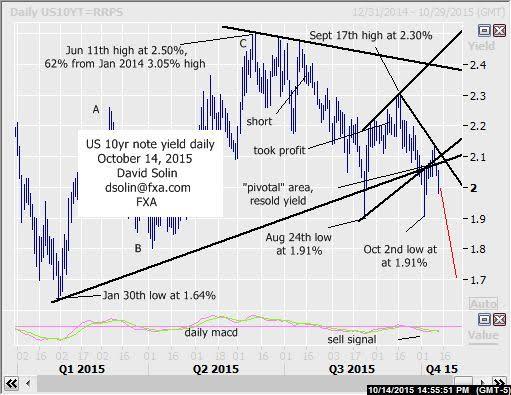

Near term US 10 year note yield outlook:

The market did indeed turned lower from the previously discussed "pivotal" area near 2.07/10% (never closed above, broken bull trendline from Jan, broken base of the bull channel from Aug), targeting declines back to the Aug/Oct 2nd lows at 1.90/92% and even below ahead. Note that weak technicals (see sell mode on the daily macd), the seasonal chart that declines into the end of the year (see 3rd chart below) and view of an important topping in the S&P 500 (and scope for a few weeks of sharp declines, would likely lead to lower yields due to safe haven buying) support this near term negative view. Bigger picture, long held view of eventual new lows below that Jan low at 1.64% also remains in place as the upmove from that low to the June high at 2.50% occurred in 3 waves (A-B-C, argues a correction). But be warned, there remains scope for as much as another few months of wide ranging first. So there is risk that the nearer term declines below 1.90/92% may be limited (as part of this potential, continued period of wide ranging). Nearby resistance is seen at the bearish trendline from Sept 17th (currently in that 2.07/10% area). Bottom line: declines below 1.90/92% favored, but the magnitude of further, near term weakness is a question (at least initially).

Strategy/position:

Still short from the Oct 7th resell of yield at 2.07%. For now would stop on a close .02 above that bearish trendline from Sept, but will want to get much more aggressive on a move below 1.90/92% to reflect that risk that further weakness may be limited (at least initially)

Long term outlook:

As discussed above, eventual new lows below that Jan low at 1.64% is favored and "fits" the very long held view (years) of an extended period of wide chopping lower, as the market forms that huge falling wedge since 2003. These patterns break down into 5 legs and continues to target new lows below 1.38% (as well as that 1.64% low) within that final leg. But as discussed above, there remains scope for a more extended period of wide consolidating (months) before those new lows are seen (see in red on weekly chart/2nd chart below). Key resistance remains just above that 2.50% at 2.60/75% (ceiling of the huge wedge) with a break/close clearly above arguing that a more major low is already in place. Bottom line : still in huge falling wedge since 2003 with eventual declines below 1.64%, as well as that June 2012 low at 1.38%, still favored (may be an extended period of time before such new lows are seen).

Strategy/position:

Switched the bias to the bearish side way back on Dec 17th at 2.09%. And with eventual new lows below 1.38% still favored and an important top seen in place, would stay with that bias for now.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.