USD/NOK

The dollar traded unchanged against most of its G10 peers during the European morning Monday in the absence of any major economic events. The greenback was lower only against NOK and SEK, while it was higher versus AUD.

The Norwegian Krone appreciated the most against the dollar after the country’s underlying CPI accelerated to 2.6% yoy in July from +2.4% in June, remaining in line with Norges bank target of approximately 2.5% over time. The rate confounded expectations of a deceleration to +1.9% yoy, pushing USD/NOK down approximately 0.75% and lessened the likelihood of a possible rate cut at the Bank’s September meeting.

The Turkish lira was the main loser among the EM currencies we track following investors’ concerns over the nation’s composition of the cabinet. TRY rallied ahead of country’s elections on Sunday but reversed some of its gains after Prime Minister Tayyip Erdogan won the nation's first direct presidential election. The market is worried about Erdogan’s ambitions to influent Turkey’s monetary policy and that he may force the Bank to cut rates more aggressively than it is anticipated. This would probably result in a weaker TRY long-term. USD/TRY is trying to move higher and break the upper bound of the sideways path it’s been trading since April. Further upside is likely to target the key resistance of 2.2450 in the longer run.

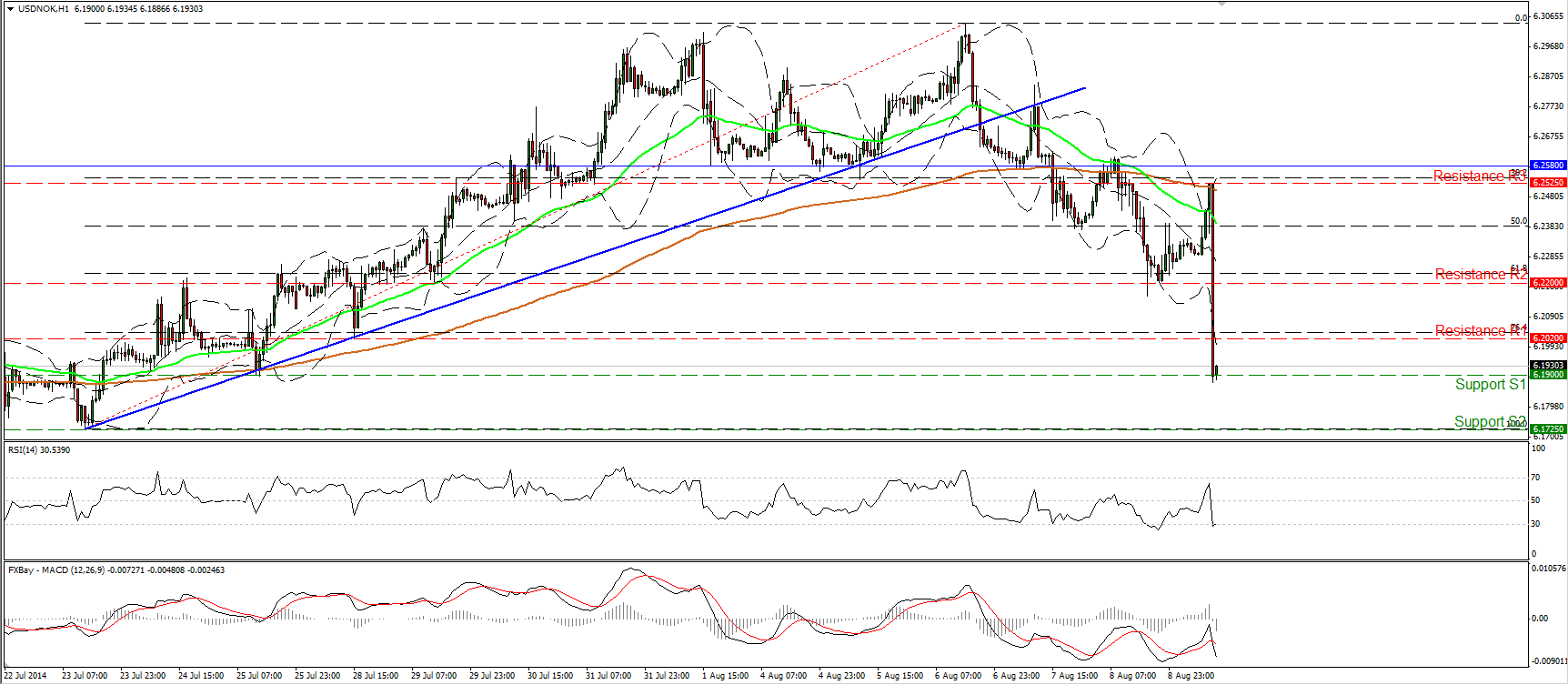

USD/NOK signaled a trend reversal last week, after dipping below the key line of 6.2580 (support turned into resistance), and since then the price structure has been lower highs and lower lows. Today, during the European morning, the pair hit the 6.2525 (R3) barrier and as soon as Norway’s CPI data were out, it collapsed, drilling two support barriers in a row. The violation of 6.2200 (R2) (support turned into resistance) confirmed a future lower low and kept the near-term trend to the downside. At midday in Europe, the rate is testing the lows of 25 July at 6.1900 (S1). A clear dip through that could tempt the bears to pull the trigger for further declines and target the next support at 6.1725 (S2), marked by the lows of 23rd July. Taking into account that the rate fell below the 76.4% retracement level of the 23rd July – 6th August uptrend, I would expect the current downtrend to continue. Nevertheless, today’s plunge was pretty steep and as a result we may experience a minor bounce on short-covering before sellers take the reins again.

Support: 6.1900 (S1), 6.1725 (S2), 6.1640 (S3).

Resistance: 6.2020 (R1), 6.2200 (R2), 6.2525 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.