Euro Research Report

Sterling Euro peaks at the 7 year highs

QE continues to weigh on the Euro

BOE concerned about headwinds from the Eurozone

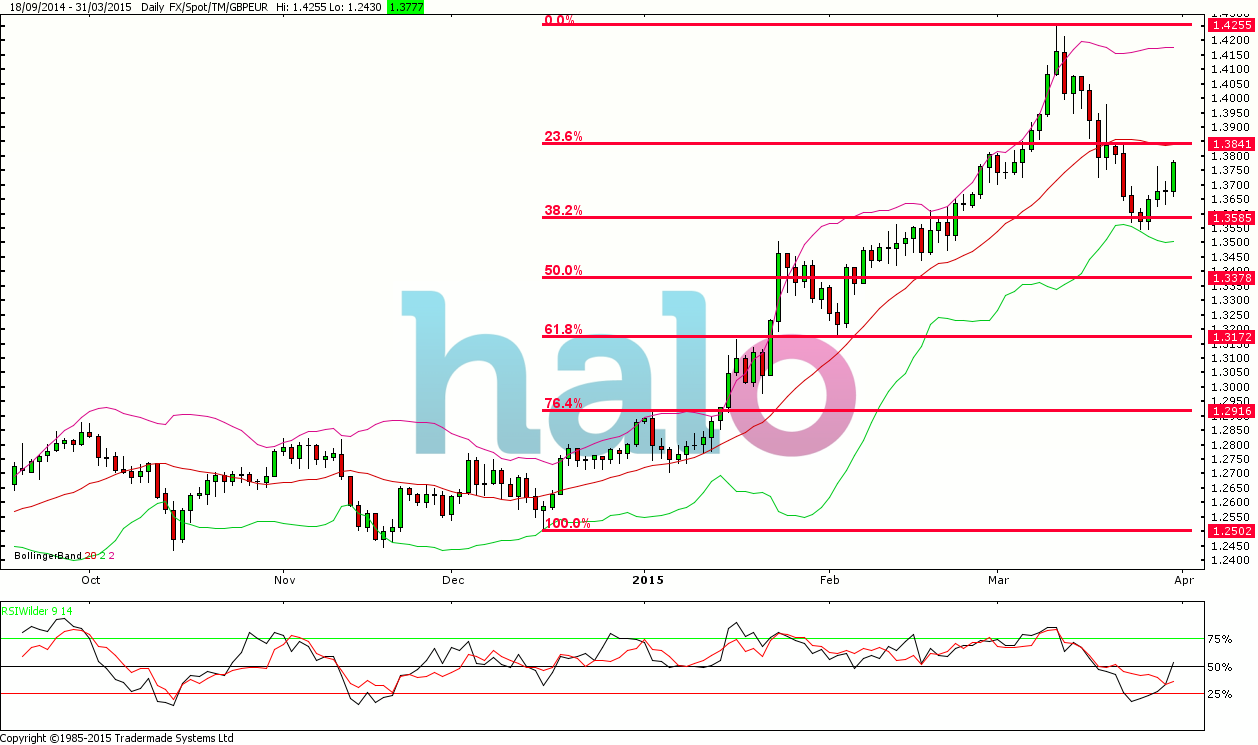

Sterling Euro (GBPEUR) FX Technical Analysis

The volatility that we observed in March was staggering. The Sterling Euro rate staged a move from the mid-1.30s up to a fresh new 7 year high of 1.4250. The move higher can be attributed to ECB President Mario Draghi's pledge to buy 60 billion worth of euros per month in assets which drove the Euro lower across the board. It was the sheer speed of the move that took the market by surprise, the Euro fell 6 per cent in six days, a pace of decline only seen before in October 2007 after the collapse of failed investment bank , Lehman Brothers. After reaching 1.4250 the market performed a sharp correction as the speed of the move higher was unsustainable. Traders noted that the Euro was severely stretched on the technical measures and began to take profit on their long positions sending the Sterling Euro rate tumbling to where it resides now around the mid-1.30s. Quantitative Easing is aimed at supporting the bloc's ailing economy and moving inflation back toward the ECB's target of just below 2%. ECB President Draghi is already convinced that an economic recovery is taking hold, maintaining that the asset purchase programme has eased financial conditions and will contribute to a gradual recovery in the Eurozone. Draghi has urged governments to use the brighter outlook to advance reforms that would improve the region’s long-term growth prospects. Germany, the Eurozone’s powerhouse has revised their annual growth forecast to 1.8 percent for the year from its previous 1% citing cheaper oil and a weaker euro reflecting this more optimistic view. Most of the forward looking indicators suggest that a sustained recovery is taking hold in the Eurozone, and that confidence among firms and consumers is rising, however the path to recovery will be long and rocky. The Eurozone’s shaky recovery will be continually hindered by ongoing internal conflict. Policy makers cannot seem to agree what to do with Greece who are still teetering on a possible default which could result in an expulsion from the Eurozone. This would have huge knock effects to other nations within the bloc which could be detrimental to the Eurozone as a whole. At this point there are no inherent reasons to hold on to Euros, so we need to take any new positive news with an air of caution.

Market focus has now changed to back to the Bank of England surrounding the timing of when the Central bank will begin its normalization of interest rates (Interest rates are a primary driver of the exchange rates). The UK economy has made a solid start to 2015 and this month was no exception as retails sales surged, trade balance deficit reduced, and the construction PMI beat all estimates. Firms across the UK hired staff at the second-fastest rate on record, while wages continued to rise, growth in Britain's dominant services sector eased back in February but still remained in expansionary territory. The Bank of England has been cautious of the more upbeat data, as inflation continues to fall. Prices decelerated more than expected in February as CPI fell to 0%. This drop in inflation has kept the Bank of England Hawks at bay and for the third consecutive month the decision was unanimous as members voted to keep rates at record lows for the 72nd consecutive meeting earlier this month.

Bank of England officials are worried about headwinds from the Eurozone and the strengthening pound which risks prolonging a spell of ultra-low inflation, and puts a brake on future interest-rate increases which are expected to begin early next year. Bank of England Chief Economist Andrew Haldane made a rather dovish statement which weakened the pound as he stated inflation will remain close to zero in the near-term and risks to inflation are two-sided with a view that these risks are skewed to the downside.

For EUR Buyers

The exchange rate is still very close to the 7 year highs and near term buyers should still think about reducing their exposure close to current levels. The recent correction however found a base at the 38.2% Fibonacci level and those with deeper pockets and a more medium term outlook should leave protection below there and look for a renewed push higher to test 1.4250.

For EUR Sellers

It's difficult to see any light at the end of the tunnel – The momentum indicators would suggest that we are heading higher again having based and turned up towards the 50% line. It looks like 1.4000 is on the cards and sellers should try to get something in place in case we break into a new trading range.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.