![]()

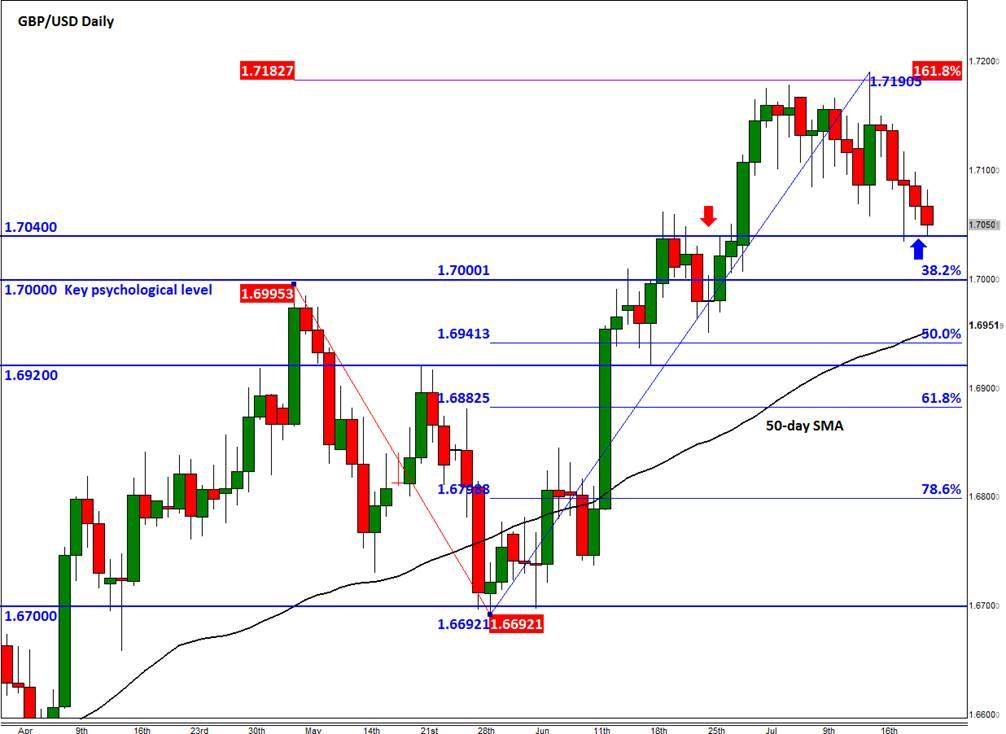

About a month ago now, we took a long-term view on the GBP/USD and suggested that there could be significant gains on the way for the currency pair. At the time, the Cable had just breached 1.7040/5 which was previously a significant resistance level and also the 2009 high. From there, it went up by another 150 pips before the rally exhausted around 1.7190. As can be seen on the daily chart, this 1.7190 level ties in with the 161.8% Fibonacci extension of the corrective move we saw during May. Because of that, I believe that the recent weakness is caused mainly by profit-taking from the longs as opposed to any real selling pressure. As a result, the upward trend may still be intact and we could after all see a major leg higher over the coming weeks and months. However, the bulls will need to show their presence soon, for if they don’t further support levels may get broken which would undoubtedly encourage the bears.

