AUD/NZD

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against NZD, AUD and GBP, in that order, while it was lower against EUR, CHF and CAD. The greenback was virtually unchanged against NOK, JPY and SEK.

Eurozone’s economic growth accelerated in July according to the strong readings of the bloc’s PMIs. Eurozone preliminary composite PMI, covering both the manufacturing and service sectors, reached a three-year high of 54.0. The strong figures were boosted from the better-than-expected prints from the bloc’s two largest economies, France and Germany. Both manufacturing and service-sector PMIs were higher, with the latter having the larger gains. However, going forward the effects of Russia’s recent sanctions may be apparent in the German PMIs due to the strong ties between the two countries. EUR rebounded at the release of the news, staying above its 21st of November lows of 1.3400 but finding resistance at 1.3485.

The British pound weakened during the European morning after the UK retail sales data for June fell short of expectations. Retail sales excluding gasoline fell 0.1% mom in June, way below the forecast of a turnaround (+0.3% mom). The slowdown in growth pushed Cable lower by approximately 0.20% at the release.

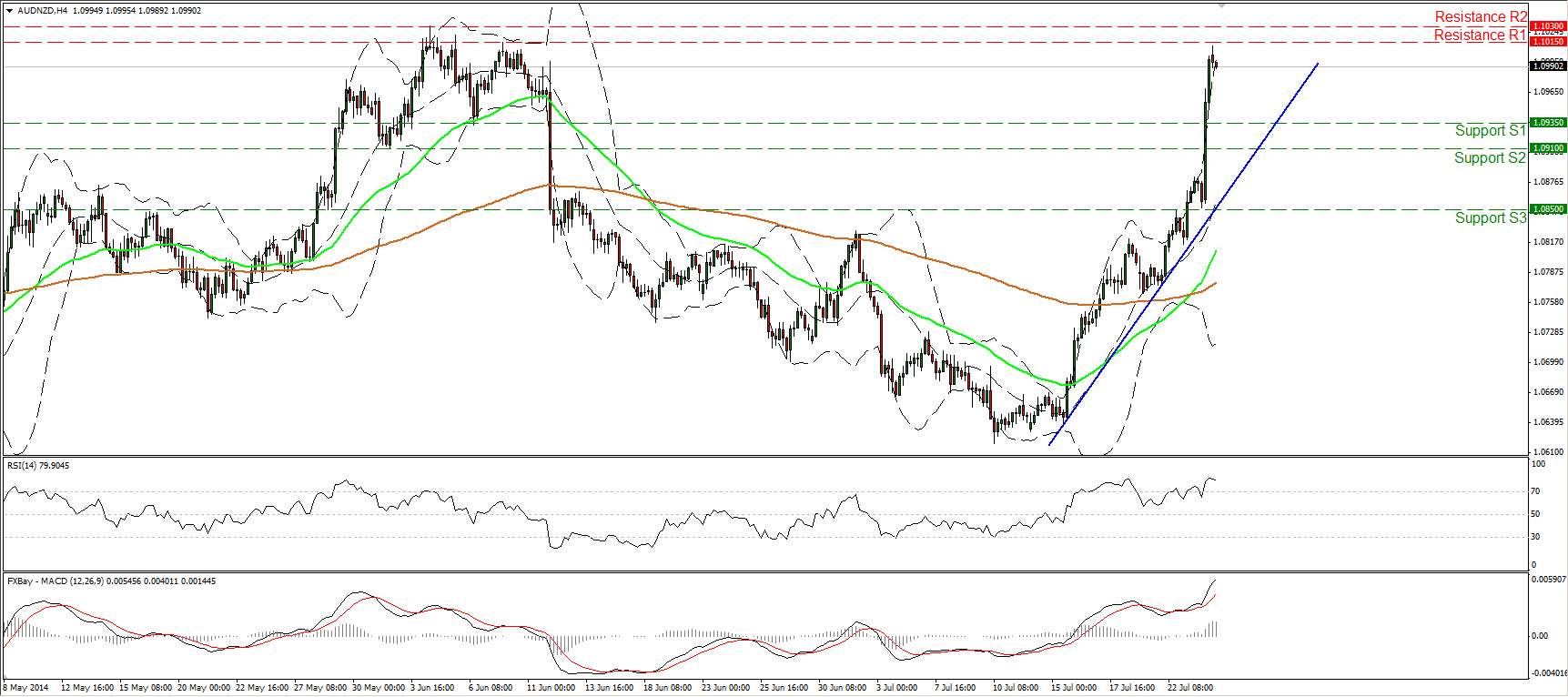

AUD/NZD surged during the Asian morning Thursday, breaking two resistance barriers in a row, but the rally was halted marginally below the obstacle of 1.1015 (R1). I would see the 1.1015/30 zone as a strong resistance zone. Taking into account that our hourly momentum studies shows signs of topping, I would expect the forthcoming wave to be to the downside, perhaps near the blue trend line and the 1.0910/35 support zone. Nevertheless, the price structure remains higher highs and higher lows above the blue uptrend line and above both the moving averages. Hence, I see a positive near-term picture and I would consider any possible future declines towards the 1.0910/35 support as renewed buying opportunities.

Support: 1.0935 (S1), 1.0910 (S2), 1.0850 (S3).

Resistance: 1.1015 (R1), 1.1030 (R2), 1.1110 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.