Today’s AM fix was USD 1,653.75, EUR 1,261.06 and GBP 1,028.07 per ounce.

Yesterday’s AM fix was USD 1,653.75, EUR 1,267.82 and GBP 1,029.60 per ounce.

Silver is trading at $30.38/oz, €23.25/oz and £18.95/oz. Platinum is trading at $1,569.50/oz, palladium at $672.00/oz and rhodium at $1,150/oz.

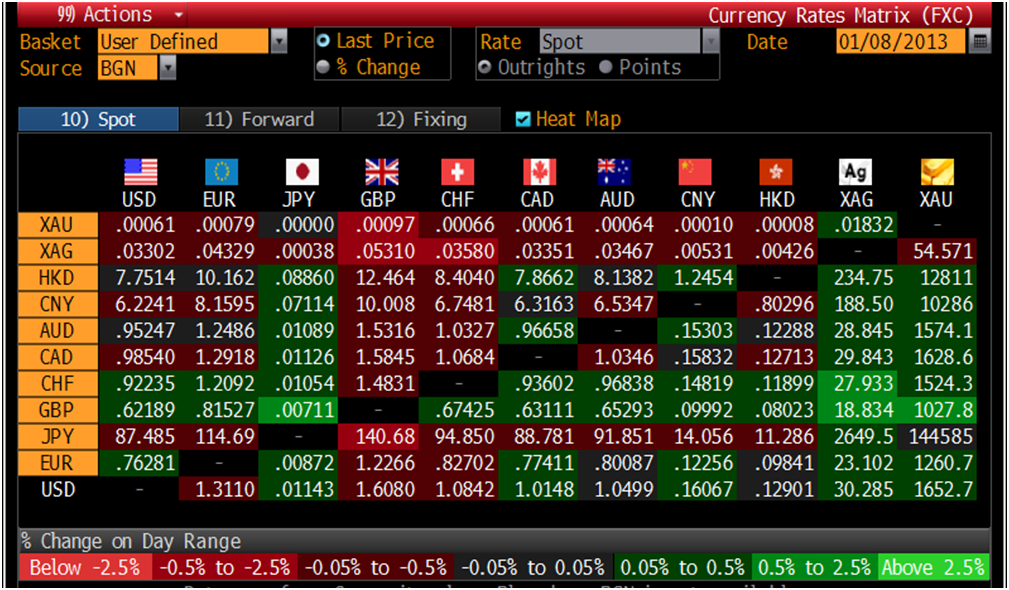

Cross Currency Table – (Bloomberg)

Gold fell $9.90 or 0.6% in New York yesterday and closed at $1,646.40/oz. Silver slipped to a low of $29.84 and finished with a loss of 0.2%.

Gold’s losses in recent days have been more pronounced in dollar terms as gold’s price fall in euros, pounds and other fiat currencies has been far more modest (see charts). Given the challenges facing all currencies in 2013 the price decline is likely another correction prior to further gains.

Gold Spot $/oz, 21 days, 30 minutes – (Bloomberg)

Gold edged up on Tuesday as the euro held steady on to two days of gains on hopes that the European Central Bank will not cut interest rates at a meeting this week.

A Reuter’s poll of economists forecast no rate cut but they cannot agree on whether there will be further cuts in the next few months due to a muddled Eurozone economy.

Data showed Eurozone sentiment improved for its 5th month in a row, based on a drop in Spanish jobless figures and a successful Greek bond repurchase.

Harmony Gold, South Africa’s 3rd biggest gold producer said its Kusasalethu mine remains closed and could be shut permanently with the loss of around 6,000 jobs after managers received death threats and police were shot at.

XAU/GBP, 1 Month – (Bloomberg)

Reuters report that Asia's physical market has picked up so far this year, with buyers tempted by last week's big drop in prices -- when prices retreated to as low as 1,626 per ounce -- and on demand ahead of the Lunar New Year, traders said.

The trading volume on the Shanghai Gold Exchange's 99.99 gold physical contract shot through the roof on Monday, hitting a record of 19,504.8 kilograms, after double-counting transactions in both directions.

XAU/EUR, 1 Month – (Bloomberg)

"Physical demand is very strong," said a Beijing-based trader. "It's a combination of the attraction of lower prices as well as pre-holiday demand."

But such appetite could waver if prices recover towards $1,700, he added.

U.S. gold gained 0.1 percent to $1,648.60. Shanghai's 99.99 gold traded at 331.58 yuan a gram, or $1,658 an ounce - a $10 premium over spot prices, compared to single-digit premium most of last year.

Technical analysis suggested that spot gold could edge higher to $1,665 an ounce, and a previous target of $1,625.79 has been temporarily aborted, said Reuters market analyst Wang Tao.

Bloomberg quoted Feng Liang, an analyst at GF Futures Co., a unit of China’s third-biggest listed brokerage who said “the recent price drop has attracted some purchases, evidenced by the volumes in China,” “Whether this rebound can be sustained depends on the emergence of physical buyers, especially from China and India, at a time when demand is meant to be strong.”

In China, demand typically picks up before Christmas and lasts through the Lunar New Year in February. India’s wedding season, a peak-consumption period for gold jewelry, runs from November to December and from late March through early May. The countries are the two biggest bullion consumers.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.