Taken Positions:

EUR/USD trading strategy: short at 1.1590, target 1.1375, stop-loss 1.1665

USD/CAD trading strategy: long at 1.1880, target 1.2200, stop-loss 1.1920

EUR/GBP trading strategy: short at 0.7640, target 0.7520, stop-loss 0.7700

AUD/NZD trading strategy: short at 1.0620, target 1.0350, stop-loss 1.0680

Pending Orders:

USD/JPY trading strategy: sell at 118.90, if filled target 116.80, stop-loss 119.90

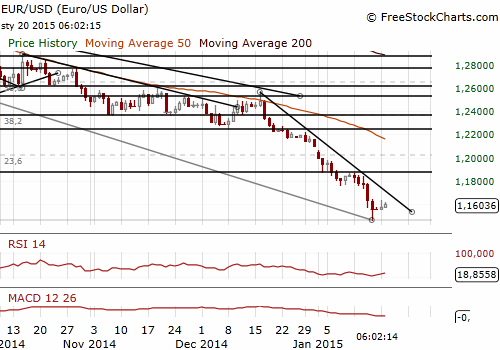

EUR/USD: QE Will Probably Have Some Limitation To Risk Distribution

(stay short ahead of the ECB’s decision on Thursday, but medium-term outlook is bullish)

German Finance Minister Wolfgang Schaeuble said that the Euro zone had overcome a lack of confidence and is working to boost growth. In his opinion emerging nations should take the lead in reviving the global economy. Germany's chancellor Angela Merkel said that the plan to buy government bonds by the ECB was no substitute for economic reforms in the euro zone.

ECB Executive Board member Benoit Coeure said the ECB had not yet reached any decisions on whether to embark on a quantitative easing programme. No final decision on the ECB's plans has been made yet and Germany's Bundesbank is still seeking safeguards, including a likely move to make national central banks rather than the ECB bear much of the risk for buying the bonds of member states.

The head of the International Monetary Fund Christine Lagarde said that ECB should make sure any quantitative easing programme it embarks on shares as much risk as it can amongst its members.

The ECB released its quarterly Bank Lending Survey that suggests rising demand for loans in the Euro zone. The document shows that a quarter of those banks surveyed saw an increase in demand for home loans in the final three months of last year, with a fifth expecting a further increase in the first quarter. Banks eased credit standards to firms and households in the fourth quarter, and expected to ease them further for both in the first quarter of 2015.

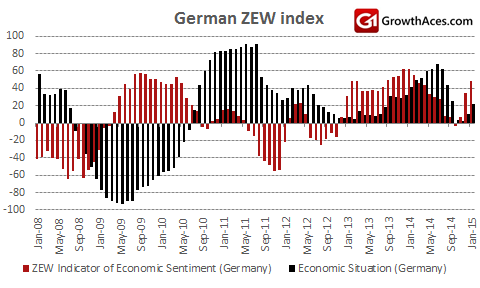

Positive survey ECB’s lending survey results were not the only good news from the Euro zone today. German ZEW economic sentiment climbed to 48.4 in January from 34.9 in December to reach its highest level since February last year. The reading surpassed a consensus forecast of 40.0. A separate gauge of current conditions rose to 22.4 from 10.0 in December and beat a consensus forecast of 14.8.

The data showed that recent EUR depreciation had strongly positive impact on the economic activity in Germany. In our opinion the fall of the EUR value is the main the most important channels through which the QE can help spur growth and revive inflation expectations. However, in our view current EUR/USD level already discounts the ECB action and the potential for further fall of the EUR/USD is limited. We expect a gradual recovery of the EUR/USD in the medium term due to possible delay of Fed’s hikes and improving economic situation in the Euro zone.

In the very short term we stay EUR/USD short. Our trading strategy is to close the position just before the ECB’s QE announcement on Thursday. GrowthAces.com is the opinion that the EUR/USD may start to rise on Thursday, a few minutes after Draghi’s press conference, because of profit taking on EUR-selling positions.

Significant technical analysis' levels:

Resistance: 1.1647 (hourly high Jan 16), 1.1726 (10-dma), 1.1792 (high Jan 15)

Support: 1.1528 (61.8% of 1.1460-1.1639), 1.1460 (low Jan 16, 2015), 1.1445 (low Nov 11, 2003)

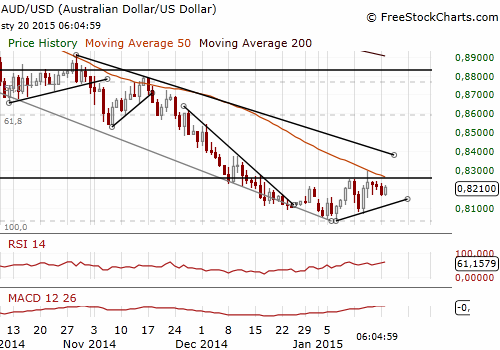

AUD/USD Without Support From Chinese Figures

(looking to get long on dips)

China's economic growth held steady at 7.3% yoy in the fourth quarter, slightly above expectations for 7.2% and unchanged from 7.3% yoy in the third quarter, which marked the economy's weakest expansion since the first quarter of 2009. A further slowdown in China could hinder the chances of a revival in global growth in 2015. China is the most important trade partner of Australia and the AUD/USD is vulnerable to the figures from Chinese economy.

Better-than-expected data from China did not support the AUD this time. The AUD/USD opened the Asian session at 0.8212 today after moving sideways in a thinned started of the week. The AUD/USD was under pressure from broad USD buying and a move of the USD/JPY above 118.00. The AUD/USD hit a day’s low at 0.8160 but recovered soon in the morning of the European session.

We stay sideways on the AUD/USD ahead of the ECB meeting that may have strong influence on the USD. Our medium-term outlook for the AUD/USD is slightly bullish and we will be looking to get long on dips.

Significant technical analysis' levels:

Resistance: 0.8244 (high Jan 19), 0.825 (high Jan 16), 0.8295 (high Jan 15)

Support: 0.8160 (hourly low Jan 20), 0.8134 (low Jan 15), 0.8068 (low Jan 14)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.