“You’re a fake and a phony and I wish I never laid eyes on you.”

Was that Sandy or was that Europe…?

Back in decision making vogue, Greek finance minister Yanis Varoufakis appeared on Greek television this morning to ‘reassure’ the public that the country is handling it’s debt issues in a positive manner. He assured the public that Greece was very close to a deal with its international creditors which would allow the rest of the bailout aid funds to be unlocked.

More importantly for forex markets, Varoufakis went on to say that the country has no thoughts on returning to the Drachma and that they were committed to the Eurozone and the single currency. “Another currency is not on our radar, not in our thoughts” he said.

Greece is sure to pay it’s creditors with yet more borrowed money to kick the can that little bit further down the road again. EUR/USD continues to cautiously rally (or move in correction mode at least) with markets expecting a last minute deal.

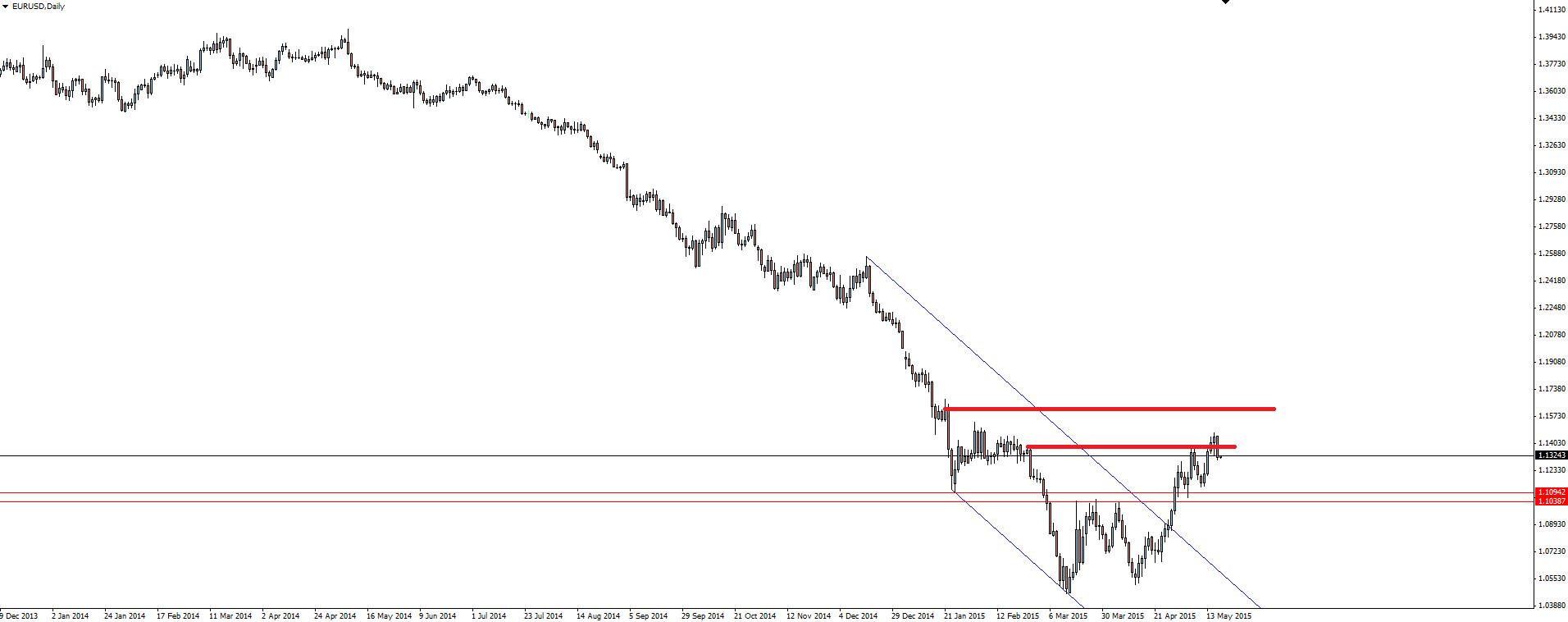

EUR/USD Daily:

Click on chart to see a larger view.

