Analysis for January 18th, 2013

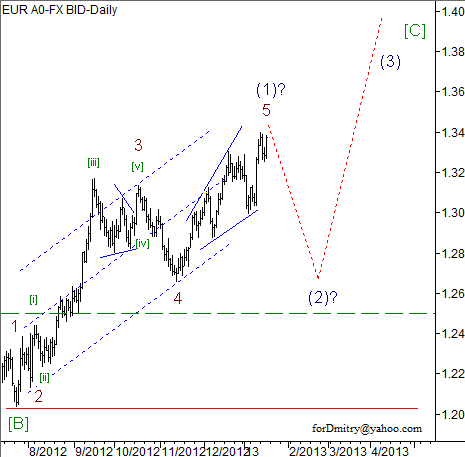

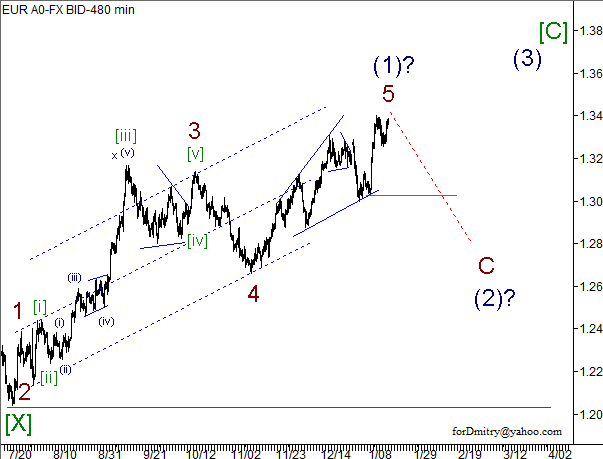

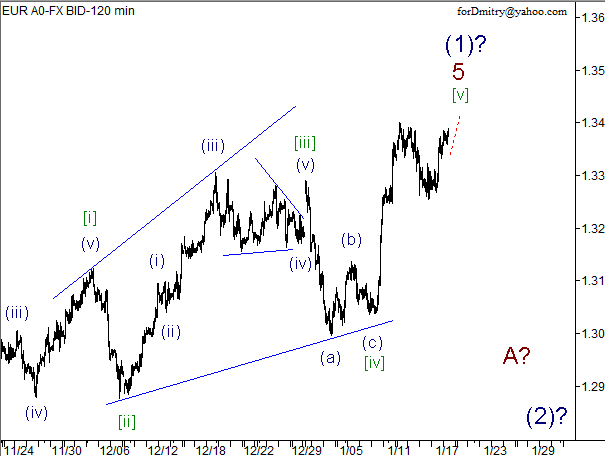

EUR/USD

The current chart structure implies that Euro is now finishing an ascending impulse (1) of [C]. If this assumption is correct, then later the price may start forming a descending correction (2).

We may assume that the price almost completed an ascending impulse (1) of [C] and is about to start forming a descending correction (2).

We can’t exclude a possibility that the price is forming final waves of an ascending impulse (1).

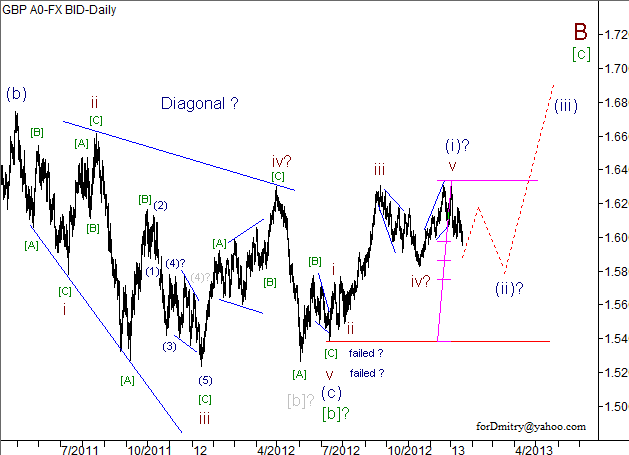

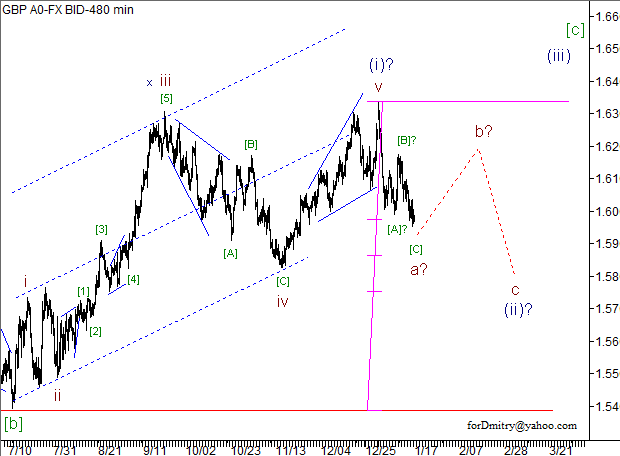

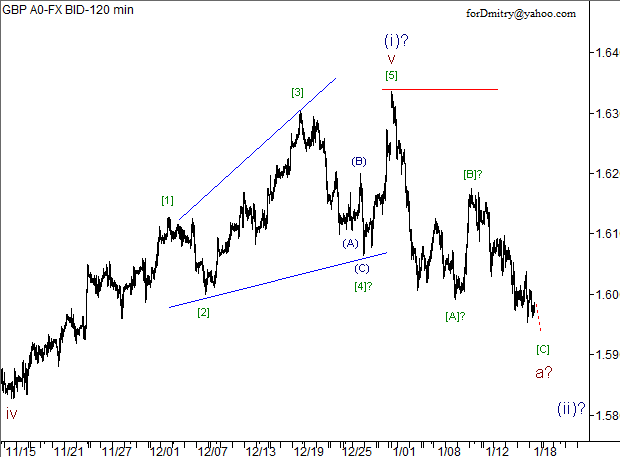

GBP/USD

Pound continues forming a descending correction (ii) of [c] of B.

