The Monday:

Welcome to another FOMC week!

While probably not yet in play. the Fed’s rhetoric out of the meeting will be hugely influential in how the US Dollar behaves heading into the following month.

Economists surveyed suggest that still 80% believe that the Fed will move to hike rates in September, meaning that a clear statement of intent could be given on Wednesday. The Fed has spoken before about limiting market surprises so a hawkish tone could signal liftoff is imminent.

If however the Fed fails to give any indication of a September hike, any early move that has been priced into the US Dollar will look to be unwound across the majors. Just how long this unwind will last is debatable.

Just remember that the day after FOMC, we get the US Q2 GDP number. This will be most significant if again the Fed delays in their rhetoric, then the GDP number or revision beats expectations.

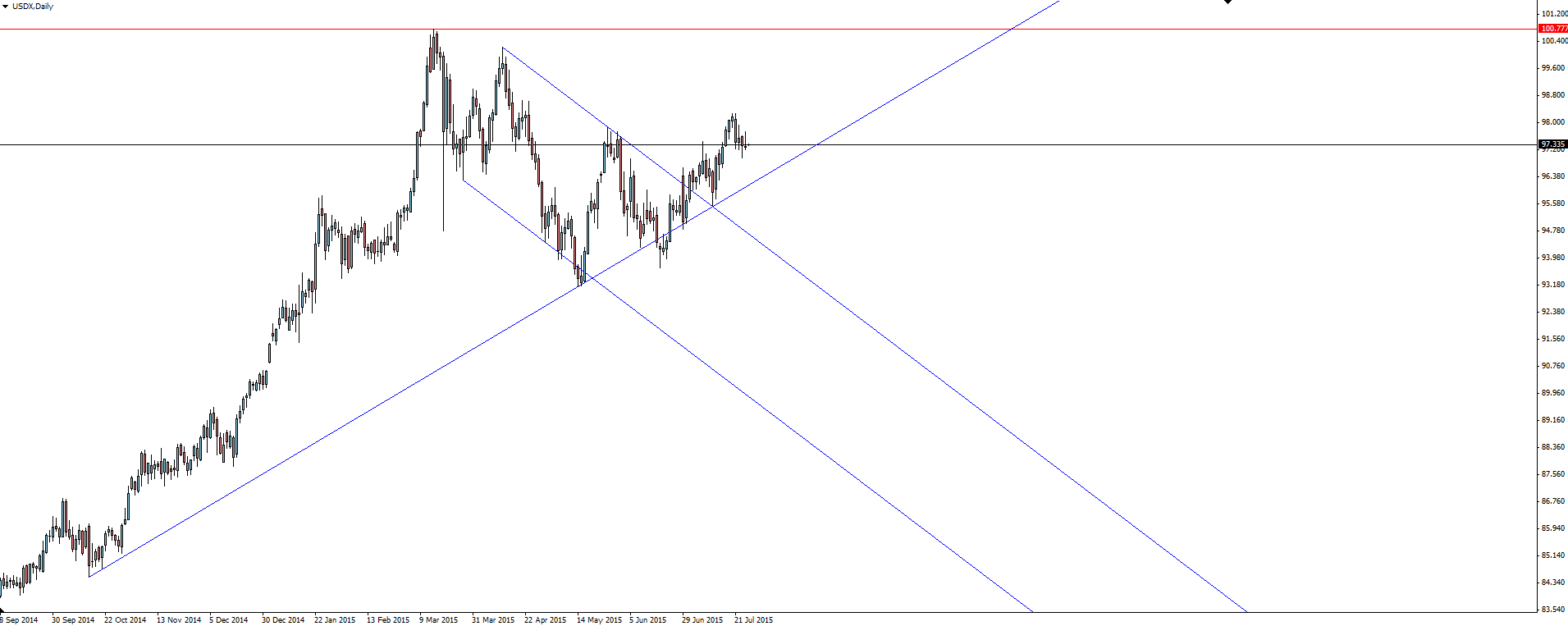

USDX Daily:

Click on chart to see a larger view.

Also keep in mind the divergence between monetary policies of other major central banks. With most others bar the Bank of England maintaining an easing bias, keep in mind where you can take the most advantage.

Greece:

I’ve thrown this one into the Monday Morning blog because we all need a smile on a Monday.

With Greece set to begin a fresh round of negotiations for its next bailout on Tuesday, journalists have been told that the talks have been delayed due to “technical reasons”.

“The delay… is due to technical reasons and not due to political or diplomatic reasons.”

There have been ‘logistical problems’ holding up officials representing the international creditors.

Seriously.

With Greek banks set to continue with capital controls, the economy continues to weaken. If people don’t have access to capital then things grind to a halt pretty quickly. One of the most concerning side effects of capital controls is the steady increase in loans that are failing to be re-paid. The cycle continues.

EUR/USD Daily:

Click on chart to see a larger view.

———-

On the Calendar Monday:

EUR German Ifo Business Climate

USD Core Durable Goods Orders

———-

Chart of the Day:

Further to my point about divergent monetary policies above, we take a look at a cross with 2 economies heading in different directions meaning the chart is heading in only 1.

GBP/AUD Daily:

Click on chart to see a larger view.

This chart is just absolutely ruthless!

Price moved upwards off its bottom inside a nice bullish channel, giving nice pullbacks to parallel lines along the way, before exploding into a move that can only be described as parabolic. And its still on its highs!

I get questions all the time about charts that look like this:

“So it’s time to fade it, right?”

“Its way overbought, we should look to sell into this move, right?”

THERE IS NO SUCH THING AS OVERBOUGHT.

Don’t go broke fading strength and if you ever need a refresher as to why, favourite the GBP/AUD chart above.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.