![]()

Precious metals have turned quite volatile over the past week or so. Both gold and silver rallied strongly last week, mainly due to a falling dollar, before dropping back sharply yesterday as the greenback surged higher on the back of some surprisingly good housing market data. The USD also received some indirect support from a falling GBP and EUR following news that the UK fell into deflation for the first time since 1960 and after an ECB member said the central bank’s QE programme could be temporarily boosted. The dollar will be in focus again when the FOMC’s last meeting minutes are released at 19:00 BST (14:00 ET) today. If this conveys a dovish message then the US currency could be hit hard, while a hawkish message could send it sharply higher. This in turn may cause the buck-denominated commodities like silver to move sharply.

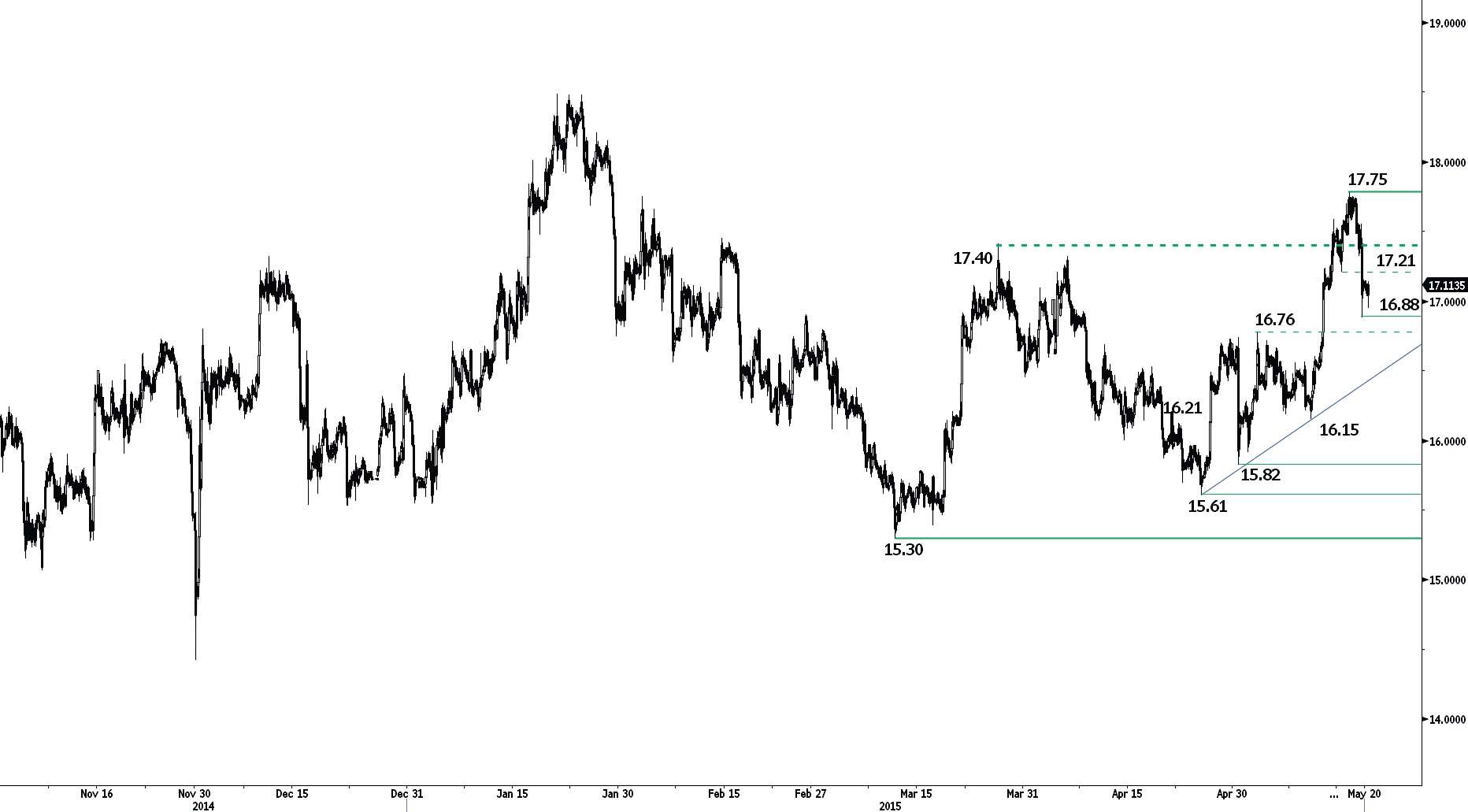

Yesterday’s sharp pullback caused silver to break below some important short-term support levels. But it has still managed to hold its own above the technically-important area of $16.90/$17.00. This is where the 200-day moving average meets the 38.2% Fibonacci retracement level of the last upward move. If this 38.2% Fibonacci level – which represents a shallow pullback, compared to say the 61.8% level – holds firm, it would suggest that the buyers may still have the overall control. Thus if silver were to rally now and eventually climb above Monday’s high then the next leg higher could be significant. What’s more, silver has already broken above a long-term downward-sloping trend line which may discourage the bears from establishing further bold positions. However if silver falls back from here then it may make a move towards $16.70 (the point of origin of last week’s breakout) or $16.40 (61.8% Fibonacci level) before deciding on its next decision.

So, in summary, the price of silver has the potential to bounce back strongly today if the dollar falls back, say as a result of a dovish FOMC minutes, or otherwise if the bulls defend the abovementioned $16.90/$17.00 area successfully. However if the bulls do not show up here then the near term outlook would become more murky and possibly bearish once again.

Figure 1:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.