- Superb US NFP leads to…very little? The big mystery in the markets is why yesterday’s much better than expected US nonfarm payrolls led to such a small movement in the USD. Although USD was up against most of its G10 counterparts (CAD and GBP being the exceptions), the gains were not as big as one might have expected, given how much the nonfarm payrolls beat expectations (288k vs forecast 215k, unemployment rate falling to 6.1% instead of remaining unchanged at 6.3%). There are probably two reasons:

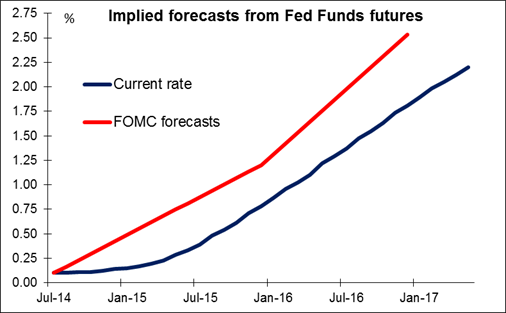

- Although the jobs data was excellent, the pace of growth in average hourly earnings actually slowed to 2.0% from 2.1%. Fed Chair Janet Yellen has pointed to wage growth as an indicator of tightness in the labor market – so long as wages are not rising, then the labor market cannot be said to be tightening. With the CPI rising 2.1% yoy, 2.0% wages growth is nothing more than keeping pace with inflation. Fed Funds rate expectations for 2017 rose another 6 bps on top of Wednesday’s 6 bps, but they still remain well below what the FOMC itself has forecast.

- The ECB clarified the rules for banks wanting to use the targeted long-term refinancing operations (TLTRO) that it announced at the June meeting. Despite some harsh stern words from ECB President Draghi during the press conference, the documentation makes clear that there won’t be anything preventing banks from using this money to buy sovereign bonds. This helped European bonds to rally yesterday. With European yields moving even lower, it’s difficult for US yields to rise significantly and this dampened the USD rally.

I still expect the market to revise up its forecast for Fed Funds to bring it more closely in line with the FOMC’s expectations. Indeed, given how quickly the US is progressing towards what is now accepted as “fully employment,” I expect the FOMC to raise its expectations for Fed Funds as well. That should support the dollar over the medium term.

CAD gained yesterday as Canada’s trade deficit for May came in at only half as wide as expected (a deficit of CAD 152mn rather than CAD 300mn as expected), owing to a rise in auto and energy shipments. Canada is apparently benefiting from the rebound in the US auto market. The rapidly improving US employment situation may prove beneficial for Canada and we could see CAD outperforming.

Friday is a relatively light day as it is a national holiday in the US. During the European day, Germany’s factory orders are expected to have fallen 1.1% mom in May, after increasing 3.1% mom in April. Sweden’s service production for May is expected to have decelerated in pace from the previous month.

