![]()

With today’s UK Manufacturing PMI report coming out rather “ho-hum” at 54.4 against expectations of a 54.5 reading and a 54.0 print last month, FX traders have had little reason to push the pound sustainably higher or lower: the currency initially dipped in the wake of the report before recovering its losses a few hours later. With GBPUSD still trapped below major previous-support-turned-resistance in the 1.49-1.50 zone, the medium-term outlook remains bearish for that pair, but we’ve recently seen signs that GBPJPY could be taking a major turn lower as well.

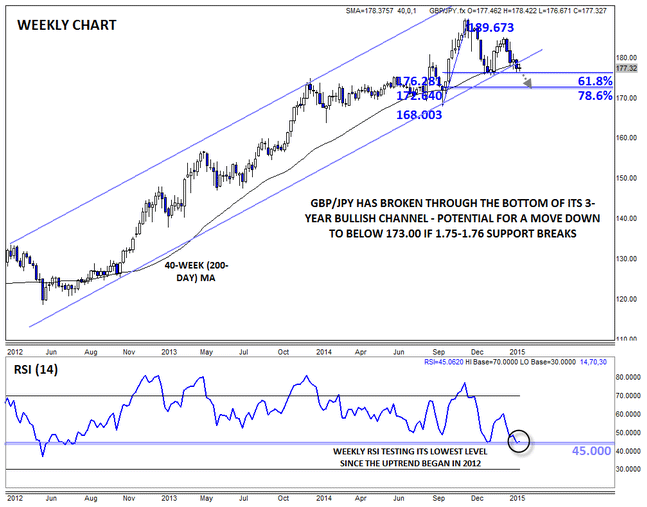

Since mid- 2012, GBPJPY had been steadily rising within a bullish channel…that is until last week. After putting in a lower high at 185.00, GBPJPY broke below both its channel support and its 200-day MA (approximated by the 40-week MA in the chart below) at 1.7825 last week. Rates are holding below those key levels thus far this week, suggesting that the move is less likely to be a false break. Meanwhile, the RSI indicator is also testing its lowest level since the uptrend began at 45, showing that the market’s momentum is clearly waning.

The next key zone to watch for GBPJPY bears will be 1.75-1.76, which marks the confluence of the 61.8% Fibonacci retracement and the year-to-date lows; if that support area gives way, another leg lower toward 172.60 (the 78.6% Fibonacci retracement of the Q4 2015 rally) may be seen. From a fundamental perspective, GBPJPY traders should keep a close eye on the UK Construction PMI report (tomorrow), Japanese Average Earnings data (Friday), and the always-impactful US NFP report (Friday) for near-term catalysts, but as long as the pair remains mired beneath its 200-day MA at 178.40, the path of least resistance will remain lower.

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.