If you remember my past article about EURUSD on 24.AUG I warned that 1.1255 is crucial for EURUSD upside. EURUSD dropped mainly because of Chinese equity markets, Shaghai index and EUROSTOXX50 futures especially at London open. Some hawkish comments about possible rate hike also gave boost to USDx which additionally lowered the pair. Yesterday we saw 2 rejections from 1.1260 each for 50+ pips and finally 1.1260 level was broken again. PMI rose to 53.3 from 51.8 and it better then preliminary estimate.

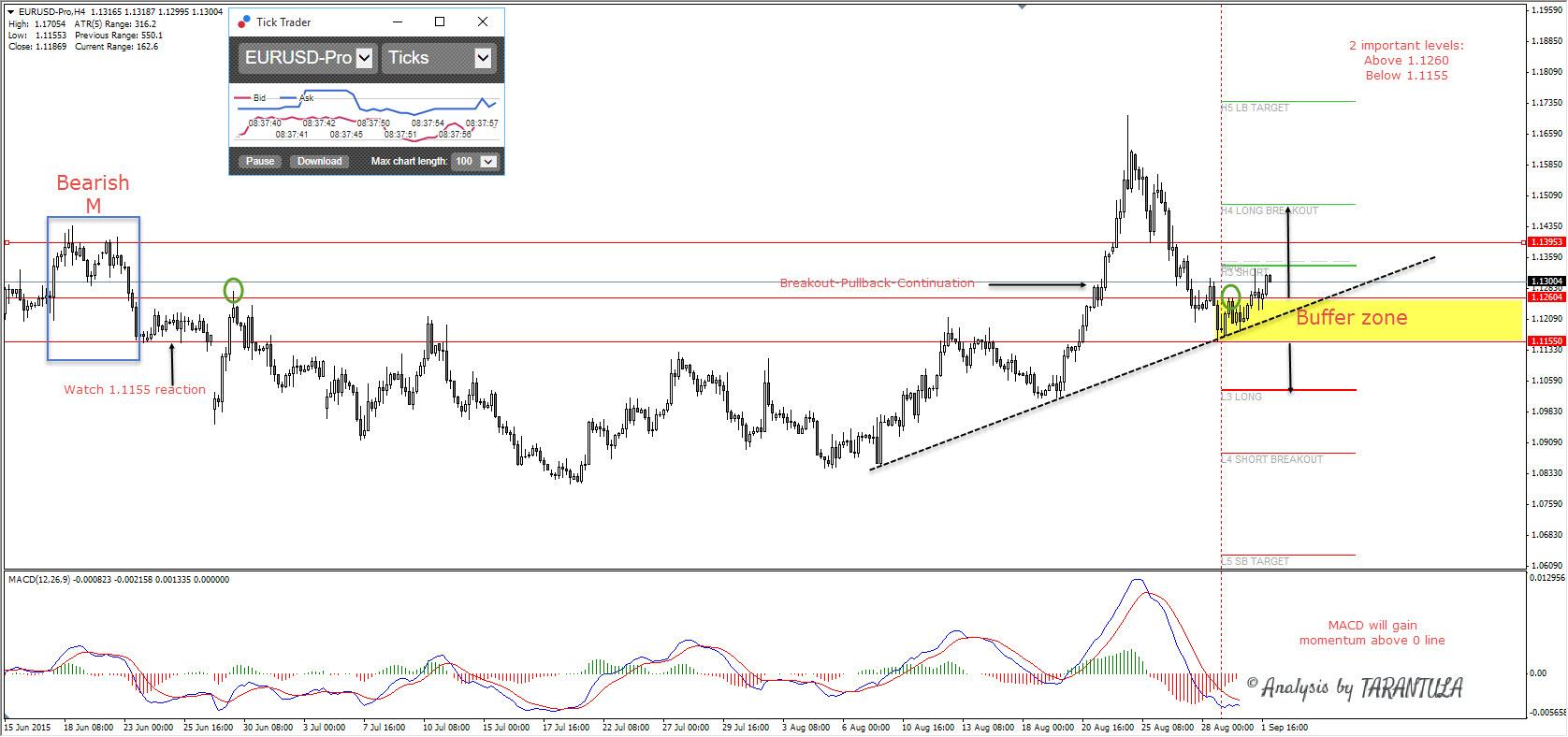

Technically we can spot HUGE Bearish M pattern which went below 1.1260 and it stopped at 1.1155 .EURUSD was sold subsequent spike to 1.1260 (green circles) and we can easily spot Historical vs Now moment sellers. Last drop from 1.1260 was good for intraday shorts but now the price is heavily bought from BUFFER ZONE. BUFFER zone shows clear levels which we should be focused on.

Historical PA shows BPC pattern at 1.1260 (1) so my conclusion is – as long as EURUSD is above 1.1260 it is bullish and below 1.1155 it is bearish. MACD is gaining a possible momentum (when above 0 line) so above 1.1260 we can expect 1.1360 and 1.1395. Only h4 close above 1.1395 will target 1.1500 again.

Below 1.1155 we can expect 1.1000 but so far this looks like a bullish price action with a possible scope for 1.17 retest.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.