Double whammy for AUD: The AUD got a double hit overnight. First the Q1 inflation figure came in well below expectations at +2.9% yoy vs a market consensus of +3.2%. While this showed some acceleration from +2.7% in Q4 2013, it was still within the RBA’s 2%-3% target range. AUD/USD had been rising into the figure as investors discounted the inflation rate going above the RBA’s range, but it collapsed about 50 cents on the news. Then a few minutes later the HSBC China manufacturing PMI for April came in as expected at 48.3, the fourth consecutive month of contraction, and AUD continued its decline. NZD also fell, but nowhere near as much AUD, and NZD remains higher vs USD on the day. I would expect AUD to continue to decline, especially after RBA Board member Edwards said he would prefer to see the AUD weaken, a sentiment that I believe other board members still hold.

Both new export orders and employment contracted in the HSBC PMI, indicating that there are further downside risks to growth in China. I expect slowing China growth to be one of the major issues for the market. The yuan also weakened further on the news, and oil prices collapsed, giving some indication of what future trends could be.

By contrast, the news out of the US continues to be good. The Richmond Fed manufacturing index for April rose more than expected, while existing home sales in March were little changed from February, and the National Association of Realtors, which assembles the data, expects to see a pickup in sales in coming months. Zillow, a real estate pricing agency, estimated that house prices in more than 1,000 US cities would exceed their pre-2008 levels within the year. The implied interest rate on Fed Funds futures rose by 4 bps and short-end yields also rose.

Oddly enough, the continued good news on the US economy did not do much to support USD against the other G10 currencies, as it fell against all but AUD and CAD. The Citi US economic surprise index bottomed on April 7th and has been trending higher since then. US yields have followed along, as usual, but that hasn’t given the dollar the support that it used to get in the past. My guess is that some investors may be pulling their money out of dollars to avoid getting caught in any US sanctions.

On the other hand, the dollar rose vs most EM currencies as the weakness in the Chinese economy and the fall in the yuan dampened sentiment for EM currencies. ZAR continued to decline. On the other hand, HUF and CZK managed to gain vs USD despite – or because of? -- news that the US was sending troops to Poland and the Baltic countries to reassure NATO allies.

