GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2560, target 1.2330, stop-loss 1.2640

USD/JPY: long at 115.00, target 117.70, stop-loss 115.00

USD/CHF: long at 0.9560, target 0.9760, stop-loss 0.9590

USD/CAD: long at 1.1310, target 1.1420, stop-loss 1.1260

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

AUD/NZD: long at 1.1040, target 1.1250, stop-loss 1.0960

USD/JPY: Roller Coaster After Japan's GDP Data

(we keep our bullish outlook)

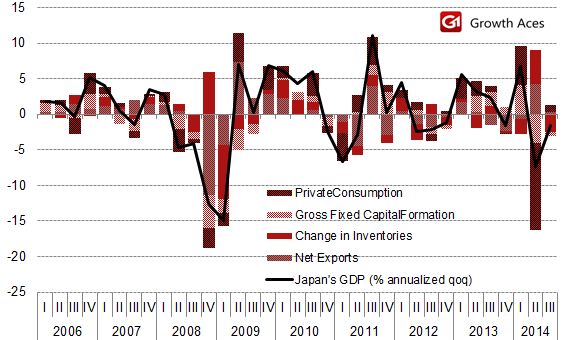

GDP fell by an annualised 1.6% in July-September, after plunging 7.3% in the second quarter following a rise in the national sales tax. Japan’s economy had been forecast to rebound by 2.1%, but consumption and exports remained weak.

On a quarter-on-quarter basis, the economy fell 0.4% in the third quarter. Private consumption rose 0.4% qoq. Capital expenditure fell 0.2% qoq.

Japanese Prime Minister Shinzo Abe said on Monday that he would analyse the situation calmly and decide whether to press ahead with a planned sales tax hike to 10% in October next year. Japanese Economics Minister Akira Amari said on Monday Prime Minister Shinzo Abe is likely to order an economic stimulus package after the economy unexpectedly slipped into recession. Amari said it would be difficult to compile a very large package because the government has to maintain fiscal discipline.

Chief government spokesman Yoshihide Suga said Prime Minister Shinzo Abe will make a decision on Tuesday about fresh economic measures in the wake of weak economic data. Abe is expected to announce his decision to delay the hike for 18 months and state his intention to call an election for parliament's lower house. Ruling party lawmakers expect the poll to be held on December 14.

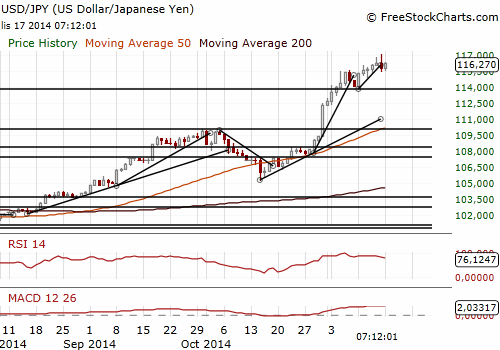

The volatility was high today. The USD/JPY broke above 117.00 just after a very weak Q3 GDP report. The market reversed fast, however. The JPY recovered from 7-year lows and stopped at 115.45.

The data raised the prospect that the Bank of Japan will add more stimulus after a snap election many expect to be called this week. The USD/JPY came back above 116.00 and continues to rise. We keep our bullish outlook. The short-term target is the new seven year high at 117.06. In our opinion the USD/JPY is likely to go higher and we keep the target of our long position at 117.70.

Significant technical analysis' levels:

Resistance: 116.89 (hourly high Nov 17), 117.06 (hourly high Nov 17), 117.20 (high Oct 17, 2007)

Support: 115.65 (hourly low Nov 17), 115.45 (session low Nov 17), 115.31 (low Nov 13)

EUR/USD: Short At 1.2560

(the target is 1.2330 and stop-loss 1.2640)

Some better-than-expected US data were released on Friday. The University of Michigan's consumer sentiment index rose to 89.4 in early November from 86.9 at the end of October. Lower fuel prices and employment increases were the main factors boosting consumer sentiment. The current conditions index jumped to 103.0 from 98.3, while the expectations index went up to 80.6 from 79.6, both reached their highest levels since July 2007. Gas prices pulled down inflation expectations. One year ahead expected rate fell to 2.6% from +2.9%, the lowest since September 2010. Five year ahead expected rate fell to 2.6% from +2.8%, the lowest since March 2009.

Retail sales rose 0.3% mom in October vs. the median forecast of 0.2% gain. When stripping out volatile elements like gasoline, autos, building materials and food services, retail sales rose 0.5% mom. That was the biggest increase since August.

The data showed on Monday the seasonally-adjusted trade surplus in Euro zone widened from EUR 15.4bn to a record EUR 17.7bn in September. A 4.2% monthly rise in exports offset a 3.0% gain in imports. The data reflects rising economic activity in some export markets (the USA and the United Kingdom) as well as recent depreciation of the EUR.

The USD rallied on Friday, helped by unexpectedly strong US retail sales. The EUR/USD fell below 1.2400, but the rally was short-lived. The EUR/USD broke above 1.2500 during Friday’s US session. Out short EUR/USD position reached the stop-loss level at 1.2540. We have placed our sell order slightly higher, at 1.2560.

The EUR/USD opened today’s Asian session at 1.2525 and rose to 1.2580 supported by broad USD/JPY weakness following a collapse in the USD/JPY from 117.08 to 115.45. Our sell order was filled at 1.2580. We have set the target at 1.2330, as previously, and the stop-loss at 1.2640.

Let’s take a look at the economic calendar for this week. We have a lot of US macroeconomic releases this week, including industrial production today. The release of FOMC minutes is scheduled for Wednesday and US CPI figures are scheduled for Thursday. Investors will be also focused on Euro zone preliminary PMI readings (on Thursday).

Significant technical analysis' levels:

Resistance: 1.2580 (hourly high Nov 17), 1.2591 (hourly high Oct 31), 1.2617 (daily high Oct 31)

Support: 1.2469 (10-dma), 1.2398 (low Nov 14), 1.2394 (low Nov 11).

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.