GROWTHACES.COM Trading Positions

AUD/USD: short at 0.8820, target 0.8660, stop-loss 0.8870

EUR/JPY: long at 135.20, target 137.70, stop-loss 136.10

EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

GBP/JPY: long at 172.00, target 175.00, stop-loss 172.30

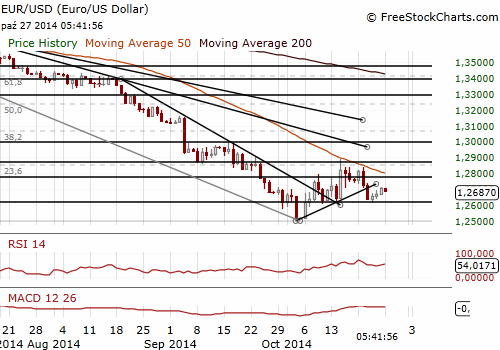

EUR/USD higher after better-than-expected ECB stress tests

(we are looking to get short at 1.2760)

The European Central Bank announced on Sunday that 24 of the euro zone's 123 biggest banks failed the health checkat the end of last year with a total capital shortfall of EUR 24.6 bn. The bank added that most of them have since repaired their finances. Many of the lenders have raised capital since the end of 2013 and the total shortfall shrank to EUR 9.5 bn across 14 lenders by the end of September 2014. The euro zone banks now have two weeks to come up with plans for plugging any capital holes uncovered by the stress test within nine months.

The ECB found the biggest problems in Italy, Cyprus and Greece. Italy faces the biggest challenge with nine of its banks falling short and two still needing to raise funds. Regulators said three Greek banks, three Cypriots, two from both Belgium and Slovenia, and one each from France, Germany, Austria, Ireland and Portugal had also missed the grade as of end-2013.

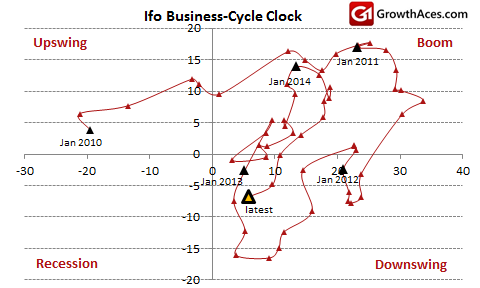

German Ifo business climate index, based on a monthly survey of some 7,000 firms, fell to 103.2 from 104.7 the previous month. That was its weakest reading since December 2012. The median forecast amounted to 104.3. Ifo economist Klaus Wohlrabe said he expected zero growth in the fourth quarter in Germany and that there were almost no bright spots for German industry at present.

Let’s take a look at Ifo Business-Cycle Clock. We see that German economy is in the downswing phase. The chart suggests that entering the recession phase cannot be excluded in the first quarter. The recession will not be deep, however.

The EUR/USD firmed on Monday after the European Central Bank's stress tests found smaller capital shortfalls among European banks than expected. The EUR depreciated slightlyafter the weaker-than-expected Ifo release.

The main event this week for the EUR/USD is the FOMC meeting on Wednesday and Janet Yellen’s speech on Thursday. In our opinion the EUR/USD is likely to fall again after a slight recovery. We have placed our sell offer at 1.2760.

Significant technical analysis' levels:

Resistance: 1.2723 (10-dma), 1.2730 (200-hma), 1.2740 (daily high Oct 22)

Support: 1.2635 (low Oct 24), 1.2614 (low Oct 23), 1.2605 (low Oct 10)

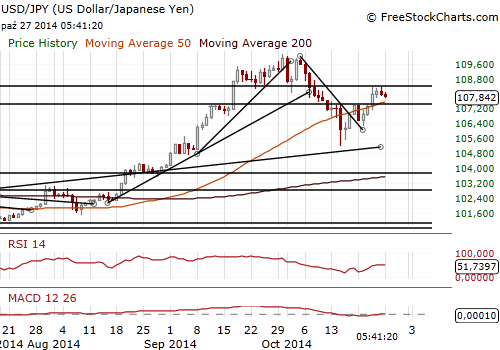

USD/JPY: Looking to get long ahead of macro releases and BoJ’s meeting

(our buy offer is at 107.60)

The USD/JPY traded up to 108.38 early Asia after the Wall Street rally on Friday and better-than-expected stress tests results in the Euro zone. The USD/JPY fell below the support at 107.78 (Friday’s low) during European session on profit taking.

We are still bullish on the USD/JPY. We keep our long positions on crosses: EUR/JPY (we have raised the target and the stop-loss level) and GBP/JPY and are going to get long on the USD/JPY at 107.60.

We have some important macroeconomic releases for Japan’s economy this week. Our forecast for retail sales (today GMT) is at the level of 0.4% yoy vs. the median forecast of 0.6% yoy. The release of industrial output data is scheduled for tomorrow and our estimate is slightly above the median forecast.

The most important event will be probably the CPI reading on Thursday (late evening GMT) ahead of Friday’s (early morning GMT) BoJ’s meeting. We expect inflation to go slightly down vs. the previous month that is likely put some pressure on the BoJ to add further dovish hints into its statement.

Significant technical analysis' levels:

Resistance: 108.38 (hourly high Oct 27), 108.74 (high Oct 8), 109.08 (76.4% of 110.09-105.20)

Support: 107.11 (low Oct 23), 106.78 (low Oct 22), 106.26 (low Oct 21)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.