![]()

An eerie calm has descended on the markets. News that the Greek PM had made an about-turn and decided that maybe he could accept his creditors’ demands after all, has unleashed a European stock market rally, which has pushed the EUR lower. This rally could be given another boost if, as rumours suggest, Greece’s referendum on the bailout terms is scrapped.

EUR weakness = stock market strength

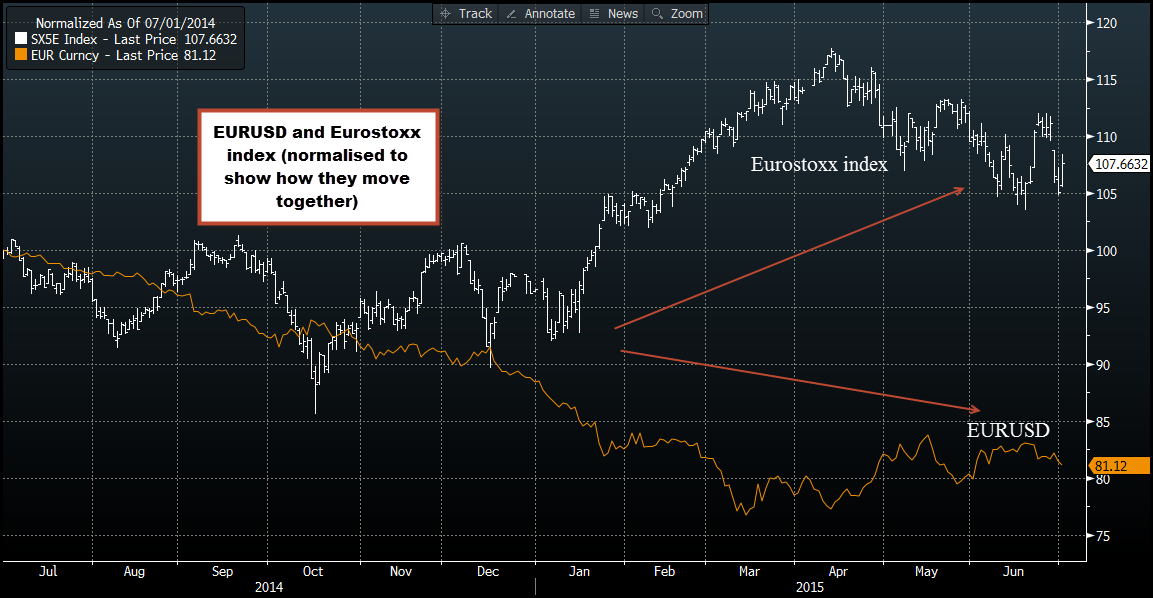

A rallying European stock market is helping to push the EUR lower. This is a long standing relationship, and since October 2014 stocks and the EUR have moved in opposite directions as you can see in figure 1. Although this relationship is not perfect, and does not necessarily suggest that every time we see stocks rally the EUR will fall, these two asset prices do have a history of moving in opposite directions. Now that it appears that the Greek crisis may be coming off the boil, then we could see this relationship come back to the fore.

EUR’s “carries” on as normal

The EUR’s next move is worth watching. We have seen EUR/USD volatility drift lower on Wednesday on the back of the news that Greece may be capitulating to European demands. Greece isn’t out of the woods yet, so we would still be wary of saying that the Greek crisis has calmed down, but if it has then it could spell weakness for the EUR going forward. We have mentioned before that during periods of heightened volatility carry trades can be unwound, triggering a rally in funding currencies like the EUR. Inverse to this, when volatility falls and the carry trade becomes more popular then we can see funding currencies sell off once again. This is one explanation why the EUR has managed to rally during periods of Greek-inspired risk aversion and why it has sold off now that the worst seems to be behind us.

Signs point to potential dollar strength

So, for those people who thought that Greek uncertainty could act as a stepping stone to 2015 lows in EURUSD around 1.05, they have been mistaken and we may need to see Greece fears subside before we can expect to see a clear break of 1.10. A dollar rally could accelerate this decline, which is why we think that the market’s focus is likely to shift across the Atlantic for the next couple of days as we wait for the US June labour market report.

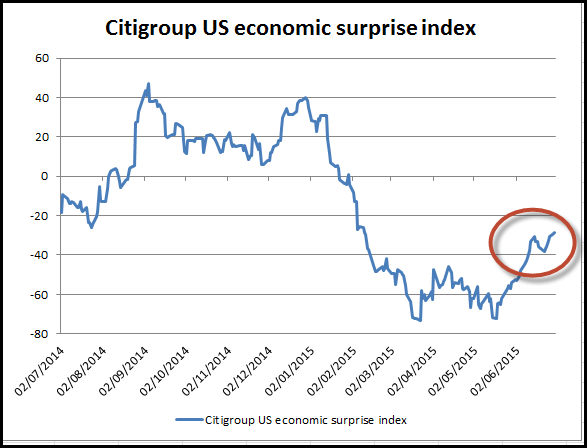

The ADP report, which was released earlier, showed a jump in private sector employment, which rose by 237k last month, up from 203k in May. This is a solid reading and bodes well for tomorrow’s early release of NFP. US treasury yields have rallied some 12 basis points so far this week, if we can get above last week’s high (and a double top) at 2.5%, then it may confirm renewed interest in the dollar. The dollar has also rallied as US economic data has picked up. As you can see in the chart below, the Citigroup US economic surprise index is back at its highest level since February, if this is maintained then we could see another leg higher in the greenback’s rally.

EURUSD; the technical view

So far EURUSD weakness has been stemmed by the 100-day sma at 1.1049 – a key level of support. If we see a strong payrolls report on Thursday then we may breach this important level, which could open the way to a break of 1.10. Key support levels below include: 1.0820 – the low from 27th May, and then 1.05 – the low from April.

Takeaway:

If Greek fears continue to subside and Sunday’s referendum is called off then we could see further weakness in the EUR.

Rather than rally on good news the EUR may be more likely to fall for reasons including a return of the carry trade and an inverse correlation with stocks.

The stars could align for USD strength this week; if we get a strong NFP report then this could send EURUSD hurtling back towards 1.10.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.