![]()

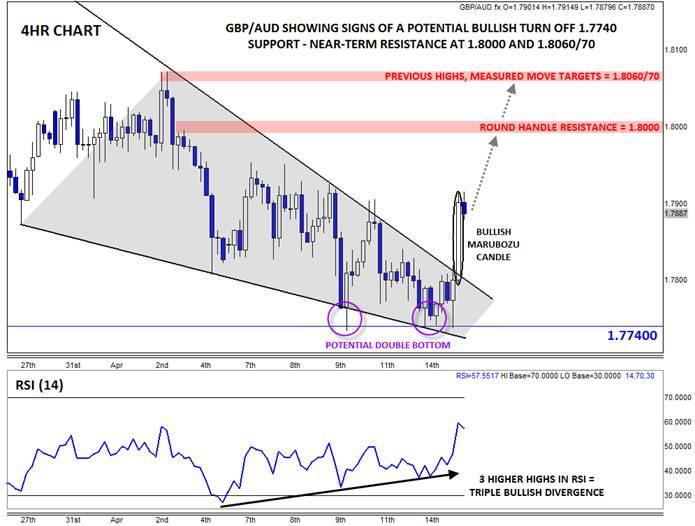

Nearly a month ago, we highlighted the uncanny convergence of multiple bearish technical signals (see “GBP/AUD: Six Technical Signs of a Longer-Term Top” for more). Since then, the GBP/AUD has collapsed around 400 pips, and though we still haven’t reached the intermediate target near 1.7600, there is a growing body of technical evidence that suggests the pair may have seen a near-term bottom.

First, and perhaps most importantly, rates have broken above the bearish trend line off the March 3rd high (the “right shoulder” of the daily head-and-shoulders pattern, not shown). In general, a broken trend line signals a change in trend, though not necessarily a reversal of the previous trend; for example, prices may simply start to “trend” sideways below 1.80 from here, so traders may want to look for further evidence before immediately buying the pair or closing longer-term shorts.

Digging deeper though, the recent technical patterns are showing nascent signs of a shift to a bullish trend. For one, connecting the lows since late March reveals a falling wedge pattern on the 4hr chart – with today’s big breakout, this pattern points to a possible recovery rally back above 1.80. The pair’s RSI also put in a triple bullish divergence with price, indicating waning bearish momentum and increasing the likelihood of a medium-term bottom in the pair.

On a candlestick perspective, the GBP/AUD just put in a large 4h Bullish Marubozu Candle*, which shows strong buying pressure throughout today’s early US session and foreshadows a potential continuation to the topside over the next few candles. Finally, the recent low came in near the same area as last Thursdays low, raising the possibility of a double bottom pattern that would be confirmed by a conclusive break above 1.7900.

Before turning outright bullish, traders should note that the pair still remains in a general downtrend (lower lows and lower highs) on the daily chart. That said, near-term bullish traders may want to watch for a bounce back toward the psychologically-significant 1.80 level, followed by a potential continuation toward the upper-1.8000s, where the measured move targets of the falling wedge and double bottom pattern converge. On the other hand, a drop back below 1.7800 or double bottom support at 1.7740 would turn the bias back to bearish for a possible move down toward 1.7600 support next.

* A Marubozu candle is formed when prices open very near to one extreme of the candle and close very near the other extreme. Marubozu candles represent strong momentum in a given direction.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.