THE MARKET

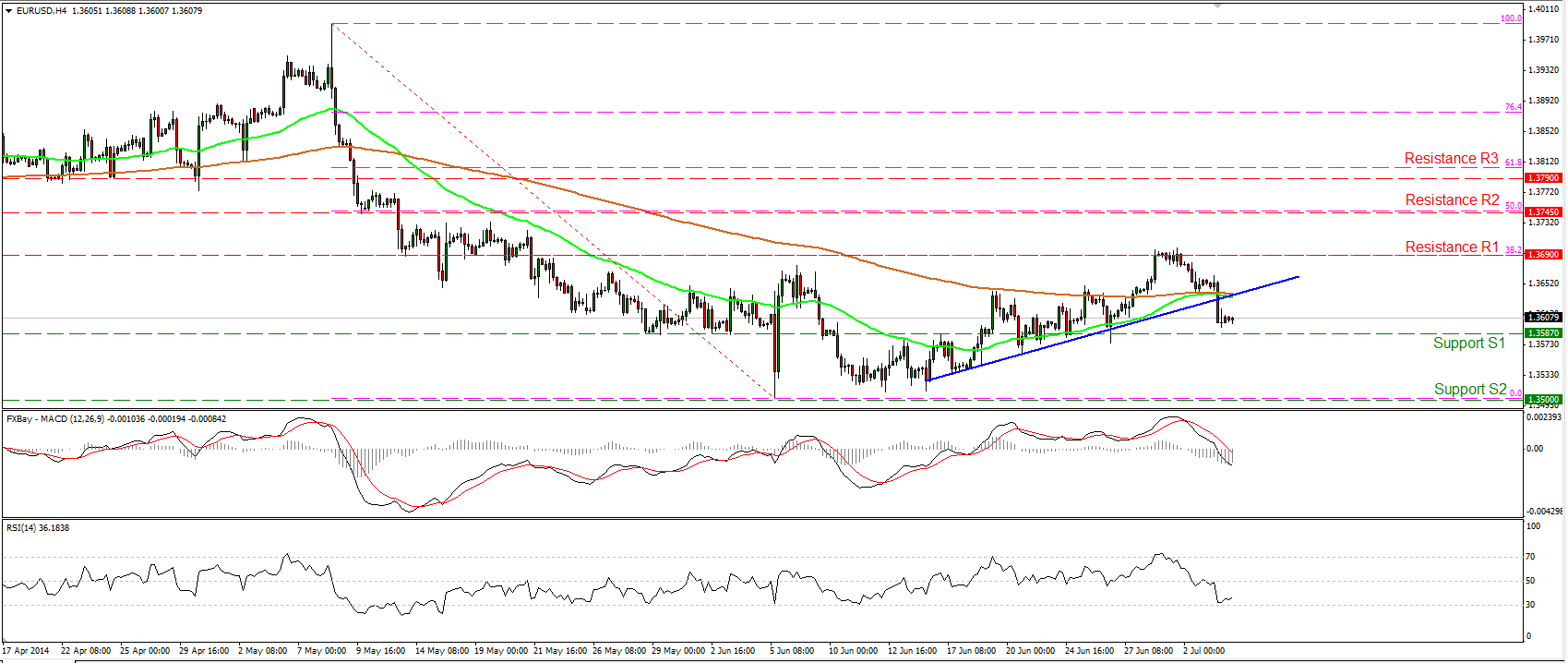

EUR/USD breaks the blue support line

EUR/USD tumbled on Thursday, breaking below the blue upward sloping support line. However, the decline was halted slightly above our support barrier of 1.3587 (S1). A dip below that hurdle may signal that the recent advance was just a 38.2% retracement level of the 8th May- 5th June decline, and could pave the way towards the key support of 1.3500 (S2). The MACD, already below its signal line, turned negative, but the RSI rebounded near its 30 level, thus I cannot rule out a bounce before the bears prevail again.

Support: 1.3587 (S1), 1.3500 (S2), 1.3475 (S3).

Resistance: 1.3690 (R1), 1.3745 (R2), 1.3790 (R3).

