GROWTHACES.COM Forex Trading Strategies

Trading Positions

EUR/USD trading strategy: long at 1.1325, target 1.1550, stop-loss 1.1250

GBP/USD trading strategy: long at 1.5400, target 1.5580, stop-loss 1.5320

USD/CAD trading strategy: short at 1.2620, target 1.2370, stop-loss 1.2710

EUR/JPY trading strategy: long at 134.60, target 137.50, stop-loss 133.30

AUD/JPY trading strategy: long at 92.60, target 94.30, stop-loss 91.90

Pending Orders

AUD/USD trading strategy: buy at 0.7720, if filled – target 0.7920, stop-loss 0.7610, risk factor ***

NZD/USD trading strategy: buy at 0.7380, if filled - target 0.7660 stop-loss 0.7260, risk factor ***

EUR/CHF trading strategy: buy at 1.0675, if filled - target 1.0990, stop-loss 1.0570, risk factor *

EUR/USD: Long Ahead Of Greece And Yellen

(long for 1.1550)

A list of Greek structural reforms was due to be presented Monday to the European Commission, the European Central Bank and the International Monetary Fund. Athens authorities announced they would not meet this deadline and said they would email the proposals to the bailout monitors in time for a European finance ministers' teleconference to review the list.

After experts from the European Commission, European Central Bank and International Monetary Fund give an initial view of the list, euro zone finance ministers will hold a telephone conference from 13:00 GMT to finalize the four-month extension.

Eurogroup head Jeroen Dijsselbloem said today international creditors will have to consider more support for Greece after the summer. He added: “In our talks with the Greek government we were looking ahead and talking about the possibility of what is called an enhanced conditions credit line... whether that is still feasible is too early to say.”

Euro zone consumer inflation fell 0.6% yoy in January, confirming its earlier flash estimate. Deflation was deepest in Greece in January, followed by Spain, while almost all euro zone countries had negative inflation rates, hurt by the biggest drop in energy prices since September 2009. Core inflation, which excludes volatile energy and unprocessed food prices, dipped to 0.6% yoy in January from 0.7% yoy for the previous three months. That figure was revised from an earlier 0.5% yoy reading.

The volatility on the EUR/USD may be high today. First, investors’ eyes will be focused on a European finance ministers' teleconference. In our opinion the EUR/USD may get a boost if Greece satisfies the EU with the list of promised reforms in order to secure the fourth-month extension.

Investors' attention will shift to Fed Chair Yellen testifying before Congress (15:00 GMT). Markets will be listening closely for whether Yellen takes a dovish tone in her testimony after dovish-sounding minutes from the Fed's January meeting released last week.

Significant technical analysis' levels:

Resistance: 1.1359 (21-dma), 1.1368 (10-dma), 1.1430 (high Feb 20)

Support: 1.1278 (low Feb 20), 1.1270 (low Feb 9), 1.1262 (low Jan 29)

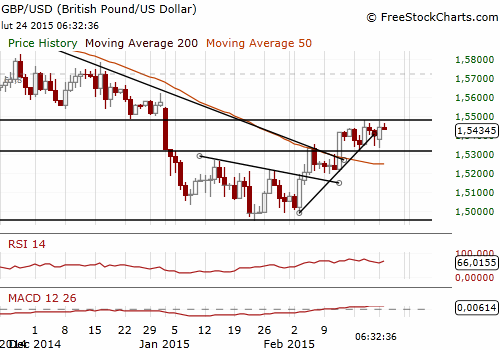

GBP/USD: Strong Resistance Near 1.5480. Our Target Is 1.5580

(we stay long)

Bank of England Governor Mark Carney and other BoE policymakers were speaking to the Treasury Committee in Britain's parliament.

In the opinion of Mark Carney inflation will rise in the medium term. He added: “The MPC will conduct policy in order to bring inflation back to target, probably within two years.”

Bank of England policymaker Kristin Forbes said British inflation pressures could pick up quickly and other factors could also mean an interest rate hike is needed in the near future but the central bank is right to keep rates on hold for now. In her opinion most of the risks to Britain's solid economic recovery come from abroad, with the euro zone among the largest.

