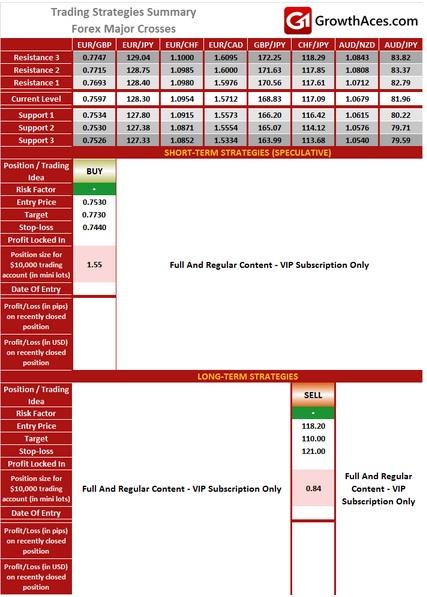

EUR/GBP: Buy At 0.7530

UK December CPI has beaten expectations of a 0.1% yoy reading by coming in at 0.2%, the highest since January last year, due partly to the biggest annual jump in volatile airfares in almost five years. British inflation has hovered near zero since early 2015, boosting the spending power of consumers that have spearheaded Britain's economic recovery but remaining far below the Bank of England's 2% target. Core consumer price inflation, which strips out changes in the price of energy, food, alcohol and tobacco, rose to an 11-month high of 1.4% compared with expectations for it to hold at 1.2%.

Sluggish price pressures and slowing wage growth have put the BoE off raising interest rates any time soon, particularly as wage growth is slowing and the weakness in the global economy is taking a toll of British output. We moved our expectation for the timing of the first hike to November this year (previously May).

The Bank of England's newest policymaker Gertjan Vlieghe said on Monday he would take a "patient" approach to raising interest rates and there was even a chance he might favour a cut if a slowdown in Britain's economy worsened.

Factory gate prices dipped 1.2%, the smallest drop in a year, and in line with market forecasts.

The Office for National Statistics also released figures for November house price inflation, which showed an 7.7% annual rise across the United Kingdom as a whole compared with 7.0% in October, the biggest increase since March.

BoE Governor Mark Carney is due to give a speech at 12:00 GMT where he will set out his latest thinking on the economic outlook. Last week central bank policymakers said a new plunge in global oil prices to their lowest in 12 years would only pose a slight drag on inflation, and should boost British growth.

The GBP strengthened against the USD and the EUR after data showed Britain's inflation rose to its highest rate in almost a year in December. The nearest support level for the EUR/GBP is 0.7530, near 23.6% fibo of November-January rise. We keep our bid at this level. Another important support is 14-day exponential moving average, currently at 0.7506.

USD/CAD: Short At 1.4465, Target 1.4220

Canadian Prime Minister Justin Trudeau on Monday struck a more downbeat note than typical on the weak Canadian dollar as well as low oil prices, saying they hurt large parts of the economy. There may be some political pressure on BoC to keep rates unchanged tomorrow.

The Bank of Canada is due to announce its latest interest rate announcement on Wednesday. We expect the BoC to leave the key policy rate at 0.50% (some market participants see a 25bp easing).

On-hold decision on Wednesday should support the loonie in the short-term. That is why we went short at 1.4465. The target of our position is 1.4220, near 23.6% fibo of October-January rise.

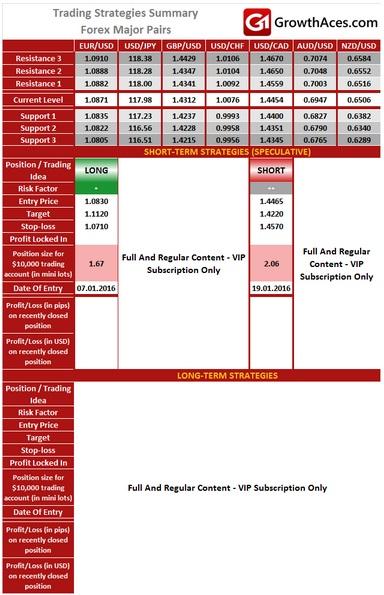

MAJOR PAIRS:

MAJOR CROSSES:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long-term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

Support/Resistance - three closest important support/resistance levels

Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.