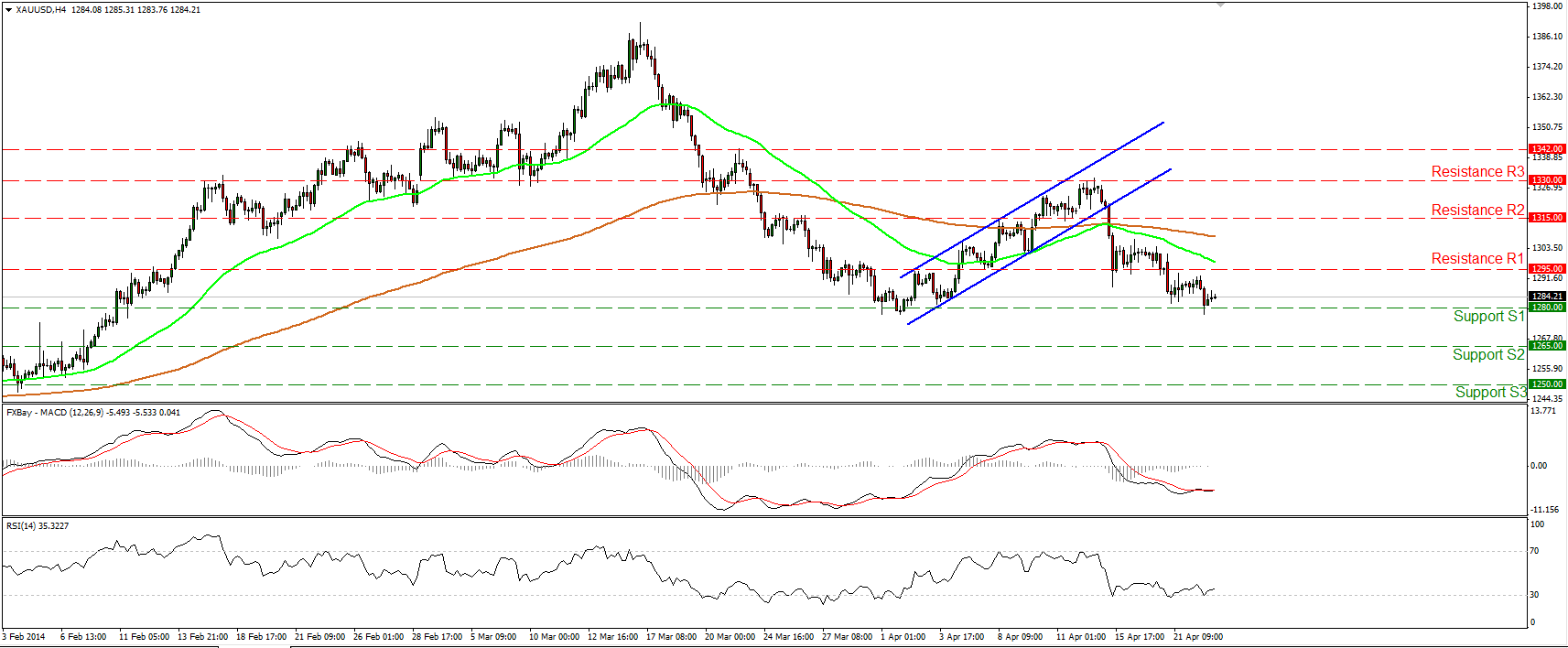

The news of US troop movements did nothing to shore up gold. The metal’s recent low was 1,277.79 on April 1st. It briefly broke through that level yesterday, hitting 1,277.69, in the face of a higher dollar and higher US yields. The fundamental news is doing nothing to support gold while the technical picture looks poor (see below).

The PMIs will be the focus for the rest of the day. The Eurozone manufacturing PMI is expected to be unchanged while the service sector PMI is forecast to be a bit higher. Somehow the composite index is forecast to be slightly lower; I’m not sure how that happens, probably different people making the forecasts. German manufacturing PMI is also forecast to be unchanged. In the US, the Markit PMI is expected to be higher, although attention usually focuses on the ISM index.

The UK CPI trends survey is forecast to show improvement in orders and optimism, which may add to the recent enthusiasm for GBP.

In Canada, retail sales for February are forecast to have slowed relative to January, in contrast to Tuesday’s strong rise in wholesale trade sales during the month. CAD has been struggling recently; it fell vs USD overnight despite the higher-than-expected wholesale trade figures. Weak retail sales are likely to give it another kick down, in my view.

Finally, US new home sales for March are forecast to be up slightly from February’s pace, contrary to the decline in existing home sales.

