Yesterday’s Trading:

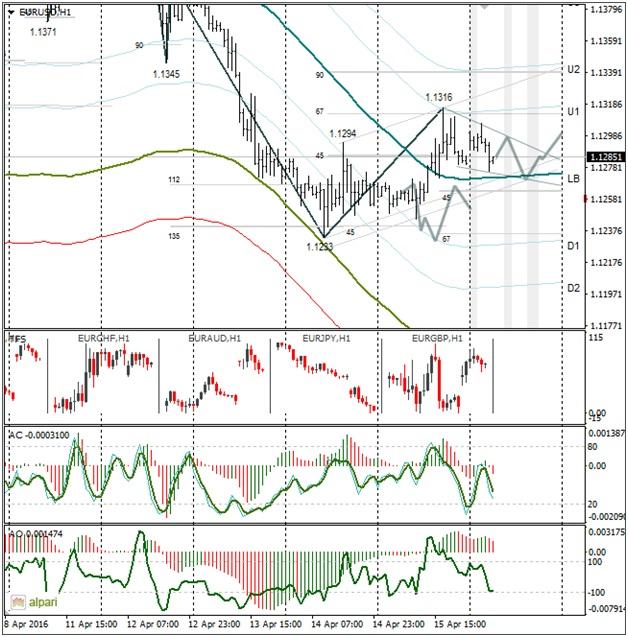

Economic data from the US on Friday was ambiguous, allowing the euro/dollar to rise to 1.1316. The New York business activity index exceeded expectations. The index for industrial production and the university of Michigan’s index were worse than expected.

The index for business activity from the federal reserve bank in New York was 9.6 for April (forecasted: 2.21, previous: 0.62).

The index for industrial production in the US for March was down 0.6% MoM against a forecasted 0.1% fall (previous: reassessed from -0.5% to -0.6%). The Michigan index for consumer confidence was 89.7 against an expected 92 and a previous 81.

Market Expectations:

Trading on Monday opened up for the dollar against commodity currencies. On Sunday in Doha negotiations regarding a freeze to oil output collapsed. The main reason for this was the lack of an Iranian representative present. The next OPEC meeting will take place in Vienna in June.

Brent fell 4.6% to $41.04. The euro/dollar opened up, but then followed the rest down and returned to 1.1275. The price is near the LB, indicating the balanced nature of the pair on the hourly and the readiness of the market to go astray. Since today is Monday – day of correctional movement – on my forecast I’ve gone for a sideways movement above the LB.

Day’s News (EET):

-

13:00, monthly Bundesbank report in Germany;

-

15:30, Canadian data on foreign securities transactions in February;

-

15:30, New York Fed’s William Dudley to speak;

-

17:00, NAHB April housing market index.

Technical Analysis:

Since the AO indicator is in the positive, I expect to see an update of the Asian minimum. If we make an upwards channel, then we see that the price should remain above 1.1267. Since today is Monday, there’s no point going deep into the technical analysis.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.