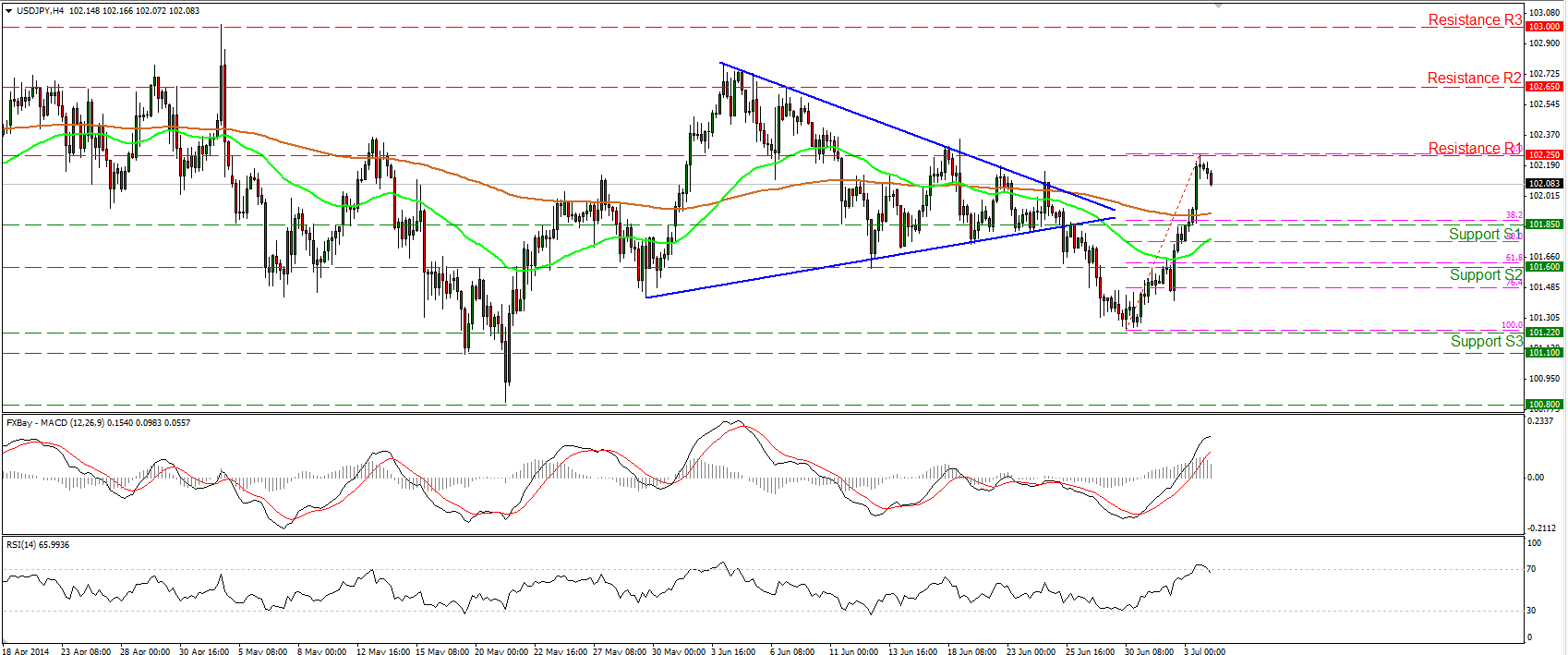

USD/JPY climbs above 102.00

USD/JPY surged yesterday, crashing two resistance barriers in a row. The rally found a ceiling at 102.25 (R1), where a decisive violation could carry larger bullish implications and aim for the hurdle of 102.65 (R2). The MACD lies above both its trigger and zero lines, signaling bullish momentum of the currency pair, but the RSI exited its overbought zone and is now pointing down. In light of this, I would expect the forthcoming wave to be to a downside corrective wave, maybe towards the 101.85 (S1) support zone, which coincides with the 38.2% retracement level of the prevailing rally.

Support: 101.85 (S1), 101.60 (S2), 101.22 (S3).

Resistance: 102.25 (R1), 102.65 (R2), 103.00 (R3).