EUR/USD is entering a zone where some sellers will be waiting to come into the market but price is holding up alright so far.

———-

On the Calendar Today:

Monetary Policy Minutes out of Australia this morning, followed closely by Inflation data from across the ditch in New Zealand which will surely move the two.

German ZEW is always a big one for the Euro later on as well.

Tuesday:

AUD Monetary Policy Meeting Minutes

NZD Inflation Expectations

GBP CPI

EUR German ZEW Economic Sentiment

USD Building Permits

CAD BOC Gov Poloz Speaks

———-

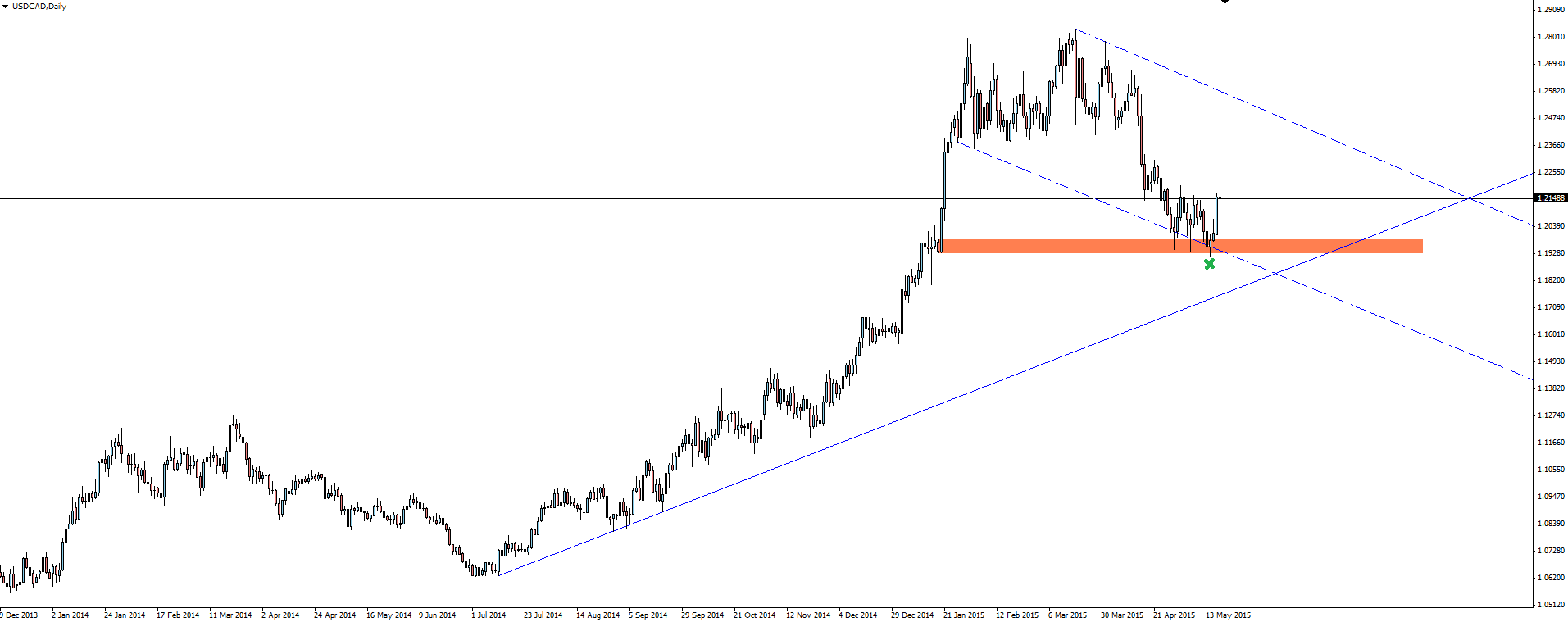

Chart of the Day:

In the Technical Analysis section of the Vantage FX News Centre we have been speaking about the demand zone that USD/CAD was approaching. On the back of renewed USD strength, we’ve had some action out of the zone.

