On Friday, May 3, at 0830ET/1230GMT the US is forecasted to report a change in non-farm payrolls (NFP) of +145K (prior +88K; range +238/100K), a change in private payrolls of +160K (prior +95K; range +220K/+105K), and a steady unemployment rate of 7.6% (prior 7.6%; range 7.5/7.7%), according to Bloomberg market surveys. Our forecast model indicates an April headline NFP number of +131K jobs, which is slightly below consensus forecasts. We expect most of the job gains to come from private payrolls and are looking for the unemployment rate to hold steady at 7.6%.

With the Federal Reserve indicating its flexibility to adjust asset purchases as needed, markets are likely to be extra sensitive to economic data surprises. Furthermore, as the Fed’s dual mandate is focused on price stability and maximum employment, labor market developments are significant to the outlook for quantitative easing (QE). As outlined in the Federal Open Market Committee (FOMC) policy statement yesterday, “the Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes.”

The circumstance that the pace of purchases can go in either direction places a good deal of emphasis on how the market interprets incoming data in relation to the expected monetary policy response. Significantly weaker than expected employment figures may be interpreted as an indication that the Fed will need to step up the pace of QE to reach its objectives, while data that shows improvement in labor markets may suggest the potential for a tapering of QE. Expected changes to the size and pace of QE tend to be inversely related to the performance of the USD. When markets begin to price in a reduction of QE, (which occurred recently when the Fed discussed tapering asset purchases) the USD benefits as fewer purchases means less dollars being printed by the central bank. On the other hand, an increase in the size or pace of QE would suggest an increase in the supply of USD which tends to have a negative impact on the dollar.

For now, we think that job growth will pick up from the previous month but remain weak overall. Job growth of 131k is well below the rolling 1-year and 2-year average job growth of about 159k and 180k respectively. Recent labor market data has been on the soft side with a decline in the ADP (Automatic Data Processing) payrolls to 118K in April from the prior 131K. The employment component of the ISM (Institute for Supply Management) manufacturing report fell to 50.2 from the previous 54.2 which indicates only narrow expansion. The ISM service sector report, which we tend to weigh more heavily in our forecast model since services represent a much larger portion of the US economy, will be released tomorrow after the BLS (Bureau of Labor Statistics) monthly employment report. Therefore it was not taken into consideration in our forecast for this month. Weekly initial jobless claims have improved notably which supports our view that job growth will increase from the prior month.

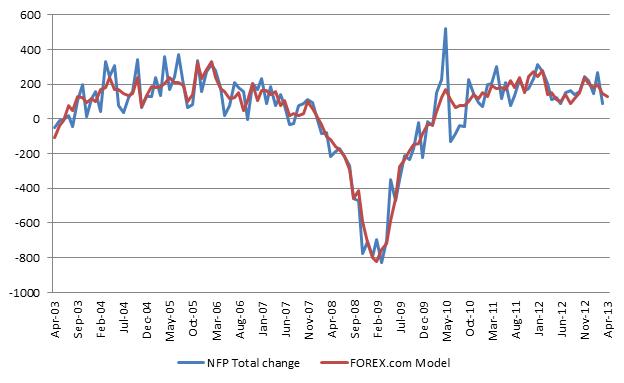

Exhibit 1: Our model forecasts headline NFP print of 131K for April

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.