GROWTHACES.COM Forex Trading Strategies:

Taken Positions

USD/JPY: short at 121.20, target 119.00, stop-loss 119.90, risk factor ***

EUR/GBP: long at 0.7175, target 0.7375, stop-loss 0.7280, risk factor *

EUR/JPY: long at 129.00, target 132.00, stop-loss 130.20, risk factor **

EUR/CHF: long at 1.0570, target 1.0990, stop-loss 1.0400, risk factor **

Pending Orders

EUR/USD: buy at 1.0920, if filled – target1.1180, stop-loss 1.0780, risk factor **

AUD/USD: buy at 0.7830, if filled – target 0.8020, stop-loss 0.7730, risk factor **

NZD/USD: buy at 0.7615, if filled – target 0.7890, stop-loss 0.7465, risk factor **

USD/CAD: sell at 1.2550, if filled – target 1.2310, stop-loss 1.2690, risk factor ***

EUR/CAD: buy at 1.3650, if filled – target 1.3900, stop-loss 1.3530, risk factor **

AUD/JPY: buy at 93.40, if filled – target 95.40, stop-loss 92.40, risk factor ***

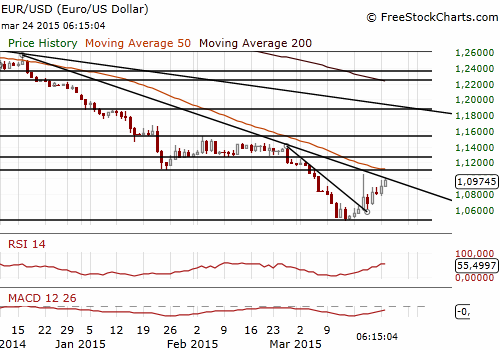

EUR/USD: Profit Taken, Looking To Get Long Again

(profit taken at 1.1000, buy again at 1.0920)

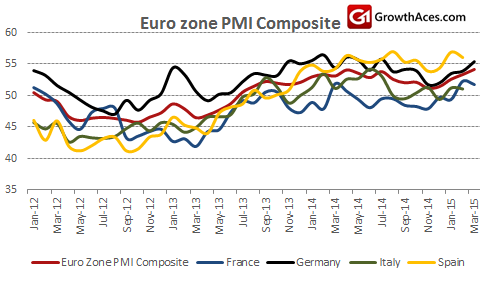

Eurozone PMI Composite rose from 53.3 in February to 54.1 in March, above the median forecast for a rise to 53.6. The average PMI reading for the first quarter (at 53.3) was the highest since the second quarter of last year. The improvement was broad-based by sector. Services PMI Activity Index rose to 54.3, 46-month high, from 53.7 in February. Eurozone Manufacturing PMI amounted to 53.5, 10-month high vs. 52.1 in February.

PMI showed that deflationary pressures eased during the month. Average prices charged for goods and services fell at the slowest rate since last July. Input prices showed the largest monthly increase since last July, boosted in part by higher USD denominated import prices arising from the EUR decline as well as higher staff costs. Employment growth meanwhile picked up to the fastest since August 2011.

PMI data signal GDP growth of 0.3% qoq in the first quarter in the Eurozone. German GDP growth is estimated at 0.4% qoq and French GDP growth at 0.2% qoq. PMI data suggest that the ECB’s QE has been started at a time when the economic upturn is already starting to gain traction. However, weaker EUR is one of the most important sources of this economic revival.

Greek Prime Minister Alexis Tsipras met with German Chancellor Angela Merkel in Berlin on Monday. Greek government spokesman Gabriel Sakellaridis said Tsipras and Merkel on Monday discussed the outline of the reforms but did not go into depth. He said Greece would present its proposed package of reforms to its Eurozone partners by next Monday.

The head of the European Central Bank Mario Draghi made the remarks in the European Parliament yesterday. He expressed cautious optimism that Greece would be able to benefit from ECB money-printing and regain normal access to central bank funds. He said: “Several conditions need to be satisfied and they are not there yet. But we are confident they will be if this process of policy dialogue is being reconstructed.” The ECB no longer accepts Greek bonds as security in return for finance to Greek lenders, which makes them reliant on emergency short-term finance. Greece can also not benefit now from the ECB's QE programme because the ECB has already bought too many Greek bonds.