USD/CAD Daily:

Click on chart to see a larger view.

It took a couple of touches (which is never usually a good thing in terms of support holding) but we got a bounce in the end.

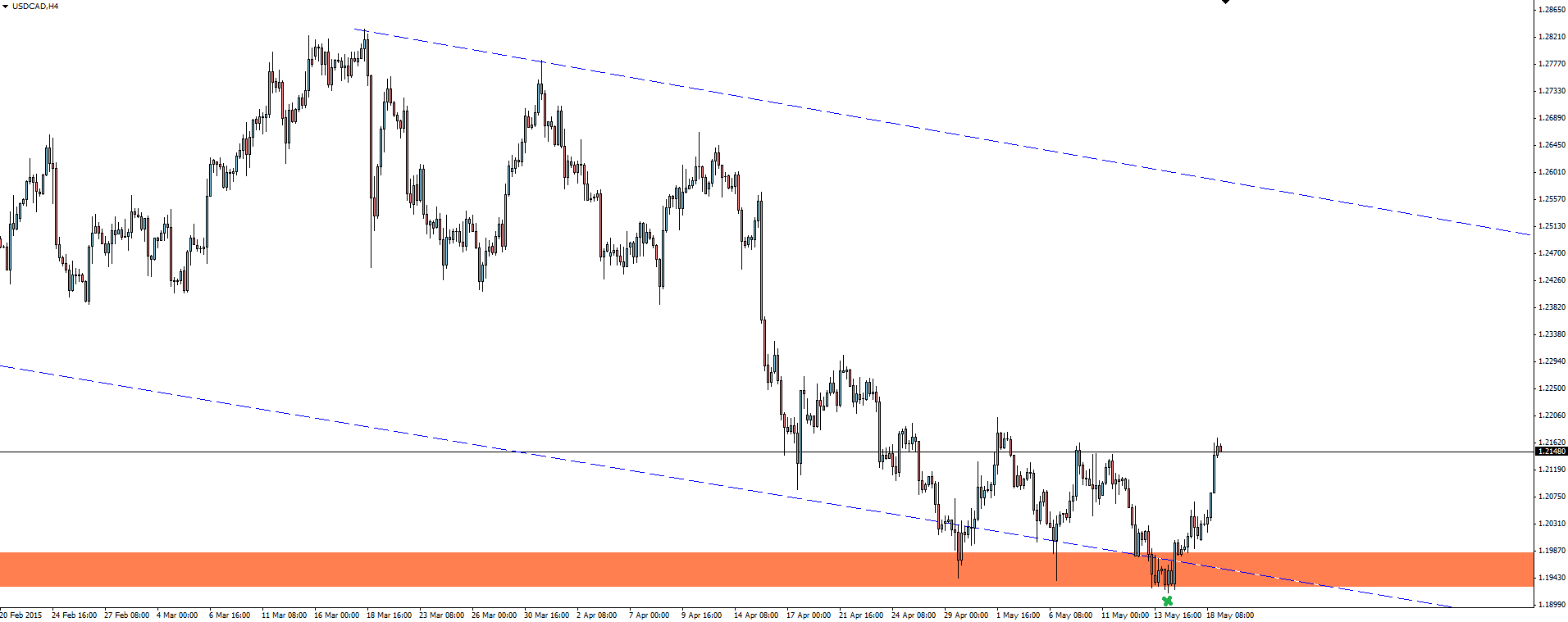

USD/CAD 4 Hourly:

Click on chart to see a larger view.

As you can see on the 4 hourly chart, price still has plenty of potential to the upside within the short term channel, especially if you interpret the pattern as a higher time-frame bull flag.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.