Increased downside risks

Let us consider the GBP/USD pair on the daily timeframe. On June 3 the Bank ofEngland decided to keep the interest rate unchanged at 0.5% and to leave themonetary stimulus program unchanged at GBP 375 billion. June 30 final reportindicated the UK economy grew 0.4% in the first quarter due to growing domesticdemand as the current account deficit of 20.6 billion pounds, or 5.8% of GDP,subtracted 0.6 percentage point from growth. The economic outlook of UK isuncertain as the winning Conservative party plans to hold a referendum on Britain’smembership in European Union by the end of 2017 and possibly as early as 2016.The conservative party has also pledged to close the budget deficit in fiveyears and Chancellor George Osborne is going to announce the austerity measureson July 8 when he presents the government’s budget for the next four years. Thefiscal tightening will likely act as a drag on growth. The political andeconomic uncertainty from the possible Greek exit form euro-zone in turnincrease the downside risks for UK economy. On this backdrop US economy appearsto be on track of firm recovery, with solid June jobs report increasing thelikelihood of September rate hike. The British pound will likely weaken againstthe US dollar in near term given the divergent growth prospects and monetarypolicies of the Federal Reserve and Bank of England.

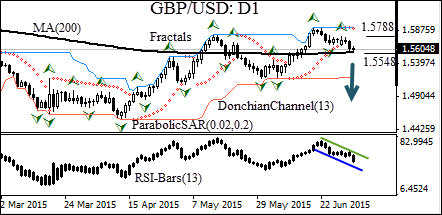

The GBP/USD has been tradingwith a downward bias since the Greek negotiators failed to reach an agreementon bailout extension with Eurogroup finance ministers on June 19. The Parabolicindicator gives a sell signal. The RSI-Bars oscillator moves in a downtrend channel. The Donchian channel isflat. The pair has crossed below the last fractal low at 1.56672 and is fallingtoward the 200-day moving average. We believe the bearish momentum will be confirmedafter the pair closes below the 200-day moving average at 1.55485. A pendingorder to sell can be placed below that level. The stop loss can be placed abovethe last fractal high at 1.57886. After placing the order, the stop loss is tobe moved every day to the next fractal high, following Parabolic signals. Thus,we are changing the probable profit/loss ratio to the breakeven point. If theprice meets the stop loss level without reaching the order, we recommendcancelling the position: the market sustains internal changes which were nottaken into account.

Position

Sell

Sell stop

below 1.55485

Stop loss

above 1.57886

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.