Carry continues to conquer Weaker data from the UK and US yesterday diminished expectations of rate hikes and sent EM currencies higher almost across the board as carry came back into fashion.

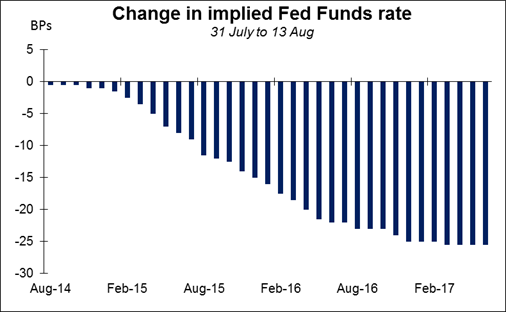

As we mentioned in yesterday’s midday comment, UK average weekly earnings fell yoy in June and the Bank of England slashed its forecast for wage increases this year in half and cut it slightly for 2015 as well. Then later in the day, US retail sales came flat in July, the worst performance in six months. Retail control group – retail sales less food, auto dealers, building materials and gas stations, which is the figure that goes into the US GDP calculation – rose just 0.1% mom, while the previous two months were revised down. This caused many US economists to revise down their forecasts for Q3 GDP. As a result, Fed Funds futures rate expectations dropped as much as 6 bps in the long end (2017), continuing the decline in expectations that has seen long-end forecasts fall by 25 bps so far this month. Bond yields also fell.

The lower US and UK interest rate expectations helped to keep global stock markets rising and naturally fuelled a search for carry. Almost all the EM currencies that we track were either unchanged or higher against the dollar. The exception was BRL, which fell after presidential candidate Eduardo Campos was killed in a plane crash, throwing the October election into disarray. So long as US interest rate expectations remain contained, the additional pick-up in yield of EM currencies is likely to remain attractive and I expect such trades to do well. There certainly are both geopolitical and economic risks, but the continued low level of the VIX index (closed yesterday at 12.90, not far above its recent low of 10.32) suggests the market doesn’t put much weight on those risks. I am personally more concerned than that – having lived in Asia during the SARS epidemic, I’m particularly concerned about the growing spread of Ebola fever as an unprecedented global risk – but it may be that I’m just too worried an individual. As Charles Prince, former chairman of Citibank once said, “as long as the music is playing, you’ve got to get up and dance.” Thus I expect the market to continue the search for yield and for EM currencies to do relatively well going forward, at least as long as the music is playing.

EUR/USD initially eased after weaker Eurozone industrial production, but then came back after the US economic data disappointed as well. The range on the day was 0.55%, which is actually rather high in the context of a 0.84% range for the month so far. Nonetheless it was unable to break last week’s low of 1.3330, nor was it able to sustain the highs set after the retail sales figures for very long, confounding both the bears and the bulls. Given how quick the market was to sell the highs yesterday, I believe investors remain bearish on EUR. The expect that a break of that 1.3330 support is likely to trigger a new leg down in the pair. Today’s GDP data could provide that trigger (see below).

Today’s data: The focus during the European day is the preliminary GDP data for Q2 from France, Germany and the Eurozone as a whole. The consensus forecast is for Eurozone’s preliminary GDP to have slowed to +0.1% qoq in Q2 from +0.2% qoq in Q1. However, both Germany, supposedly Europe’s strongest economy, and France missed their forecasts. Germany registered a fall in output of 0.2% qoq, worse than the expected -0.1% and a marked turnaround from +0.8% qoq in Q1. (And this was before the Russian sanctions!) French GDP was unchanged qoq, below the forecast rise of 0.1% qoq, i.e. France continued to stagnate. Coming on top of the unexpected contraction in Italy’s Q2 GDP, EUR weakened as investors worry that the Eurozone is falling back into recession. The ECB today publishes its quarterly Survey of Professional Forecasters, which will show what the consensus view is on that issue. The bloc’s final CPI for July is also coming out.

In Canada, we get new housing price index for June as well as the revised labor market report after Statistics Canada found an error in the original report published last Friday. The Canadian dollar recovered all the losses ahead of the revised report amid expectations that the error understated the net employment change. We would expect CAD to strengthen further if a strong rebound above 20.0k (the original market forecast for the figure) is recorded.