THE MARKET

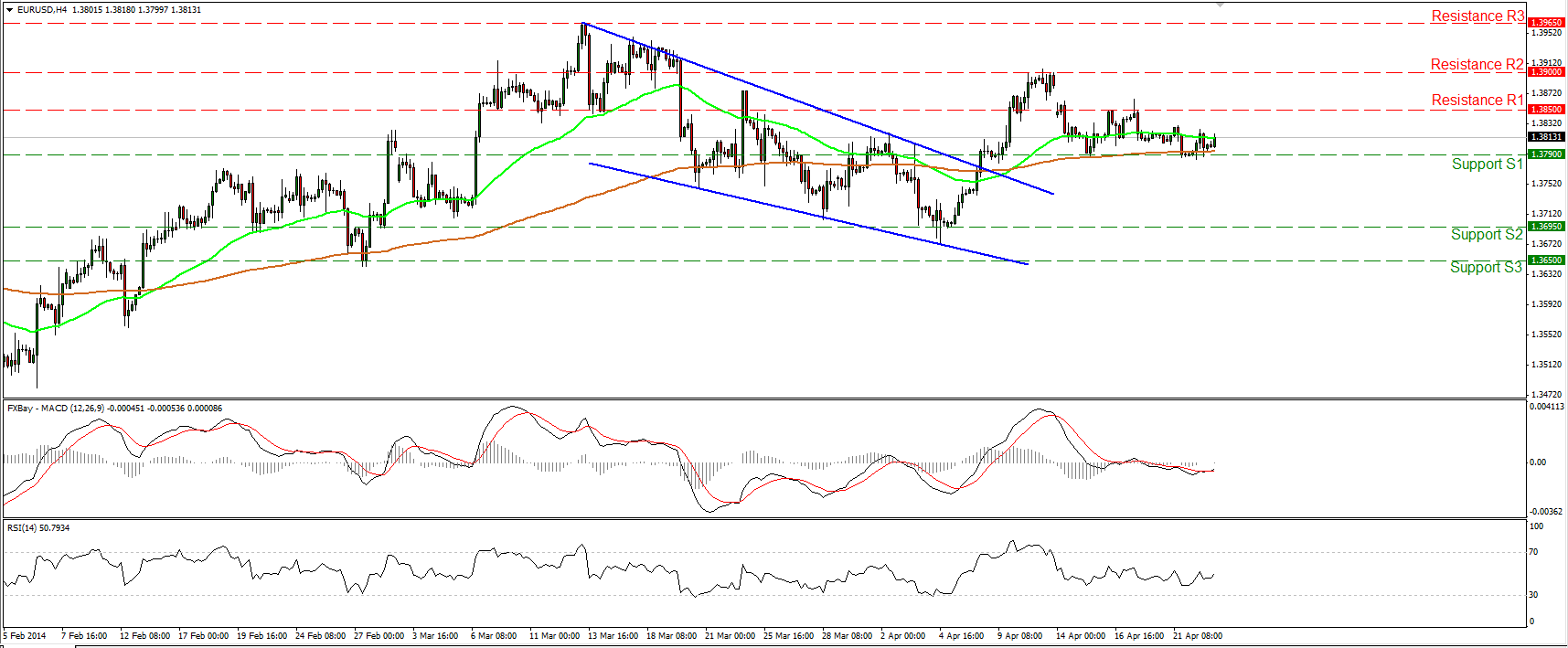

EUR/USD

EUR/USD moved slightly higher after finding support at 1.3790 (S1), near the 200-period moving average. I maintain my neutral view as the pair continues to oscillate between that barrier and the resistance of 1.3850 (R1). Both the moving averages are pointing sideways, confirming the non-trending phase of the price action. A clear dip below the support of 1.3790 (S1) may have larger bearish implications and target the lows of 1.3695 (S2). On the upside, a clear move above 1.3850 (R1) could probably challenge the resistance bar of 1.3900 (R2).

Support: 1.3790 (S1), 1.3695 (S2), 1.3650 (S3).

Resistance: 1.3850 (R1), 1.3900 (R2), 1.3965 (R3).