A local descending correction (ii) of [c], which is taking place right now, may take the form of flat.

We may assume that the pair is forming a descending wave a of (ii), which is taking the form of zigzag.

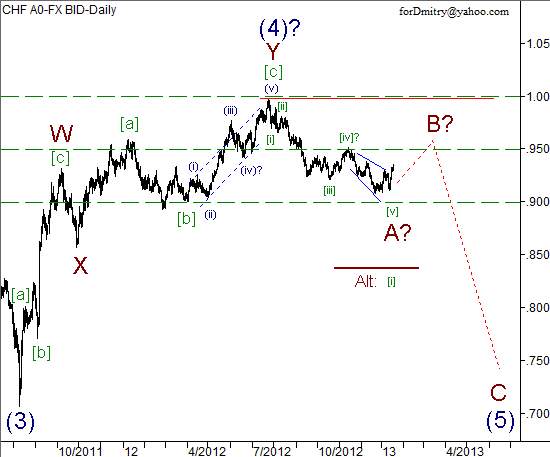

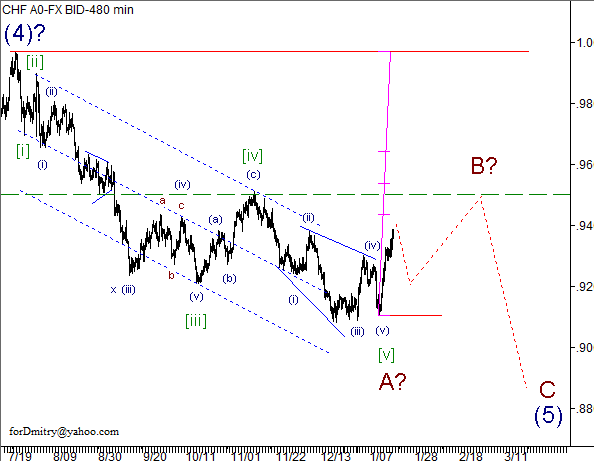

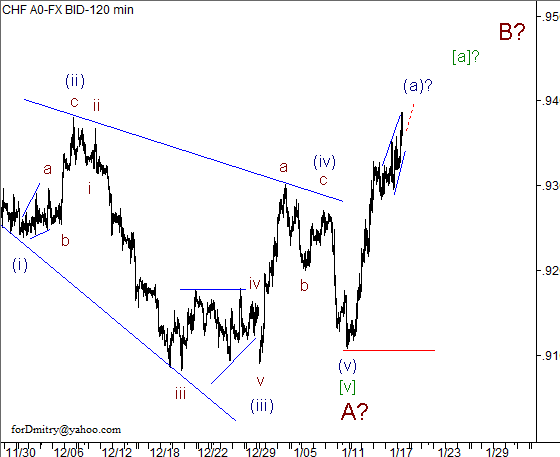

USD/CHF

We may assume that Franc completed a descending impulse A of (5) and started forming an ascending correction B of (5).

We may assume that the price is forming an ascending correction B.

We may assume that the first wave [a] of B of an ascending correction B may take the form of zigzag.

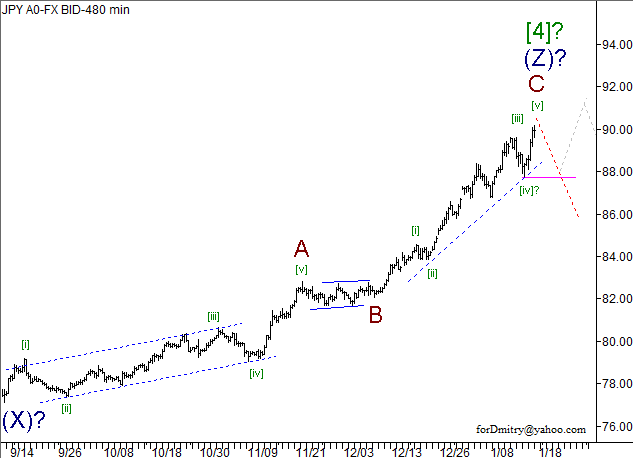

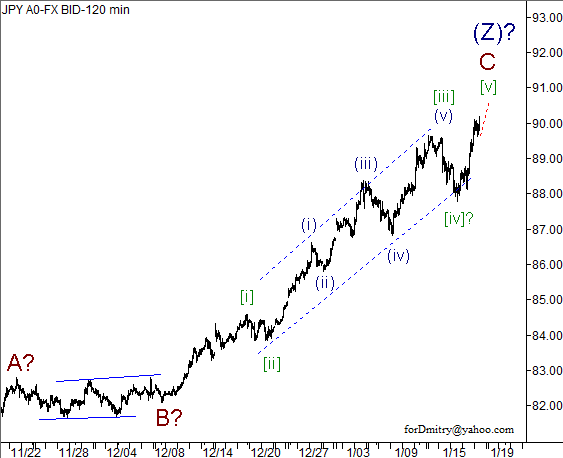

USD/JPY

We may assume that the price almost finished a long horizontal correction [4] of V, which may be followed by a descending wave [5] of V.

We may assume that the pair almost completed zigzag (Z) of [4] and a large correction [4]. If this assumption is correct, then later we can expect the price to make a reverse downwards.

We can’t exclude a possibility that the pair is finishing an ascending impulse C of (Z). If this assumption is correct, then later we can expect the price to make a reverse downwards.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.