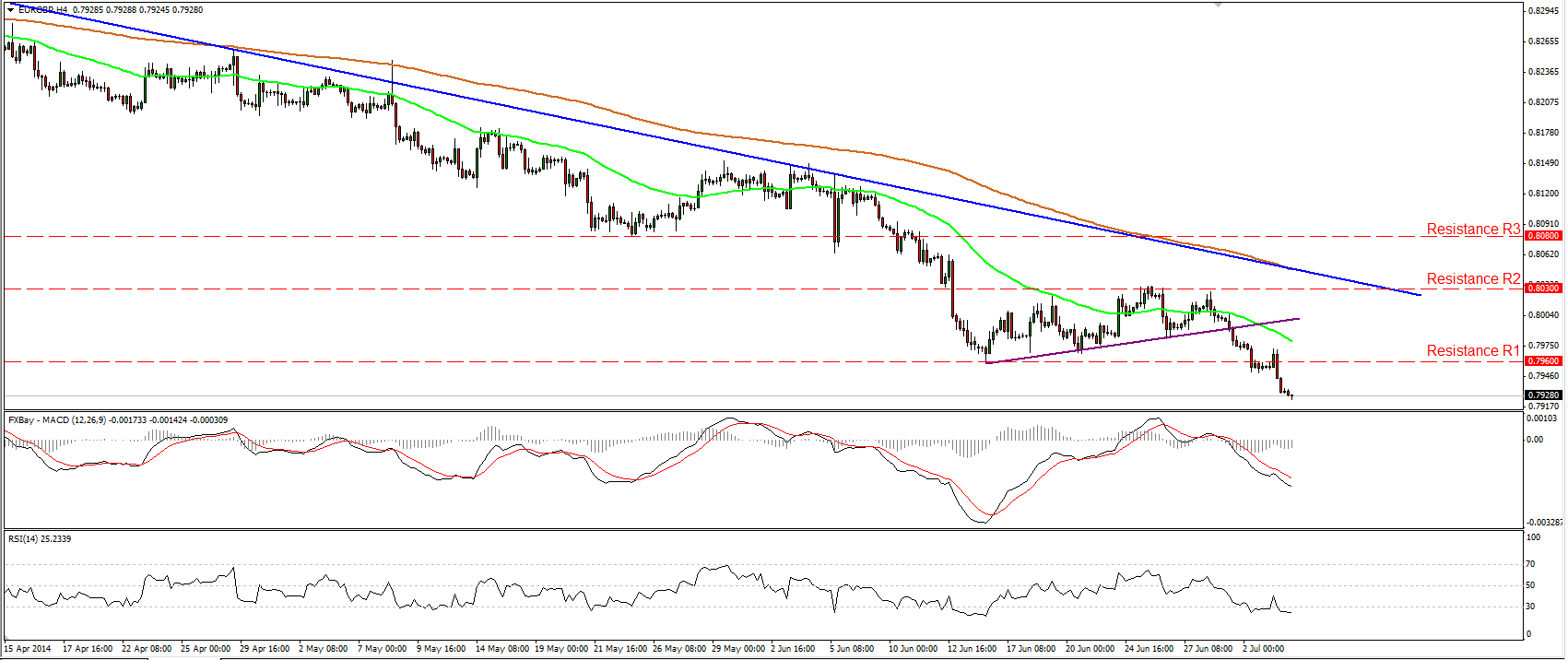

EUR/GBP continues the downtrend

EUR/GBP fell below the 0.7960 barrier, confirming a forthcoming lower low and signaling the continuation of the downtrend. I would now expect the rate to challenge the 0.7900 (S1) zone, where a clear break could pave the way towards 0.7830 (S2). I would ignore the oversold reading of the RSI for now, since the oscillator is pointing sideways and could stay within its extreme territory for an extended period of time. As long as the pair is forming lower highs and lower lows below both the moving averages and below the blue downtrend line drawn from back the 11th of April, I consider the overall outlook to be to the downside.

Support: 0.7900 (S1), 0.7830 (S2), 0.7760 (S3).

Resistance: 0.7960 (R1), 0.8030 (R2), 0.8080 (R3).