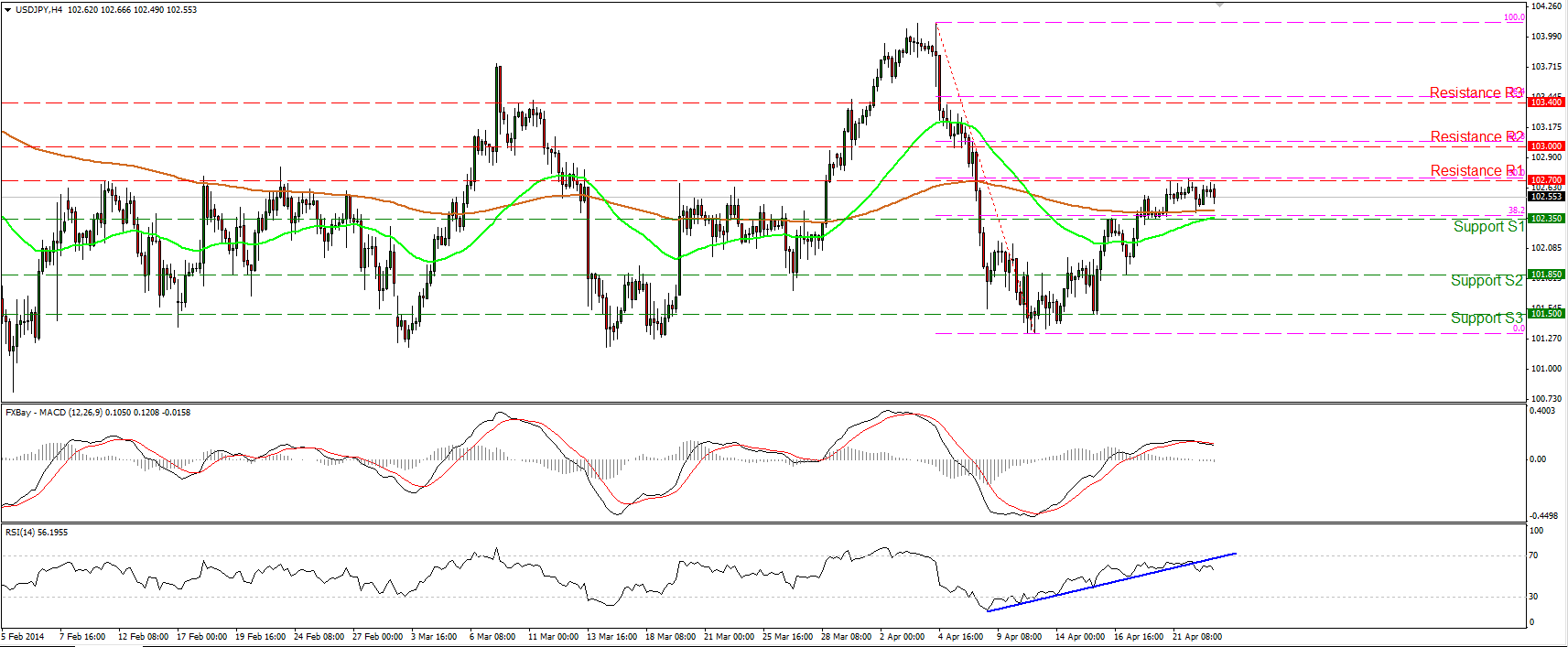

USD/JPY

USD/JPY remained below the resistance obstacle of 102.70 (R1), which coincides with the 50% retracement level of the 4-11 Apr. decline. A break above that bar may challenge the next resistance at 103.00 (R2), near the 61.8% retracement of the aforementioned decline. The RSI fell below its blue support line, while the MACD crossed below its trigger line, thus I would expect some further consolidation or a downward corrective wave, before the bulls prevail again. On the daily chart, the pair is in a sideways mode between 101.20 and 104.00.

Support: 102.35 (S1), 101.85 (S2), 101.50 (S3).

Resistance: 102.70 (R1), 103.00 (R2), 103.40 (R3).

