USD/CAD

The dollar traded unchanged or higher against its G10 peers during the European morning Tuesday. The greenback was higher against GBP, AUD, CAD and NZD, in that order.

The British pound was the main loser during the European morning despite the better-than-expected construction PMI reading for August. Sterling weakened however against the dollar after a survey by Yougov, a British opinion research firm, showed support for Scottish independence had risen to 47% vs 53% opposed, a sharp increase for the “yes” vote from just two weeks ago. Although this poll’s results are not borne out by other polls, nonetheless it does raise the risk that as the Sep. 18th referendum is approaching, support for Scottish independence is rising, increasing the negative sentiment over the pound.

The Canadian dollar weakened ahead of the country’s central bank policy meeting on Wednesday. It is unlikely that the Bank will change its neutral stance with respect to the timing and direction of the next change to the policy rate, but investors’ concerns are whether the governing council will attempt to talk down the CAD. The nation’s manufacturing PMI is due out later in the day but no forecast is available.

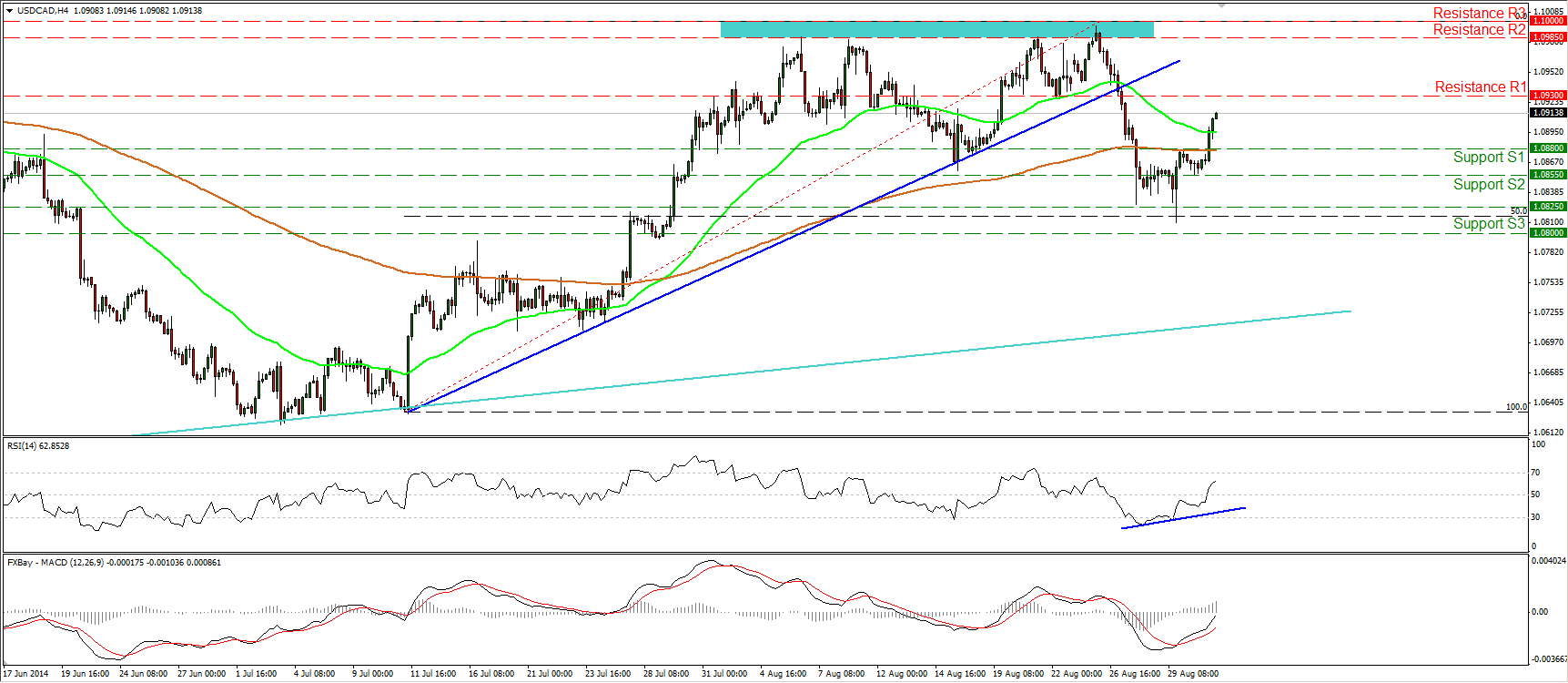

USD/CAD recovered approximately half of its last week losses after finding support near the 50% retracement level of 11th July – 26th August near-term uptrend. Today, during the Asian morning, the pair moved above the 1.0880 (resistance turned into support) barrier and at midday, in Europe, is heading towards the resistance line of 1.0930 (R1). A successful move above that hurdle could drive the battle towards the critical and strong resistance zone of 1.0985/1.1000. On the daily chart, I see a hammer candle pattern near the 50% retracement level of the aforementioned uptrend, corroborating my view that we are likely to experience the continuation of the up leg. In the bigger picture, the long-term uptrend is still in effect. The pair is still trading above the major uptrend line, drawn from back the beginning of September 2012, connecting the lows on the weekly chart. However I would prefer to see a clear close above the 1.0985/1.1000 strong resistance zone before regaining confidence on the long-term path. Remember that in August, the bulls failed four times to overcome that area.

Support: 1. 0880 (S1), 1.0855 (S2), 1.0825 (S3).

Resistance: 1.0930 (R1), 1.0985 (R2), 1.1000 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.