DAX futures

The dollar traded mostly unchanged against its G10 peers during the European morning Friday. It was lower against NZD and SEK, in that order, while it was fractionally higher against JPY.

The euro was stable against the dollar during the European morning, after the Eurozone’s unemployment rate remained unchanged in July and the August CPI estimate came in line with expectation. Nonetheless, the fall in the rate of inflation to +0.3% yoy in August, its lowest level since last November 2009, added pressure to the European Central Bank to introduce new stimulus measures along with the anticipated TLTROs at its meeting next week. The recent weak data from the Eurozone, especially by its strongest economy, has left no choice for the ECB but to act as fast as it can to reverse the negative sentiment and boost growth in the region, in my view.

The DAX index opened the trading day with a gap up, ignoring a 1.4% mom fall in German retail sales in August. However, the index filled the gap within the next few hours on news about rising tensions in Ukraine and fears of further tit-for-tat sanctions that could further depress the country’s industrial output.

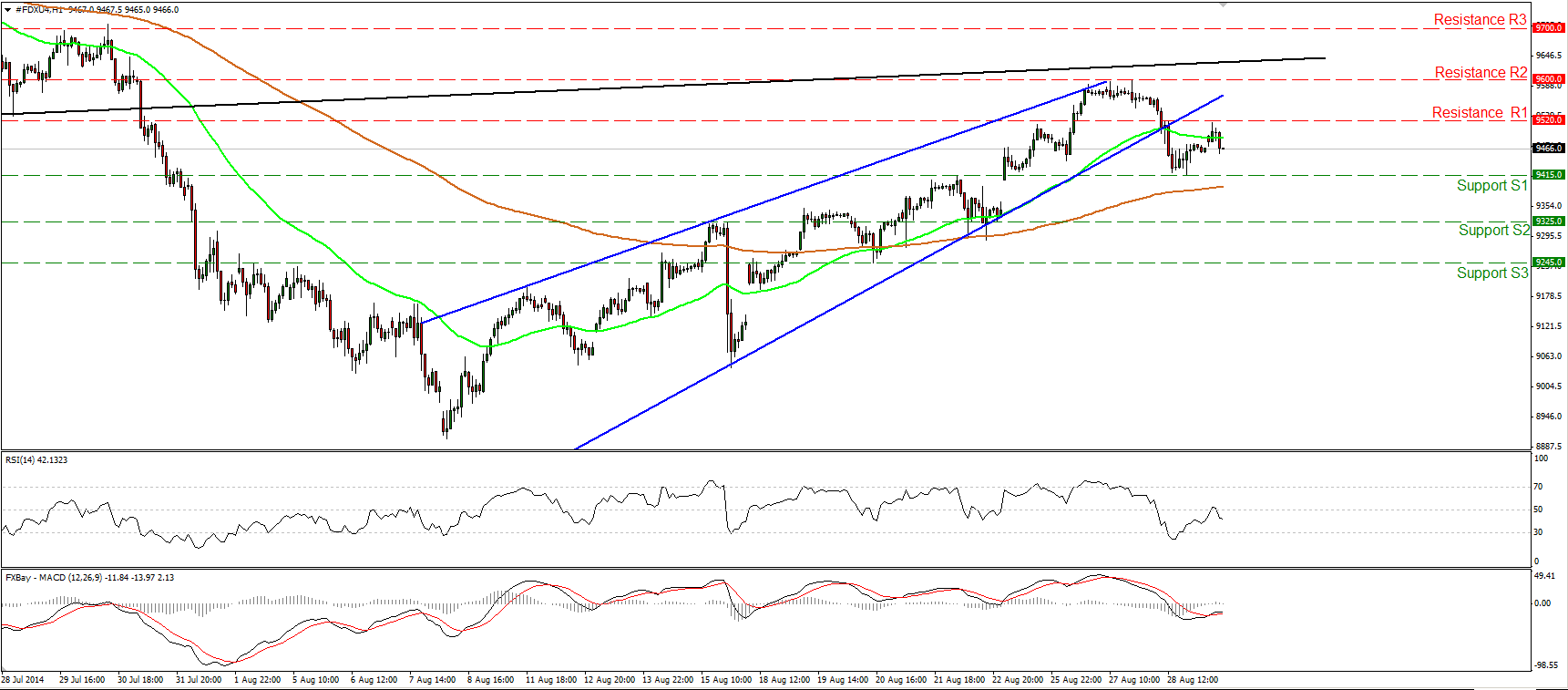

DAX futures fell below the lower bound of a possible rising wedge formation yesterday but later in the day rebounded from the support line of 9415 (S1). Today, during the European morning, the index found resistance near the 9520 (R1) area before sliding somewhat. As long as the price is trading below the rising wedge pattern and as long as the possibility for a lower high exists, I would consider the near-term bias to be mildly to the downside. A clear move below 9415 (S1) could set the stage for extensions towards our next support line of 9325 (S2).

On the daily chart, I see an evening star candle pattern, supporting the cautiously negative picture of the DAX. On the 31st of July, the index fell below the long term trend line (black line), drawn from back at the lows of June 2012 and connecting the lows on the weekly chart. However, I don’t expect a new long-term downtrend, as the index would need to fall below the 8900 line to establish a lower low.

Support: 9415 (S1), 9325 (S2), 9245 (S3).

Resistance: 9520 (R1), 9600 (R2), 9700 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.