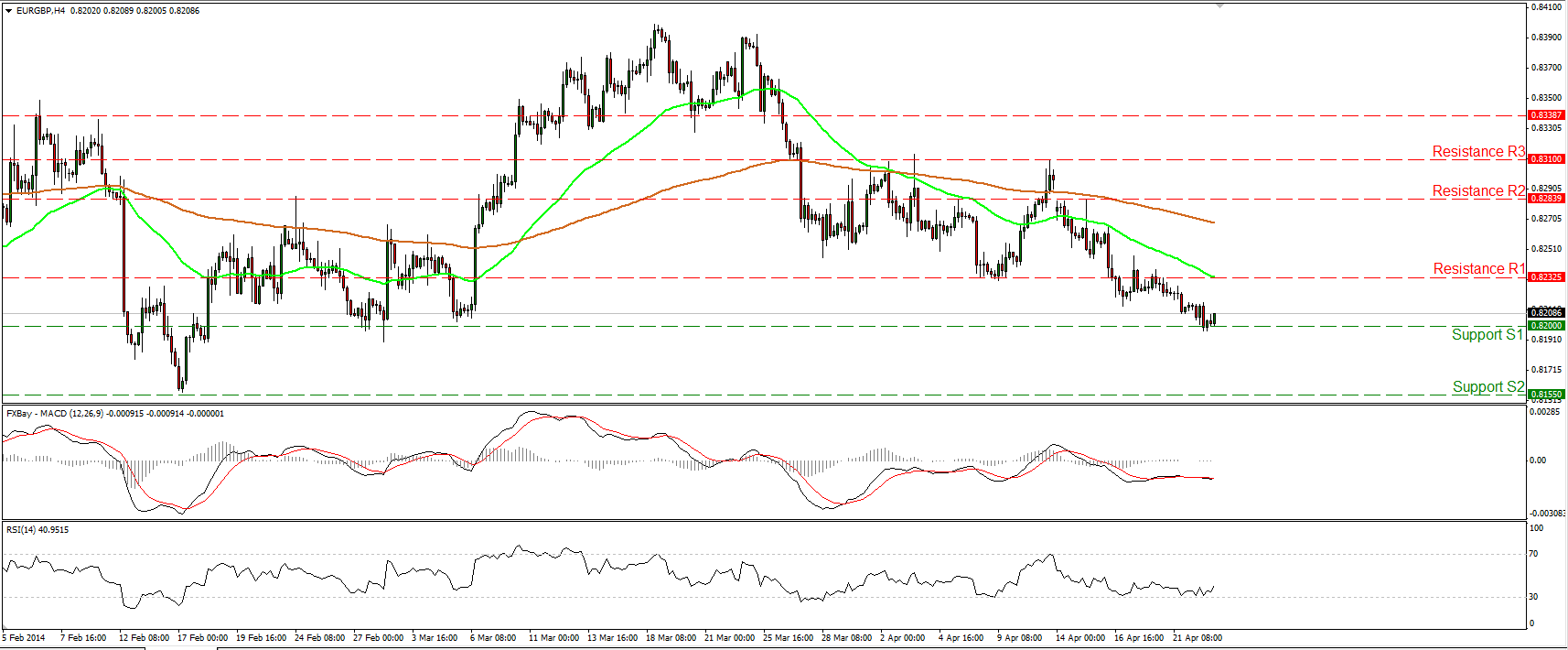

EUR/GBP

EUR/GBP moved lower to meet the support of 0.8200 (S1). If the bears are strong enough to drive the price below that bar, I would expect them to target the next support at 0.8155 (S2). The structure of lower highs and lower lows remains in effect and as long as the pair is trading below both the moving averages, the outlook remains negative. Nonetheless, since the RSI met support near its 30 level, an upside retracement is possible before the continuation of the short-term downtrend.

Support: 0.8200 (S1), 0.8155 (S2), 0.8085 (S3).

Resistance: 0.8235 (R1), 0.8285 (R2), 0.8310 (R3).

GOLD

Gold declined slightly to find support at the 1280 (S1) level. A clear break below that obstacle may extend the decline towards the next support at 1265 (S2). As long as the precious metal is printing lower highs and lower lows below both the moving averages, the short-term outlook remains negative. Nonetheless, considering that the RSI once again met support at the 30 level and moved higher, I would expect a corrective wave before sellers take control again.

Support: 1280 (S1), 1265 (S2), 1250 (S3).

Resistance: 1295 (R1), 1315 (R2), 1330 (R3).

