Introduction

AUD/USD moved to a low of .7605 overnight after poor inflation data led the pair lower by over one big figure. The central print came in at 1.3% compared to 1.7% last and 1.8% anticipated. It cannot be said that Kiwi Dollar has followed suit although the currency is the second biggest loser within the G10 space against the greenback. Trade balance data out of Wellington missed expectations and some market analysts are predicting a benchmark interest rate cut tonight as opposed to the wider expectation that this will come in June. The market tentatively waits today for central bank meetings worldwide, culminating in arguably the most important BoJ fixture for quite some time.

Asian Session

Stocks in Asia have slided, partly on the back of poor results from major companies bringing the equity markets lower in New York. Apple Inc., Alphabet Inc. and Microsoft Inc. all disappointed markets with the former company losing approx. 8% from its stock price. JPY has gained a touch, perhaps in reaction to equity market moves, but the USD/JPY pair has ultimately traded in a particularly tight range ahead of the central bank meeting in Tokyo later this week.

Ahead of the weekly report from The EIA later today, WTI Crude Oil Futures have risen to a high for 2016 of US$44.83. This can explain a rise in MYR by 0.11% versus USD to the current 3.9150 level.

In the Aussie-cross space, EUR/AUD and GBP/AUD have made as significant moves as AUD/USD has, both trading higher by close to 2%. AUD/JPY has traded with similar volatility, moving from 86.30 to 84.53 during APAC trading.

The day ahead in Europe and NY

A busy day of data lies ahead today with Swedish consumer confidence already released and surprising to the down-side a touch. EUR/SEK has since bounced around but essentially trades at the pre-data level of approx. 9.170. European money supply and private loan data will be released at 09:00 BST today.

Gross domestic product data will be released out of London at 09:30 BST this morning, with the YoY figure expected to print at 2.0% compared to 2.1% in Q4 of 2016. An index of services will be released at the same time too, along with the distributive trades survey from The CBI.

European traders may wrestle books from their colleagues in New York this afternoon and evening with the interest rate decision and monetary policy statement from The Federal Reserve at 19:00 BST and 19:30 BST respectively. Furthermore, The RBNZ will host a similar event at 22:00 BST, with the benchmark interest rates ultimately anticipated to be kept stagnant on both sides of the globe.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1323 | 0.23% | 1.1328 | 1.1292 |

| USDJPY | 111.21 | -0.08% | 111.36 | 111.21 |

| GBPUSD | 1.4617 | 0.25% | 1.4622 | 1.4554 |

| AUDUSD | 0.7619 | -1.67% | 0.7765 | 0.7605 |

| NZDUSD | 0.6877 | -0.31% | 0.6907 | 0.686 |

| USDCHF | 0.9718 | -0.18% | 0.9743 | 0.9714 |

| EURGBP | 0.775 | 0.03% | 0.7762 | 0.7746 |

| EURCHF | 1.1006 | 0.06% | 1.1007 | 1.0995 |

| USDCAD | 1.2604 | 0.00% | 1.2634 | 1.2597 |

| USDCNH | 6.5025 | 0.00% | 6.5046 | 6.4964 |

FXO

The re-launch of USD/RUB forwards and options on the trading platform at Saxo Bank is more than likely to garner interest from retail and institutional clients alike over the coming weeks. The currency is particularly sensitive to the oil price with Russia prominently involved in recent talks amongst major oil producing countries. USD/RUB spot has recently hit yearly lows of 64.66, significantly below its 2016 average of 72.74, whilst volatility in the one month space stands at around the 20% mark. The market awaits the release of GDP figures for March, released at 13:00 BST today, with the previous figure showing a contraction in the economy there of 0.6%.

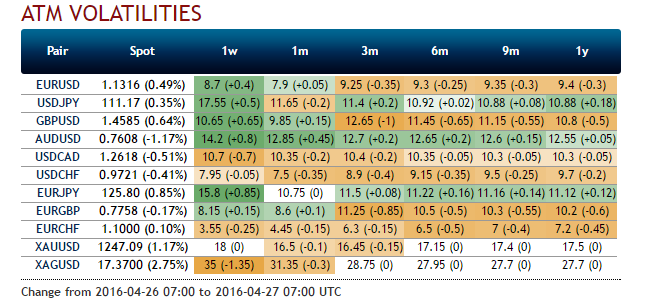

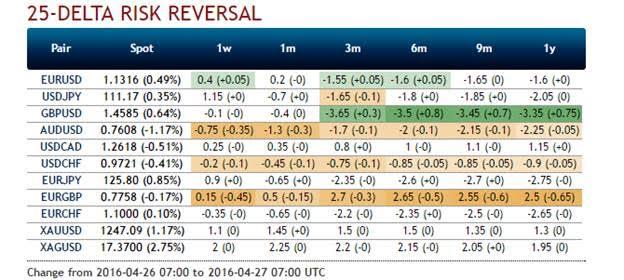

Friday USD/JPY volatilities are trading at around the 25% mark today, with central bank meetings in both countries. Furthermore, the meeting in Japan comes with a plethora of other economic data, such as unemployment and retail trade figures. It comes as no surprise that AUD/JPY volatilities have risen significantly, with the one month straddle moving to trade at close to 16%.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.