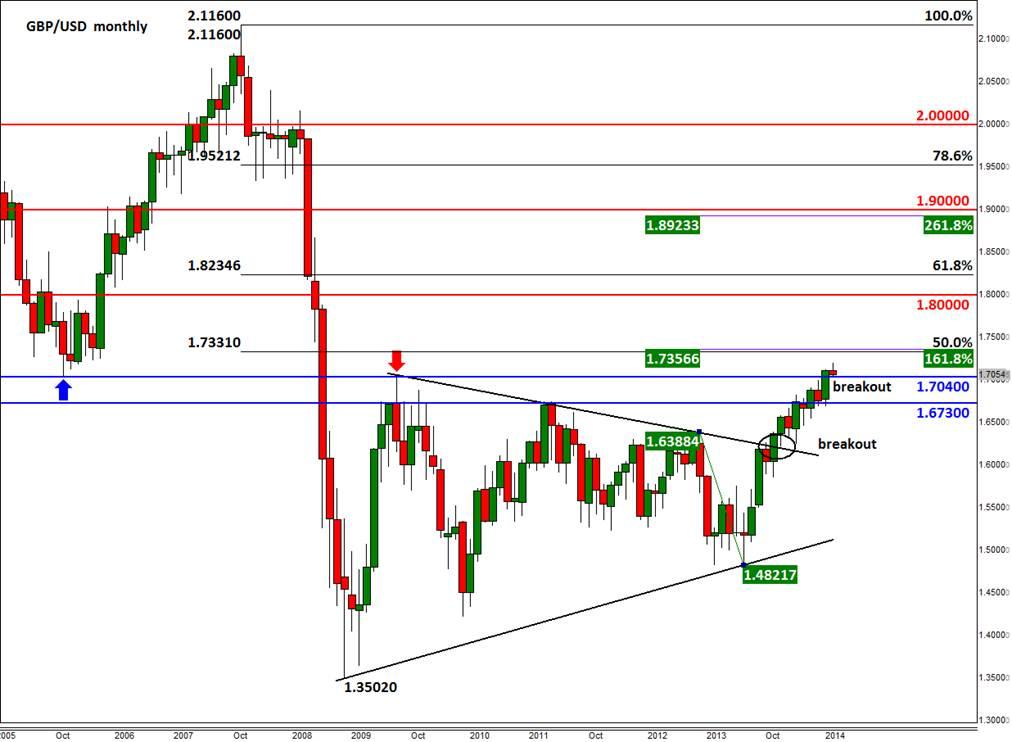

Interesting, the GBP/USD is today testing the 1.7040/5 level again, this time as support. Although we haven’t seen any major reaction here so far, this could change as we head into the second half of the week when we have important data releases scheduled from the UK. As such, it is possible we may see some more weakness in the very near-term before a potential rally back towards 1.7190 and beyond. At 1.7000, the next key support level is not too far away anyway. As well as this being a psychologically-important level, it is where we also have the 38.2% Fibonacci retracement of the upswing from the May low. A potential break below there however could expose the 1.6920/50 area for a test. This is where previous support meets the 50-day SMA and the 50% retracement level. Even if the Cable were to reach 1.6920/50, the long-term bullish trend would still be intact and would remain so unless 1.6730 is taken out on a monthly closing basis (see the monthly chart, below).

Figure 1:

Source: FOREX.com.

As before, the key Fibonacci-based resistance area remains at 1.7330/55. Here, the 50% retracement level of the bear move we saw during the Great Financial Crisis ties in with the 161.8% extension level of the corrective move of 2013. Beyond 1.7330/55 there are no obvious resistance levels apart from psychological milestones such as 1.7500. We will of course revisit the long-term chart of the Cable if and when we get there. But in the near-term, what happens next depends on price action around 1.7040 and this week’s data releases:

From a fundamental point of view, the GBP/USD could find some support if there are any hawkish remarks printed in the Bank of England’s last meeting minutes, scheduled for release Wednesday morning. On Thursday, we will have UK retail sales, which are expected have risen 0.2% in June after dropping 0.5% in May. Then on Friday, we will have the preliminary estimate for the second quarter UK GDP. The economy is expected to have grown 0.8% between April and June just like it did in the first three months of the year. Meanwhile from the US, we have already seen a gauge of inflation come in weaker today, namely core CPI which rose 0.1% in June versus 0.3% expected. But existing home sales was better and that overshadowed the inflation figure. The new home sales estimate is due for release on Thursday, along with weekly unemployment claims and the latest manufacturing PMI. Friday’s key US data is the durable goods orders for the month of June.

Figure 2:

Source: FOREX.com.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.