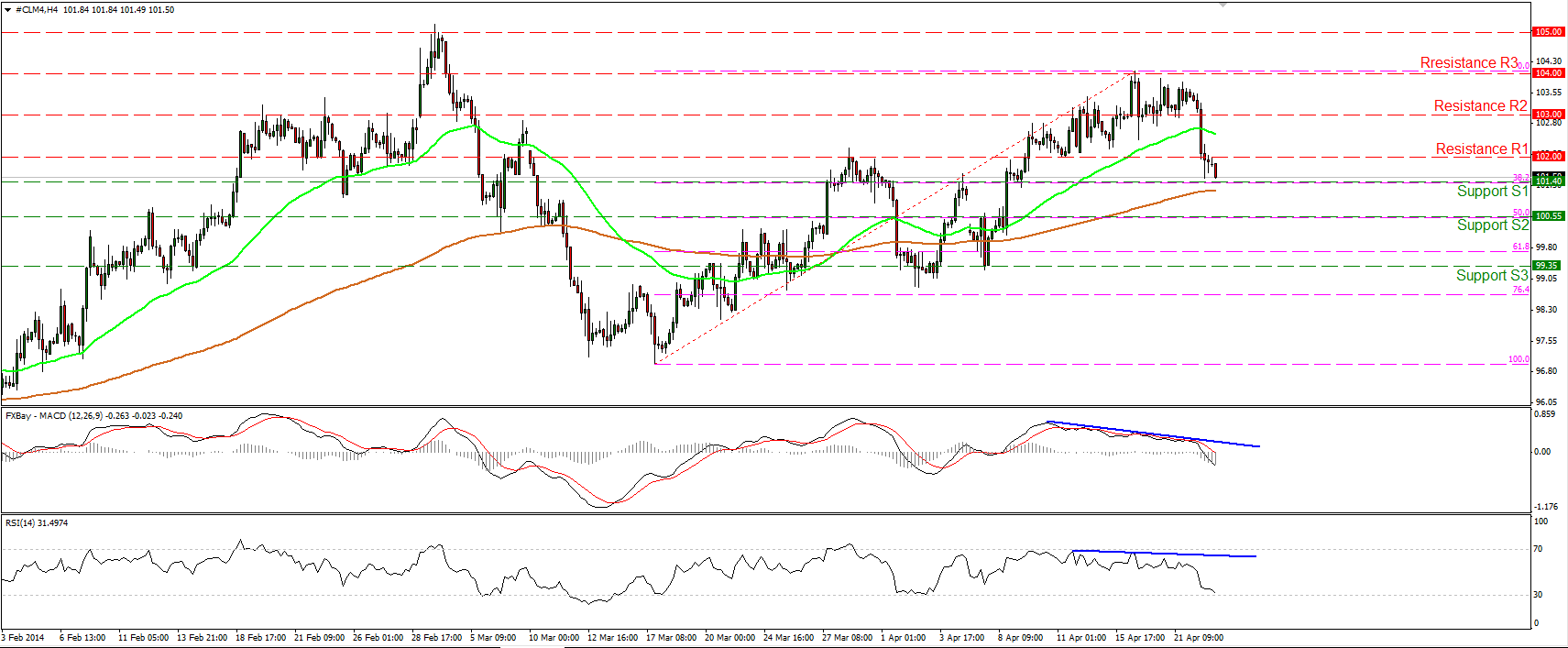

OIL

WTI collapsed on Tuesday, breaking two support barriers in a row and confirming the negative divergence between our momentum studies and the price action. The price is now heading towards the support of 101.40 (S1), which coincides with the 38.2% retracement level of the 17 Mar. -16 Apr. uptrend, and a clear break may challenge the 50% retracement bar at 100.55 (S2). The MACD fell below its zero line, confirming the bearish momentum of the price action.

Support: 101.40 (S1), 100.55 (S2), 99.35 (S3).

Resistance: 102.00 (R1), 103.00 (R2), 104.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.