Morning View:

What we can take out of last night’s FOMC meeting is that although the Fed signalled that a pickup in the overall economy is keeping it on track to hike rates this calendar year, they are now talking down the rate that rates will be lifted.

From a data point of view, Yellen singled out gains in the labour market as positives:

“Since the committee last met in April, the pace of job gains has picked up and labour-market gains have improved further.”

The big line however now seems to be:

“The date of the first rate increase is less important than the trajectory of subsequent rate increases.”

This was the point that markets have taken the most notice of, seeing this as more dovish than what has previously been priced in and therefore sending the USD crashing down.

Take a look at the Fed “Dot Plot which shows where individual FOMC members are forecasting that the federal funds rate will be in the coming months:

As shown above, with hikes coming still as early as September, any weakness in USD on the back of perceived wording can most definitely be viewed as a buying opportunity over the coming months.

So where does this decision leave EUR/USD? In yesterday’s FOMC preview, we spoke about the way that big fundamental decisions like this, almost always end up sitting on major technical levels such as the one marked on the daily chart below.

EUR/USD Daily:

Click on chart to see a larger view.

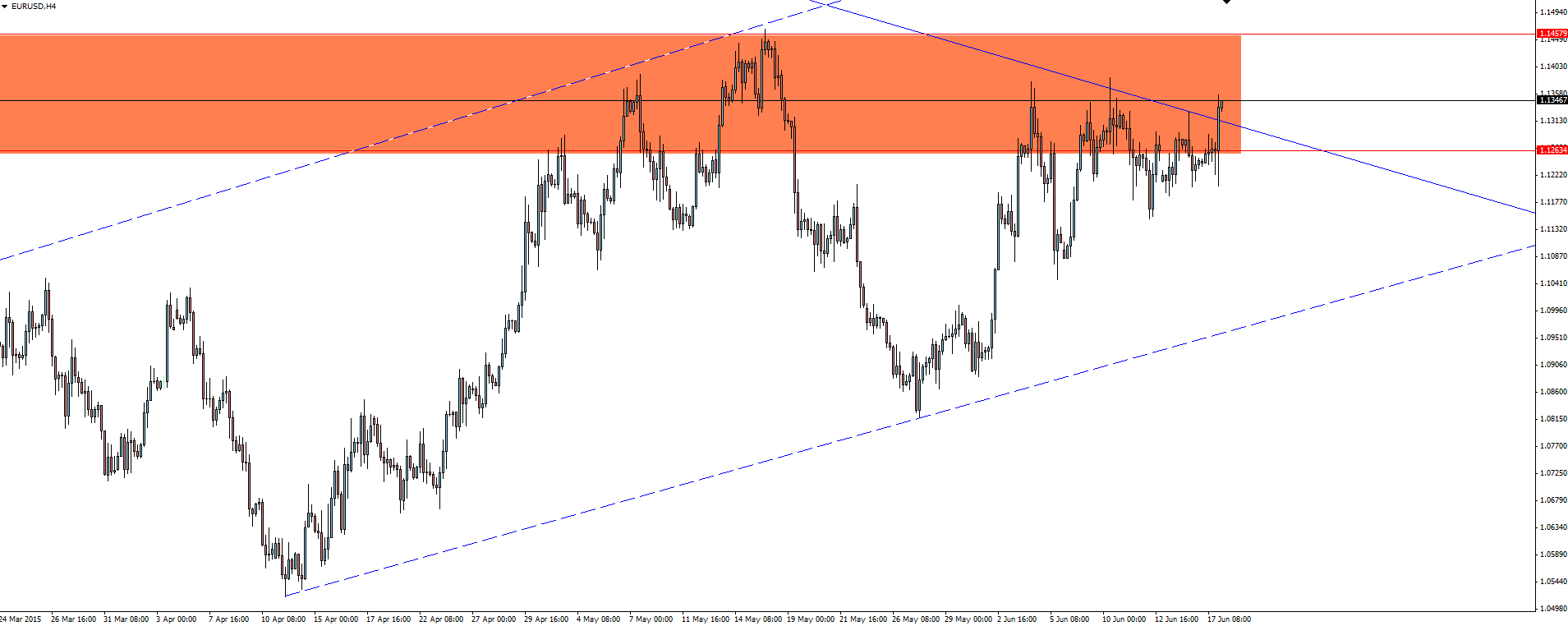

EUR/USD 4 Hourly:

Click on chart to see a larger view.

