Copper

The dollar was unchanged against most of the other G10 currencies during the European morning Monday, as no major market-affecting indicators were released. It was slightly higher against CAD, AUD and NOK, in that order.

The Russian ruble was the main loser among the EM currencies we track, as talks between Russia and Ukraine over gas prices failed. Russian stocks were also down as OAO Gazprom, Russia’s biggest natural gas producer, slumped. Gazprom said Ukraine will only receive gas paid for in advance due to chronic non-payment of its bills.

The Polish zloty was also among today’s EM losers after seeped recordings of a conversation between NBP (National Bank of Poland) Governor Marek Belka and a minister raised concerns about Governor’s future and triggered a government crisis.

Copper edged higher after the central bank in China, the world’s biggest consumer of the metal, extended a reserve requirement cut in an attempt to support its economic growth.

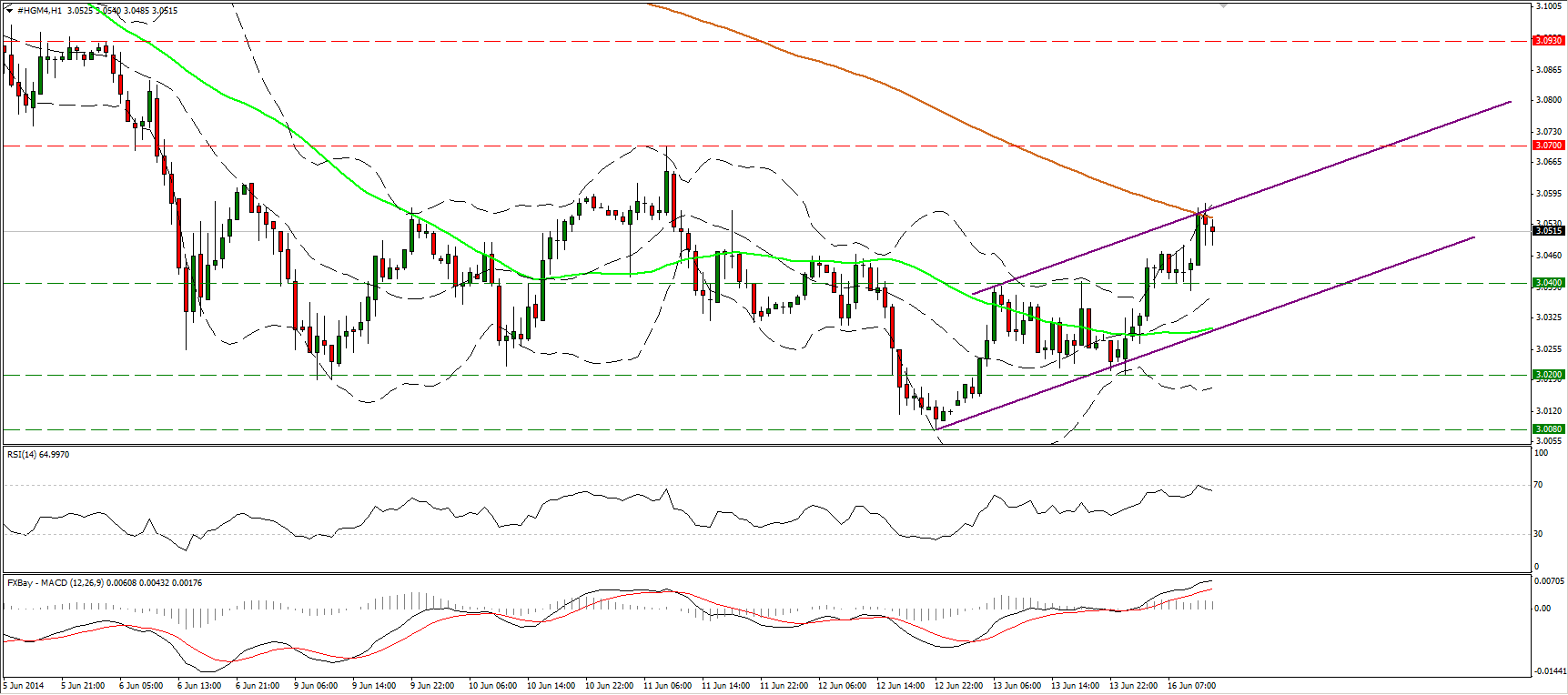

Copper moved higher during the European morning, but the decline was halted by the 3.0560 (R1) barrier, near the upper boundary of the purple upward slopping channel and the 200-hour moving average. Considering that the RSI met resistance at its 70 level and moved lower, I would expect the forthcoming wave to be to the downside. However, as long as the rate remains within the purple uptrend channel, I see a positive picture and I would consider a possible decline as a pullback before the bulls prevail again.

Support: 3.0400 (S1), 3.0200 (S2), 3.0080 (S3).

Resistance: 3.0560 (R1), 3.0700 (R2), 3.0930 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.