![]()

The Kiwi is the top performing currency in the G10 so far today and is up across the board. The chief driver of Kiwi strength is the better than expected February trade balance, which jumped to its highest level in nearly three years. This could further improve New Zealand’s current account balance, which is currently NZD 1.43bn in deficit. As we have said before, a strengthening balance of payments position can be good news for a currency as it suggests economic health.

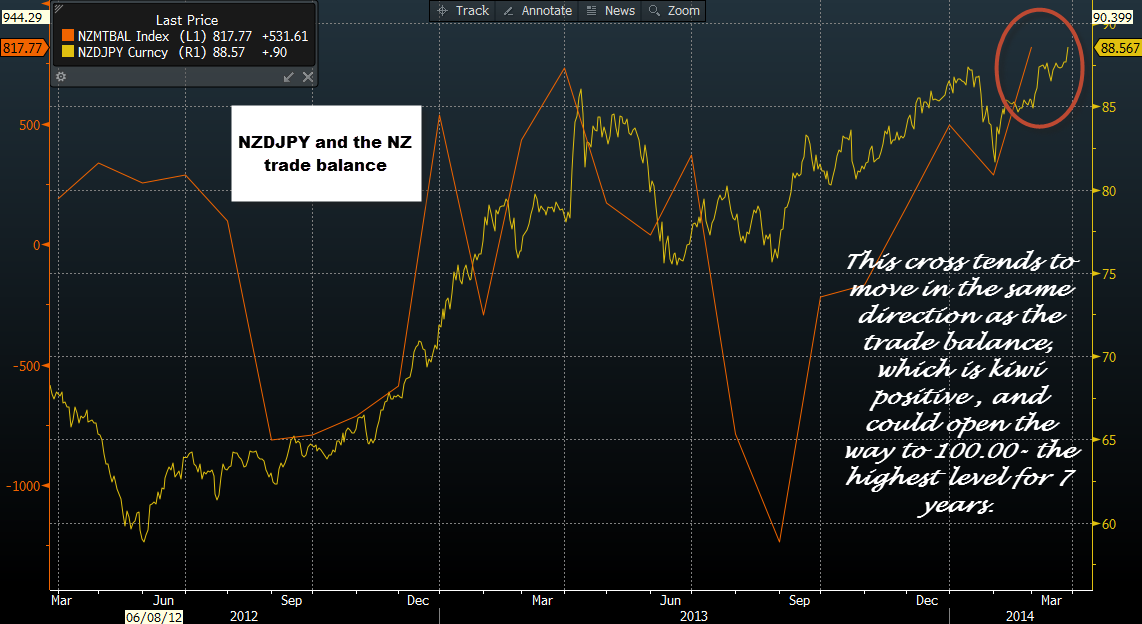

The chart below shows NZDJPY and New Zealand’s trade balance, as you can see, this currency pair tends to move in the same direction as the trade balance. NZDJPY could also be getting a boost from the weakening trade position in Japan. Whereas in New Zealand the trade balance is in a multi-year surplus, in Japan the trade balance has reached a record deficit.

What does this mean for NZDJPY?

The fundamental picture is still positive for this cross as the relative trade position and contrasting central bank stances of the RBNZ and BOJ are NZD supportive for now.

From a technical perspective, the daily RSI is at 70.00, which suggests this pair is oversold and could be due a pullback.

We could see a shallow pullback in the short-term, key support lies at 88.31 – Wednesday’s high, then 87.30 – today’s low.

If the fundamental picture holds then we could see further upside in NZDJPY, 100.00 is a key psychological level of resistance and the highest level since 2007.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.