Silver

The dollar traded mixed against its G10 peers during the European morning Thursday. It was higher against EUR, CHF and NOK, in that order, while it was lower against AUD and NZD. The greenback was stable vs CAD, JPY, GBP and SEK.

The euro was lower during the European morning ahead of the preliminary German CPI for October. All of the regional CPIs were unchanged or 0.2 ppt lower on a yoy basis, indicating that the national inflation rate is also likely to be unchanged or lower. In the meantime, even though the unemployment rate remained unchanged at 6.7% in October, the unemployment change declined 22k from +9k previously, showing that the labor market in Germany remains strong. Although the labor market shows signs of improvement, the softer inflation data on top of the poor data coming out, only reinforce my opinion that the euro has plenty of room to the downside. While the gyration of EUR/USD around 1.2600 may continue, the weaker economic data could push the rate to test the psychological barrier of 1.2500 in the near future.

Silver fell sharply after the surprisingly hawkish FOMC statement and added to its losses after China said to send investigators to probe a surge in precious metal exports. Silver dropped as much as 1.50%, to reach its lowest level since early October.

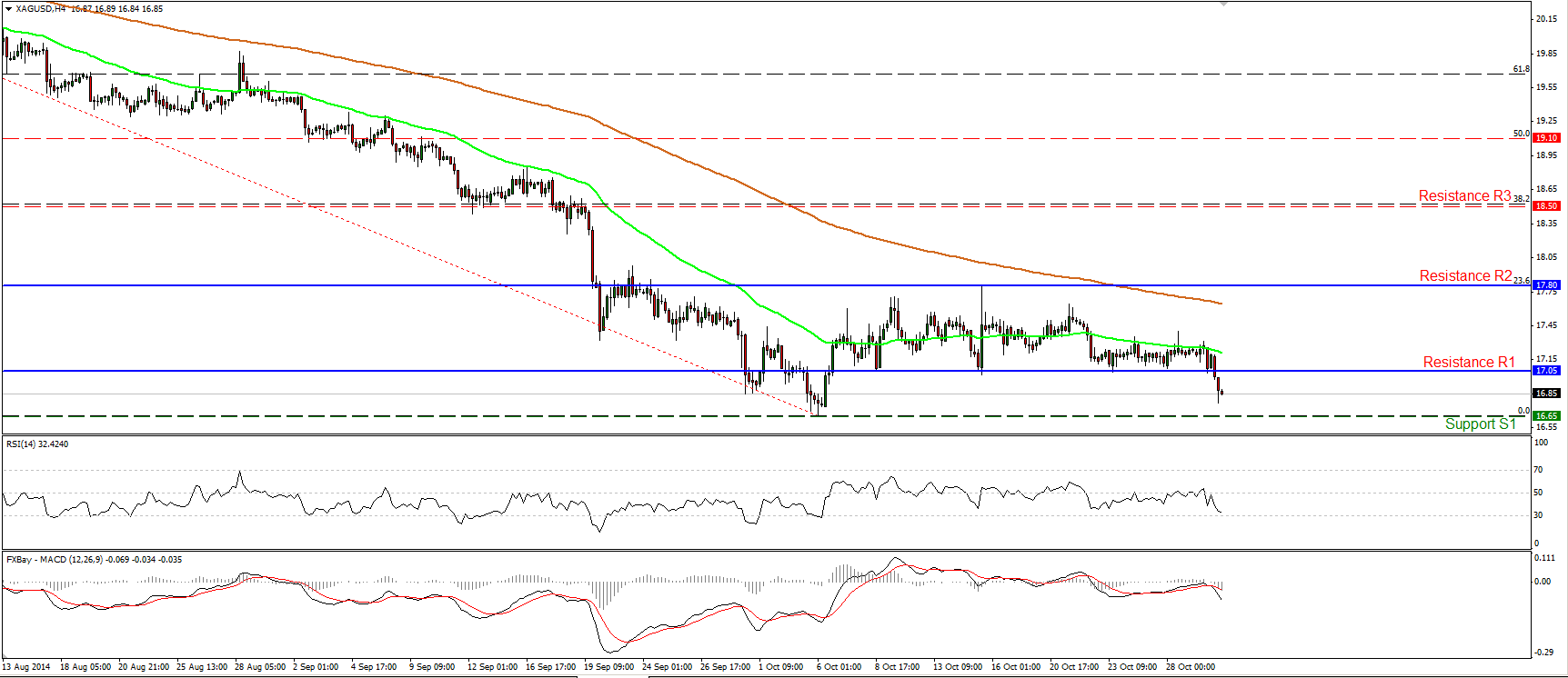

Silver continued tumbling during the European morning Thursday, breaking below 17.05, the lower boundary of the sideways path it’s been trading recently. I would now expect silver to challenge our support hurdle of 16.65 (S1), which is determined by the low of the 6th of October. In my view, the price has the necessary momentum to challenge that line, as the RSI moved lower after finding resistance at its 50 line, while the MACD, already negative, fell below its signal line. A break below the 16.65 (S1) barrier would confirm a forthcoming lower low on the daily chart and is likely to set the stage for further bearish extensions. Such a move could target the support line of 15.60 (S2), marked by the low of the 24th of February 2010. Our daily oscillators maintain a negative tone as well. The 14-day RSI is pointing down and could move again below 30 in the not-too-distant future, while the MACD, already below zero, appears willing to cross below its trigger line.

Support: 16.65 (S1), 15.60 (S2), 15.00 (S3).

Resistance: 17.05 (R1), 17.80 (R2), 18.50 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.