Mario Draghi said he expected inflation to rise gradually by the end of the year even if they might remain very low or negative in the months ahead. Some investors took Draghi’s comments on inflation as a sign that the ECB may end its bond-buying scheme early, though he said it intended to carry out purchases at least until end-September 2016.

San Francisco Federal Reserve Bank President John Williams said he still expected the U.S. economy to expand by around 2.5% in 2015 even with the USD high. He added the rise in the currency was partly due to the easy polices being followed by major central banks in Europe and Japan, which in turn was a positive for global growth and thus the United States. John Williams said he expected the Fed to start raising interest rates sometime this year, in part because the economy was nearing full employment and that would push up inflation over time.

Federal Reserve Vice Chairman Stanley Fischer says he expects the Fed to start raising interest rates sometime this year. He said that after its first increase, the Fed may adjust its key rate either up or down, depending on the economy's performance.

The EUR/USD is rising on broad USD weakness stemming from lower US yields, optimism in Draghi’s comments on inflation and lack of bad news from Merkel-Tsipras summit. The USD recovered slightly after Fed Williams’ comments but they did not change current bullish bias on the EUR/USD.

U.S. CPI data will be released today (12:30 GMT). Our forecast is in line with the market consensus and amounts to 0.2% mom, -0.1% yoy for CPI and 0.1% mom, 1.6% yoy for core CPI.

We have taken profit on our EUR/USD long position (1.0670-1.1000). In our opinion there is potential for further rise in the EUR/USD after a corrective move. We have placed our buy offer at 1.0920, just above 21-dma of 1.0909 and support level of 1.0905 (hourly low on March 24). Our next target will be 1.1180, below high on March 4.

Significant technical analysis' levels:

Resistance: 1.1000 (session high Mar 24), 1.062 (high Mar 18), 1.1115 (high Mar 5)

Support: 1.0909 (21-dma), 1.0905 (hourly low Mar 24), 1.0768 (hourly low Mar 23)

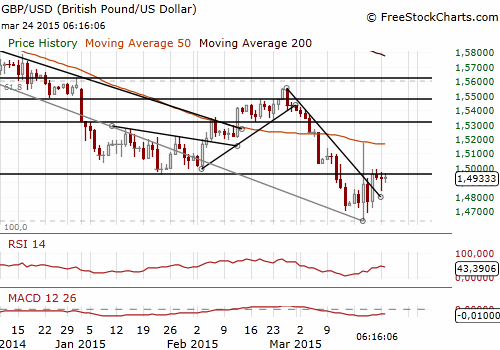

GBP/USD: UK Inflation Below Expectations

(sideways on GBP/USD, long on EUR/GBP)

Britain’s Consumer price inflation dropped to 0.0% yoy in February from an annual rate of 0.3% in January. The fall was stronger than the median forecast for a fall to 0.1%. Today's data showed downward pressure on inflation from falling prices for food. The Bank of England predicts inflation to fall below zero in the next few months. Core measure of inflation, which strips out increases in energy, food, alcohol and tobacco, is still positive, but fell to 1.2% yoy in February compared with 1.4% yoy in January.

Inflation data will probably keep the MPC sticking to the existing rhetoric that a tightening labor market will require the BoE to make policy less accommodative. Bank of England Chief Economist Andy Haldane said last week the chances of an interest rate rise or cut were evenly balanced. However, BoE Governor Mark Carney said earlier this month that it would be "extremely foolish" to use more monetary stimulus to fight a temporary plunge in British inflation caused by declining oil prices. We expect the first rate hike in the first quarter of 2016.

We stay sideways on the GBP/USD despite broad USD weakness. Political uncertainty surrounding the upcoming UK general elections is likely to weigh on the GBP. However, we stay EUR/GBP long and our position is close to its target of 0.7375.

Significant technical analysis' levels:

Resistance: 1.4990 (high Mar 23), 1.5008 (high Mar 19), 1.5155 (high Mar 18)

Support: 1.4840 (low Mar 23), 1.4723 (low Mar 20), 1.4689 (low Mar 19)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.