From the US, we get the initial jobless claims for the week ended 9th of August. The forecast is for claims to increase marginally.

We have no speakers scheduled on Thursday.

The Market

EUR/USD stays within its recent range

EUR/USD moved higher after the soft US retail sales data, but gave back its gains within the next few hours to trade virtually unchanged. As long as the rate is trading within the long-term blue downside channel, connecting the highs and the lows on the daily chart, I still believe that the overall trend is to the downside. However, on the 4-hour chart, the pair remains within a trading range between the support of 1.3330 (S1) and the resistance of 1.3415 (R1). As a result, I would prefer to see a dip below 1.3300 (S2) before regaining confidence on the downtrend. Such a dip could pave the way towards the 1.3200 (S3) zone.

Support: 1.3330 (S1), 1.3300 (S2), 1.3200 (S3).

Resistance: 1.3415 (R1), 1.3445 (R2), 1.3500 (R3).

Carney pushes GBP/USD below 1.6700

GBP/USD came under broader pressure yesterday after Governor Carney revealed that the Bank cut its wage growth forecasts. Carney's speech corroborated our previous comments, with Cable reaching and breaking below the 1.6700 line (support turned into resistance). Our next support stands at 1.6655 (S1). A clear dip below that level could set the stage for extensions towards the hurdle of 1.6600 (S2). On the daily chart, GBP/USD remains below the 80-day exponential moving average and is now trading below the lows of May. This enhances my view that we are likely to see a weaker pair in the near future. However, zooming on the 1-hour chart, the 14-hour RSI seems ready to exit oversold conditions, while the MACD moved above its trigger. As a result, since prices do not move in straight lines, I cannot rule out a corrective bounce (following yesterday's sharp fall), before the bears prevail again.

Support: 1.6655 (S1), 1.6600 (S2), 1.6500 (S3).

Resistance: 1.6700 (R1), 1.6755 (R2), 1.6815 (R3).

EUR/JPY somewhat higher

EUR/JPY moved somewhat higher but found resistance at 137.15 (R1). At the time of writing, the pair is trading marginally below that barrier and its decisive violation could drive the battle towards the upper boundary of the blue downside channel, or near the zone of 138.00 (R2). The RSI rebounded from near its 50 line and is now pointing up, while the MACD, already above its trigger, obtained a positive sign, confirming the recent bullish momentum. Nevertheless, as long as the rate remains within the channel, the downside path remains intact in my view, and I would consider the recent advance as a corrective move. On the daily chart, the 50-day moving average is getting closer to the 200-one and a bearish cross in the near future would add to the negative picture of EUR/JPY.

Support: 136.40 (S1), 135.70 (S2), 135.50 (S3).

Resistance: 137.15 (R1), 138.00 (R2), 138.45 (R3).

Gold continues quiet

Gold moved only two dollars higher, staying between the support of 1305 (S1) and the resistance of 1323 (R1). On the 4-hour chart, both our momentum indicators are still within their positive territories, but they both follow downside paths. Moreover, on the daily chart, both the 50- and 200-day moving averages are still pointing sideways, while the daily oscillators are sitting near their neutral lines, keeping the overall path sideways. As a result, I would stay to the sidelines here as well, until investors decide to paint a trending technical picture. A dip below 1305 (S1) is likely to find support at 1295 (S2), while a move above 1323 (R1) could target the highs of the 10th of July, at 1345 (R2)

Support: 1305 (S1), 1295 (S2), 1280 (S3).

Resistance: 1323 (R1), 1345 (R2), 1355 (R3).

WTI not choosing a direction

WTI moved in a consolidative mode on Wednesday, staying within the range between the support of 96.50 (S2) and the resistance of 98.65 (R1). As a result, the near term path remains to the sideways in my view, and I would prefer to carry my neutral view for another day, until we have a clear trending environment. A decisive move above 98.65 (R1) would signal a future higher high and could bring a near-term trend reversal, while only a dip below 96.50 (S2) could signal the continuation of the prevailing downtrend.

Support: 97.00 (S1), 96.50 (S2), 95.85 (S3).

Resistance: 98.65 (R1), 99.45 (R2), 100.45 (R3).

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.