In recent months USD/CAD has traded-up from 1.19 to 1.27, confidently approaching 1.30 a price not seen since March 2009! However, the pair must break-through resistance in the 1.28’s, a level last tested in March 2015, before it moves higher. The following article explains why CAD has weakened so tremendously against the USD and what we can expect in the coming days and weeks.

This pair has been in a determined rally since early 2013, when the rate was below 1.0500. This is due to the more buoyant economy in the USA compared to Canada where the GDP growth rate has been well below 1% since 2012 compared to an average growth rate in the US of over 2% for the same period.

USD/CAD Weekly Chart:

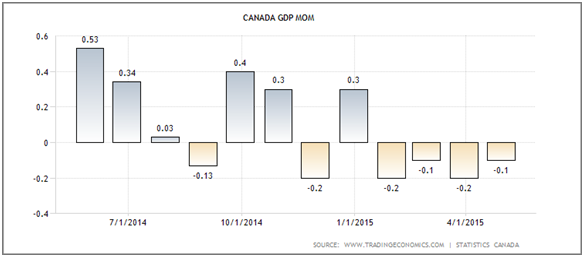

Last January, the Bank of Canada (BoC) surprised markets with an interest rate cut from 1% to 0.75%, which sent the USD/CAD flying from 1.21 to over 1.28 by month end. Canada’s economy, unlike the U.S., has not shown signs of recovery and expansion. Also, they largely rely on oil exports hence ever falling oil price is an extra burden. Many analysts are looking for another interest rate cut and given the continued drop in Canada's Gross Domestic Product (GDP) into negative figures, with last month-on-month figures at-0.1%, the question is more a matter of when than if. See GDP chart below.

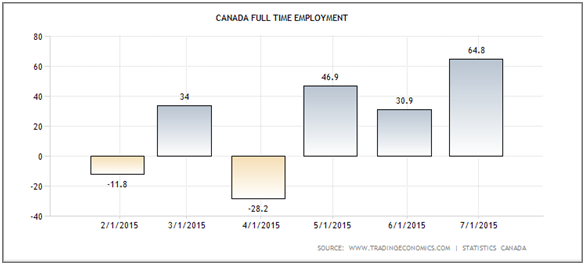

There is a possibility this Wednesday 15th, at the scheduled BoC rate announcement, for a rate cut to 0.50%. However, this may be unlikely to happen so soon given recent higher than expected Inflation data and good job growth. The BoC has a target for inflation of 2%, most recent data came out at 2.2% and the next data release on Friday July 17th is expected at 2.2% also. The job market has added over 136,000 full time jobs (net), see chart below. Plus, Bond yields on 10 year notes bounced from a low at 1.52% on July 8th to today’s 1.72% indicating traders do not see a rate cut as being very likely just yet.

When trading this pair it may be wise to follow the BoC updates and forecasts along with its rate decision on Wednesday at 14:00 GMT, they may provide more insight as to the timing of the next rate cut (if there isn’t one at this announcement), but more data offering clues will be released going forward in particular GDP Growth and the core Consumer Price Index (CPI).

How to trade USD/CAD moves?

Buying Options may be used to trade currency fluctuations with the benefit of limited risk and avoidance of stop-outs. The following provides you with two examples.

Trading an Uptrend

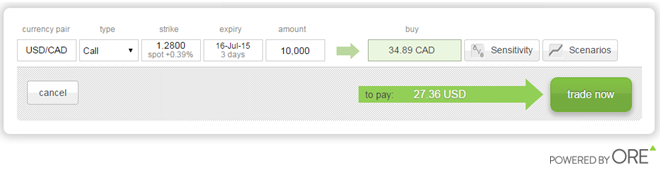

As explained above, an interest rate hike may send this pair even higher still. In this case, if you think a rate cut is likely, you may buy a USD/CAD Call option because a Call gives the right to buy at a certain rate over a certain period of time. If USD/CAD rises above your strike price, the option trade becomes more profitable.

The below image is an example of a Call option trade with a three day expiry, target rate (strike) of 1.2800 for an amount of 10,000 USD. That is, a contract reserving the right to buy 10,000 USD/CAD at 1.2800 over the next 3-days (during the BoC rate announcement). If USD/CAD moves above 1.28, the option contract’s value will increase and the trade may be profitable. On the other-hand, if USD/CAD does not rise, in the given time frame, then the trade will lose. The maximum loss is 34.89 CAD (27.36 USD), which is the cost to buy the option.

Trading a Downtrend

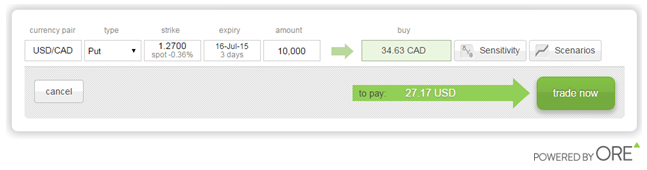

If you think there will be no rate hike and that USD/CAD will subsequently fall in price then you may buy a Put option, because a Put gives the right to sell at a certain market rate over a certain period of time.

The below image is an example Put trade with a three day expiry, target rate (strike) at 1.2700 and amount 10,000 USD. That is a contract with the right to sell 10,000 USD/CAD at 1.2700 over the next 3-days. If USD/CAD falls below 1.2700, the option contract’s value will increase and the trade may be profitable. If USD/CAD does not fall, by expiry, the trade will lose. The maximum loss is the cost to buy the option, which is 34.63 CAD (27.17 USD).

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD maintains ground near the major level, Australian Budget Release eyed

AUD/USD retraces its recent gains on Tuesday ahead of the Yearly Budget Release by the Australian Government due to be published later in the day. Treasurer Jim Chalmers hinted at positive developments suggesting that the upcoming budget could show a faster decline in inflation than the RBA had predicted.

EUR/USD tests the upper boundary around the level of 1.0800

EUR/USD has recovered its recent gains registered in the previous session, trading around 1.0780 during the Asian session on Tuesday. From a technical perspective, analysis indicates a sideways trend for the pair as it continues to lie within the symmetrical triangle.

Gold price gains ground ahead of US PPI data, Fed’s Powell speech

Gold price rebounds despite the consolidation of the US Dollar on Tuesday. The upside of yellow metal might be limited as traders might wait on the sidelines ahead of key US inflation data this week. The higher-for-longer US rate mantra has exerted some selling pressure on the XAU/USD in recent sessions.

Top meme coins post gains following increased social activity amid GameStop pump

Meme coins in the crypto market saw impressive gains on Monday following a recent surge in GameStop stock. The increased attention surrounding these tokens signifies a potential resumption of the meme coin frenzy of March.

PPI to test the soft landing narrative

Investors brace for key U.S. inflation data, which are anticipated to play a crucial role in shaping the outlook for Federal Reserve policy and contributing to the market's cautious stance. Investors are particularly sensitive to this data, given its potential to influence interest rate decisions and broader market sentiment.