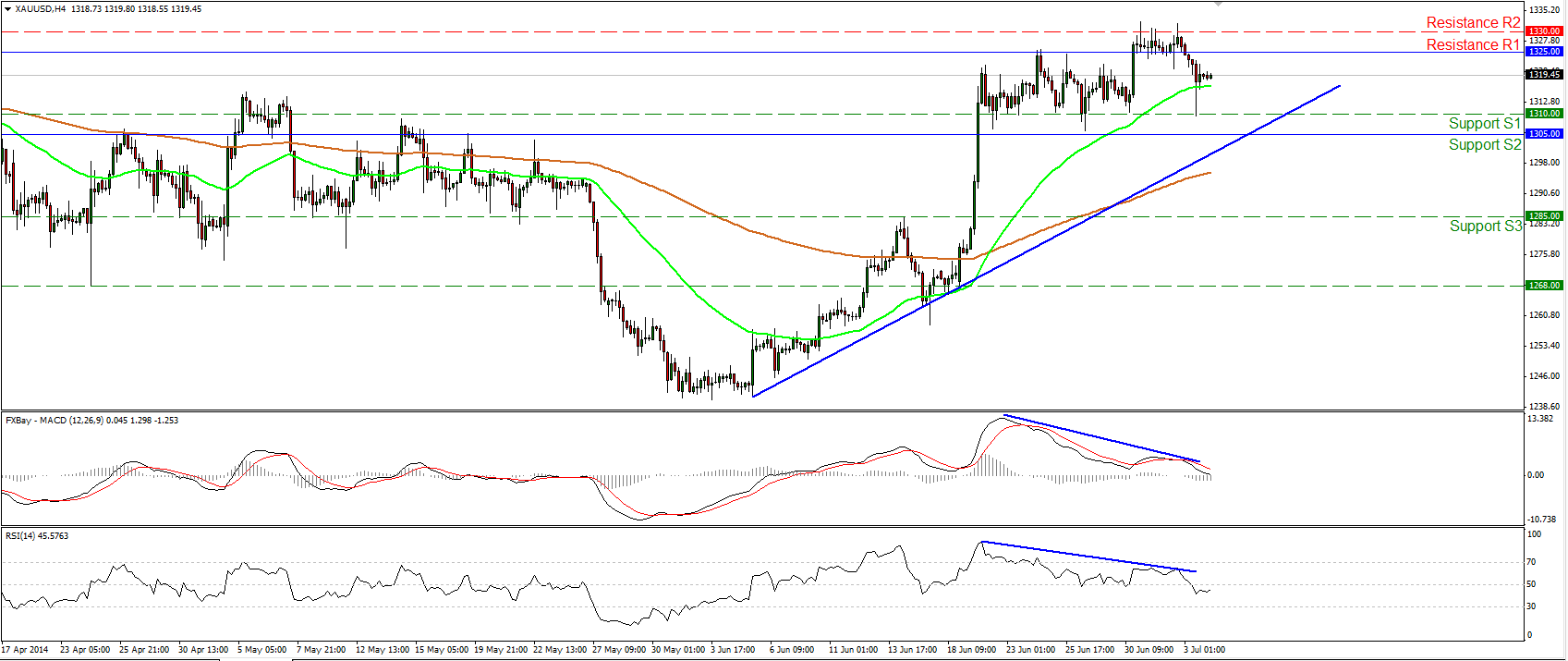

Gold in a retracing mode

Gold continued declining on Thursday and found support at 1310 (S1). Having in mind that the negative divergence between our momentum studies and the price action is still in effect, I cannot rule out the continuation of the retracing wave. Nevertheless, as long as the precious metal is trading above both the moving averages and above the blue uptrend line, the overall technical picture remains positive and I would see any further declines as a renewed buying opportunity, at least for now. On the daily chart, yesterday's candle confirmed the spinning top candle pattern and this amplifies the case for the continuation of the pullback.

Support: 1310 (S1), 1305 (S2), 1285 (S3).

Resistance: 1325 (R1), 1330 (R2), 1342 (R3).

