achieve this. Thus I would expect AUD/NZD to appreciate.

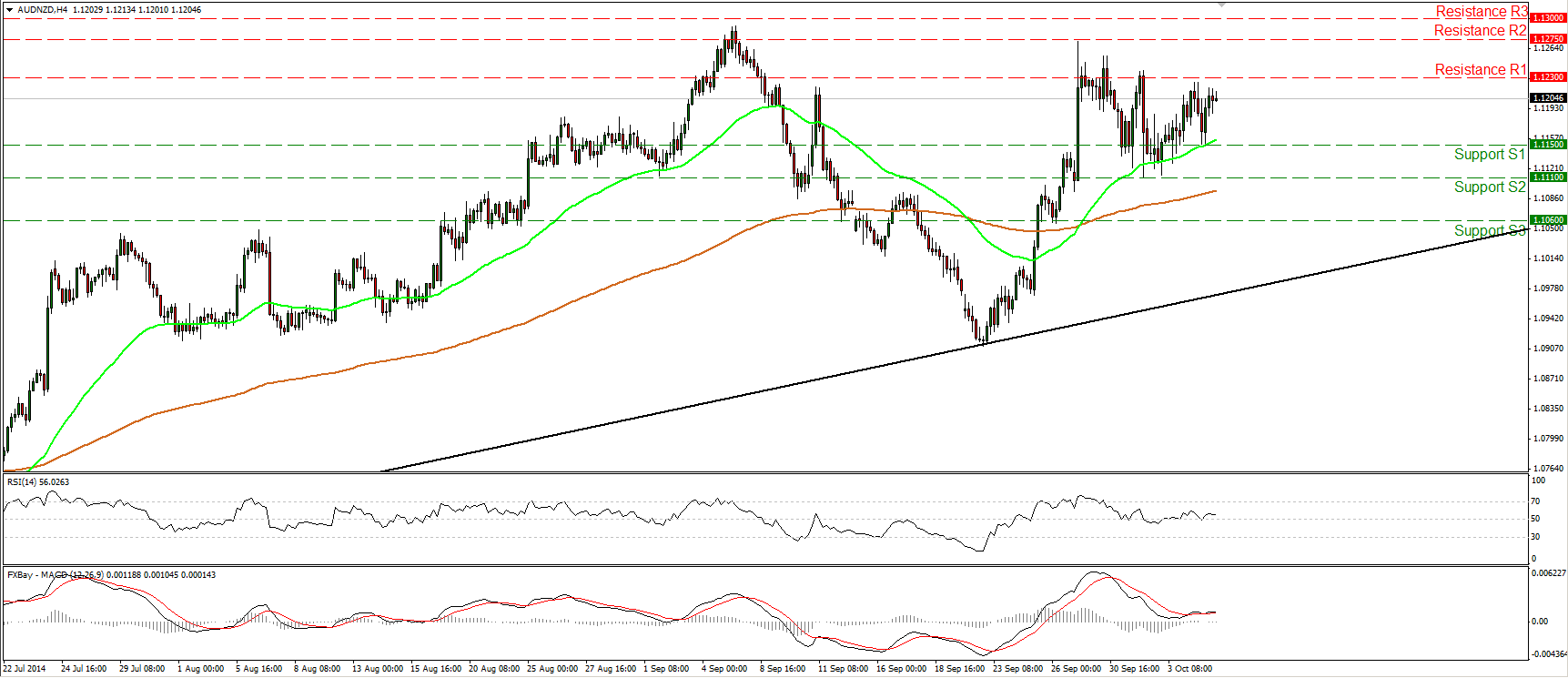

AUD/NZD moved higher during the European morning Tuesday, after finding support near the 1.1150 (S1) line. At midday, the rate is trading slightly below the resistance of 1.1230 (R1). A clear and decisive upside break of that line could trigger extensions towards the next obstacle at 1.1275 (R2). The momentum studies are both positive, as the RSI moved higher after finding support at its 50 line while the MACD remains above both its zero and trigger lines. In the bigger picture, as long as the pair remains above the longer-term black uptrend line (drawn from back at the low of the 10th of July), and above both the 50- and the 200-day moving averages, I would consider the overall trend to be to the upside.

Support: 1.1150 (S1), 1.1110 (S2), 1.1060 (S3) .

Resistance: 1.1230 (R1), 1.1275 (R2), 1.1300 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.