BoE policymaker Martin Weale said it may be appropriate for the central bank to start raising interest rates rather earlier than financial markets anticipate. Martin Weale is a known BoE hawk. Two policymakers, Martin Weale and Ian McCafferty, had voted to raise rates in the last five monthly meetings of the Monetary Policy Committee of 2014, but changed their minds after oil prices pushed Britain's inflation rate to near zero.

BoE policymaker Ben Broadbent said he shared view in inflation report that moderate rate rises would be necessary.

BoE’S David Miles is the opinion that the MPC should not hurry to normalize police or raise the bank rate. He said he is more pessimistic on UK productivity and slack in the economy.

The Confederation of British Industry's retail sales balance slumped to +1 in February from +39 in January. Sales expectations for March also fell sharply to +27 from +42 in February, though Newton-Smith was still relatively upbeat about the sector. We should notice that despite strong fall the outlook for the retail sector still is fairly positive. We can expect a boost to household incomes from falling inflation which would be supportive for consumer spending.

We do not change our GBP/USD long position. There is strong resistance level near 1.5480 (daily high on February 18 and 23.6% of 1.7192-1.4952). If the GBP/USD breaks above this level the next short-term target for the currency bulls will be 1.5580, just below a high on January 2.

Significant technical analysis' levels:

Resistance: 1.5480 (high Feb 18), 1.5481 (23.6% of 1.7192-1.4952), 1.5500 (psychological level)

Support: 1.5400 (psychological level), 1.5333 (low Feb 23), 1.5317 (low Feb 17)

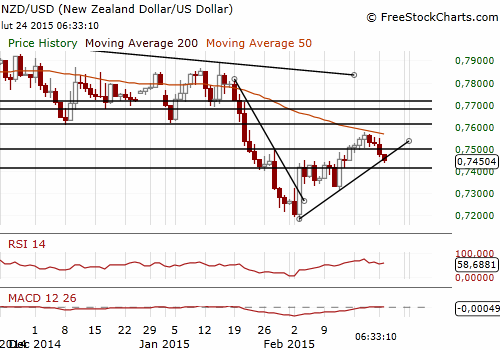

NZD/USD: Buy At 0.7380

(small profit taken, buy at 0.7380)

New Zealand's near-term inflation expectations eased in the first quarter, retreating further from the midpoint of the central bank's target band. The quarterly survey of expectations done on behalf of the Reserve Bank of New Zealand showed business managers forecast annual inflation to average 1.11% over the coming year, from 1.59% in the previous survey in November. Two-year inflation expectations - seen as the monetary policy horizon - were 1.80% from 2.06% in the previous survey.

The NZD was the biggest mover on major currency markets on Monday. The NZD/USD reached the stop-loss level of our long position at 0.7450, but we took small profit (0.7340-0.7450).

In our opinion the reaction of the NZD/USD to inflation expectations data was too strong. We stay bullish on the NZD/USD because of several factors.

First of all, the NZD is on track for a solid gains on an attractive interest rate advantage vs. other major currencies and the Reserve Bank of New Zealand has signaled keeping rates on hold in the foreseeable future, while some other central banks (Canada, Australia) are still expected to cut rates.

Secondly, the NZD is likely to appreciate on improving risk appetite as a consequence of global economic recovery and accommodative monetary policy led by major central banks (ECB, BOJ). The NZD is in the group of so-called commodity currencies, highly correlated with commodities prices.

Thirdly, the NZD will gain on recovery in commodities prices, which is likely along with the expected revival in global economy.

We are looking to get long on the NZD/USD again at 0.7380. If the order is filled, out target will be 0.7660.

Significant technical analysis' levels:

Resistance: 0.7534 (session high Feb 24), 0.7547 (high Feb 23), 0.7553 (high Feb 20)

Support: 0.7412 (low Feb 13), 0.7316 (low Feb 12), 0.7291 (low Feb 4)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.