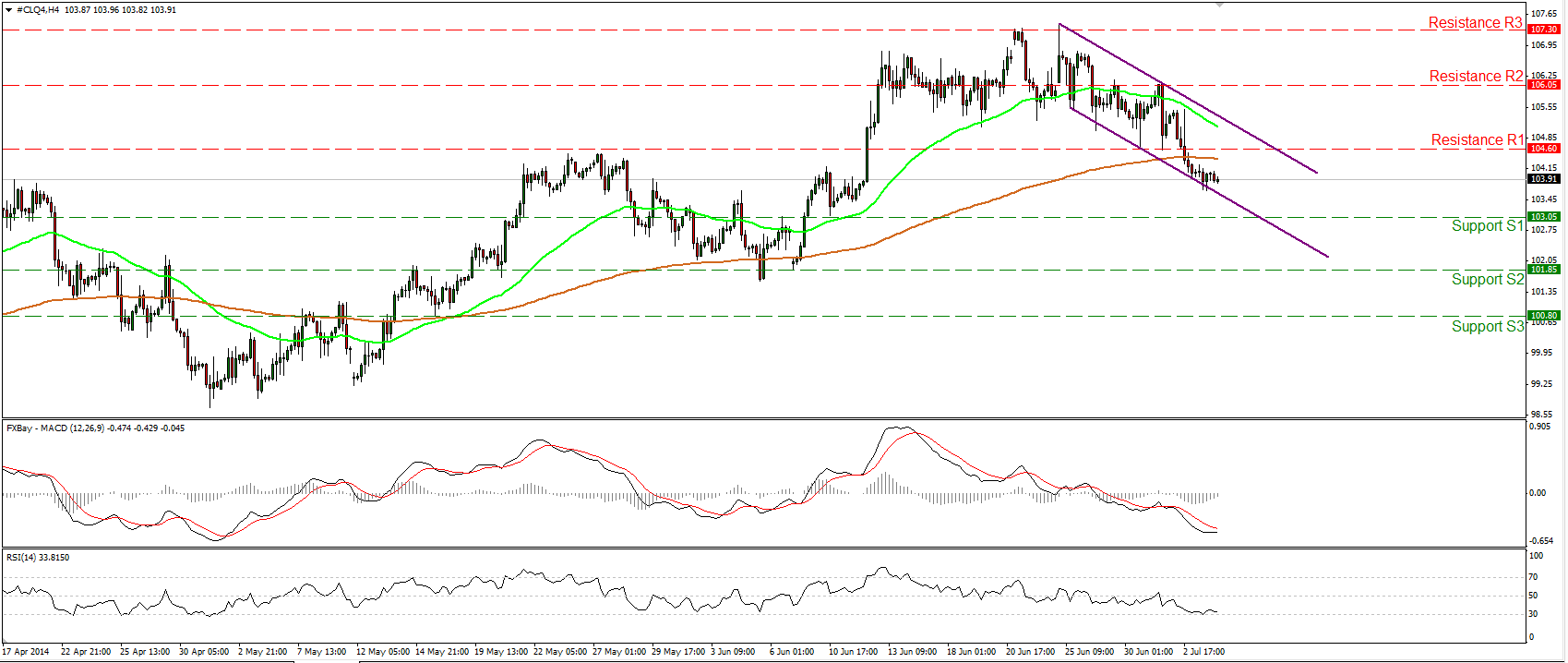

WTI remains within the downside channel

WTI moved in a consolidative mode, remaining near the lower boundary of the purple downward sloping channel. The MACD shows signs of bottoming while the RSI found support near its 30 level. Moreover, zooming on the 1-hour chart, I can identify positive divergence between our hourly momentum studies and the price action. As a result, I still expect the forthcoming wave to be an upside corrective wave within the downtrend channel. Nevertheless, as long as WTI is printing lower highs and lower lows within the downward sloping channel, the short-term outlook remains to the downside.

Support: 103.05 (S1), 101.85 (S2), 100.80 (S3).

Resistance: 104.60 (R1), 106.05 (R2), 107.35 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.