As you can see highlighted by the 4 hourly chart, EUR/USD rallied hard on the back of USD pressure at a perceived lack of impetus from the Fed as to how fast they will hike rates over the coming years.

However, the fact we are not even half way into the orange supply zone now a few hours after the release, says to me that markets are wary to push too hard on news that we all knew was coming anyway.

Definitely be careful buying into this.

———-

On the Calendar Today:

Thursday:

NZD GDP (0.2% v 0.6% expected)

CHF Libor Rate

CHF SNB Monetary Policy Assessment

CHF SNB Press Conference

GBP Retail Sales

EUR Targeted LTRO

EUR Eurogroup Meetings

USD CPI

USD Core CPI

USD Unemployment Claims

USD Philly Fed Manufacturing Index

———-

Chart of the Day:

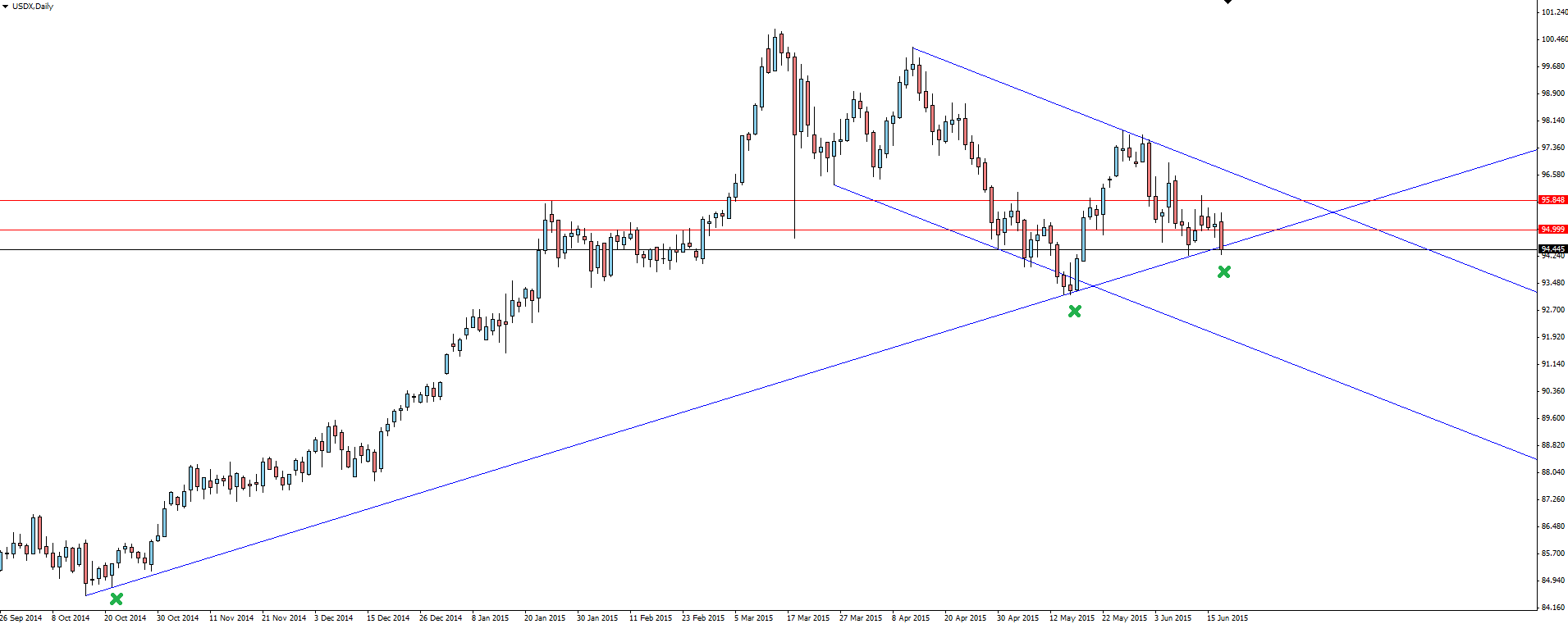

USDX Daily:

Click on chart to see a larger view.

If you only look at the 1 chart today, make it the USDX Daily chart below. It tells you everything you need to know about how the market is digesting what is being reported as a ‘dovish’ Fed. Further to that, I’d always recommend keeping a USDX chart open at least for reference.

With the Fed driving market sentiment in the near term, so long as we are above this trend line on the USDX chart, none of the majors are going to have sustained breakouts to the upside.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.