![]()

The second half of North American trade was very similar to the first half in that the USD continued to take a beating at the hands of the rest of the developed world’s currencies. Major currency pairs were all making notable highs against the USD at least once during the day as EUR/USD rose up to 1.07, NZD/USD took out 0.76, GBP/USD burst through 1.48, and USD/CAD went on a rampage by falling over 250 pips and breaking out of its long drawn out range. Even the much beat up upon AUD/USD made a nearly 100 pip run up to 0.77 before retreating slightly as we careen toward the end of the trading day.

The AUD/USD is where there could be plenty more intrigue though heading in to the Asian trading session. Australia will be releasing their ever-important employment figures this evening which are expected to increase at about a 15k clip. Simply looking at recent examples of Aussie employment doesn’t give us a real good read on how this may end up, but judging by general sentiment out of Australia, it doesn’t look like they could be classified as optimistic. The Westpac Consumer Sentiment released yesterday fell for the second month in a row, meaning that consumers aren’t feeling too good about the current situation. On the other hand, Australian businesses have been faring better as NAB Business Confidence survey increased last month with a small uptick in employment according to the results.

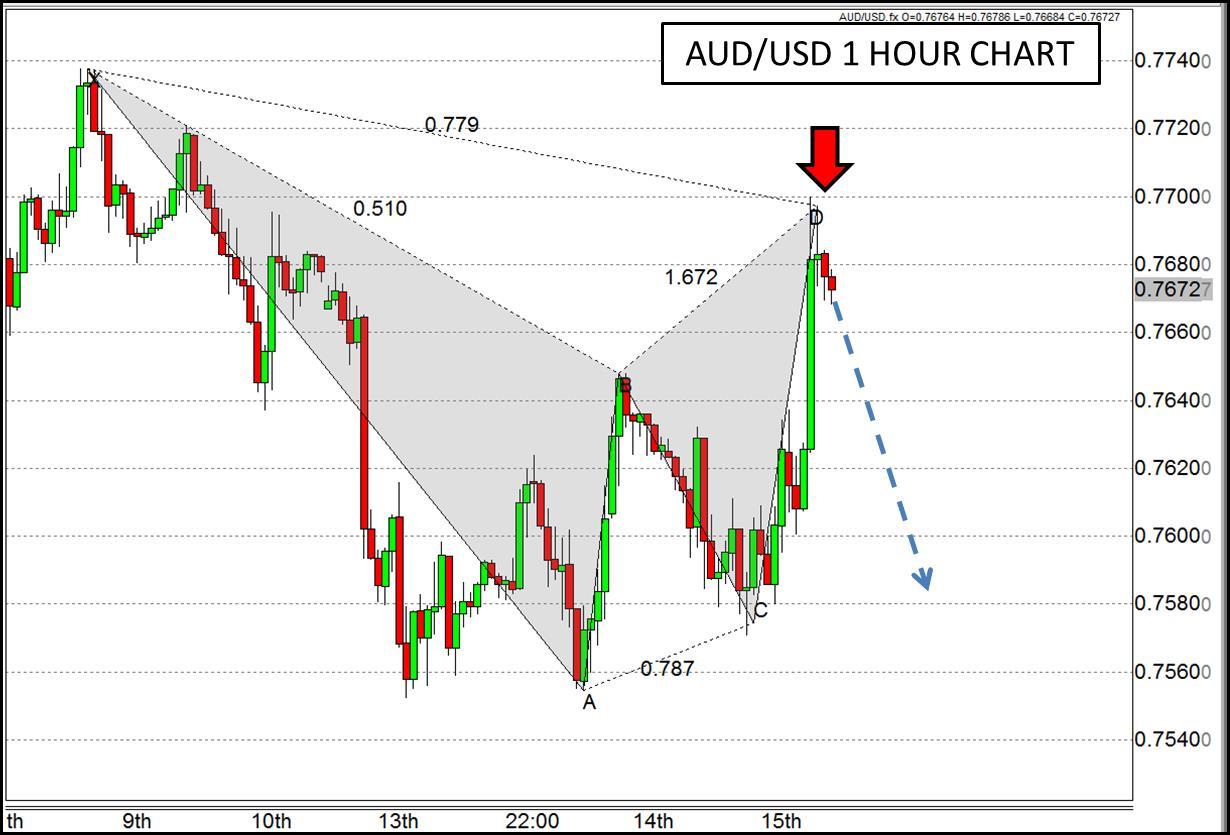

The divergence between consumers and businesses makes this employment figure particularly difficult to predict as the situation appears mixed on the fundamental side. When looking at the technical side of the equation though, there could be a compelling reason to consider a move back down in the AUD/USD. The rally today brought the currency pair right up to 0.77 where it completed a Fibonacci based Bearish Gartley pattern that could prove to be the ceiling on this rise. So at this point, it depends on which dollar you believe in more. Is it the AUD which could prove businesses correct by having a strong showing in employment? Or is it the USD which has shown strength for many months heading in to this report? Based on the arguments laid out here, it would seem the case for a drop back down may be the more likely of the two scenarios as it has both fundamental and technical biases.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.