Before us traders take in the statements from the BOJ, BOE and FOMC, we may be thinking two questions. Firstly, is another global financial crisis coming? It has been the constant question people have been asking this year. Now we are near the end of 2014 and seven years since the GFC hit, yet the global economy is still far from being in safe mode. Japan has once again slipped into recession; Eurozone is still struggling with weak demands and deflation; China is slowing down; commodities and oil prices plummet to the bottom; and so hence, the fear of deflation spreads around the world.

And there is the other question: can the US economy keep its steady growth under this global environment? Especially after the data has shown that the UK economy is being dragged by the weakness of the Euro area. Market participants are seeking the answer of this question as it is crucial to the future trend of the US Dollar. The FOMC meeting minutes tomorrow morning may tell us what the committee think about a stronger Dollar in a weaker world economy.

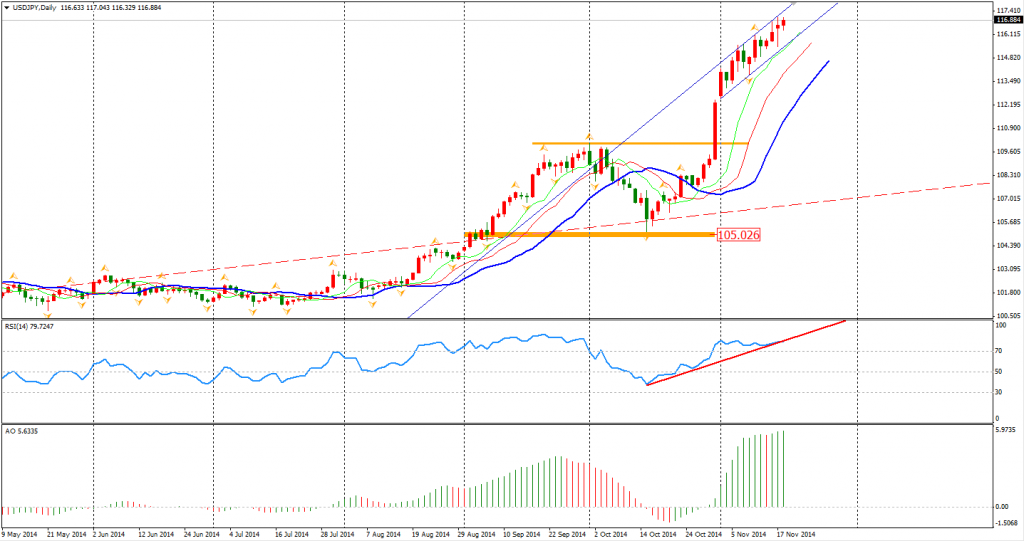

Japanese PM Abe declared to dissolve the parliament and delay the planned consumption tax increase. The Dollar Yen jumped to the 117 again, but later fell back to the consolidation area around 116.50. The Yen is still expected to rise to higher levels like 120 or 125 in the next year. The support below is 116.20 and Monday’s low at 115.44.

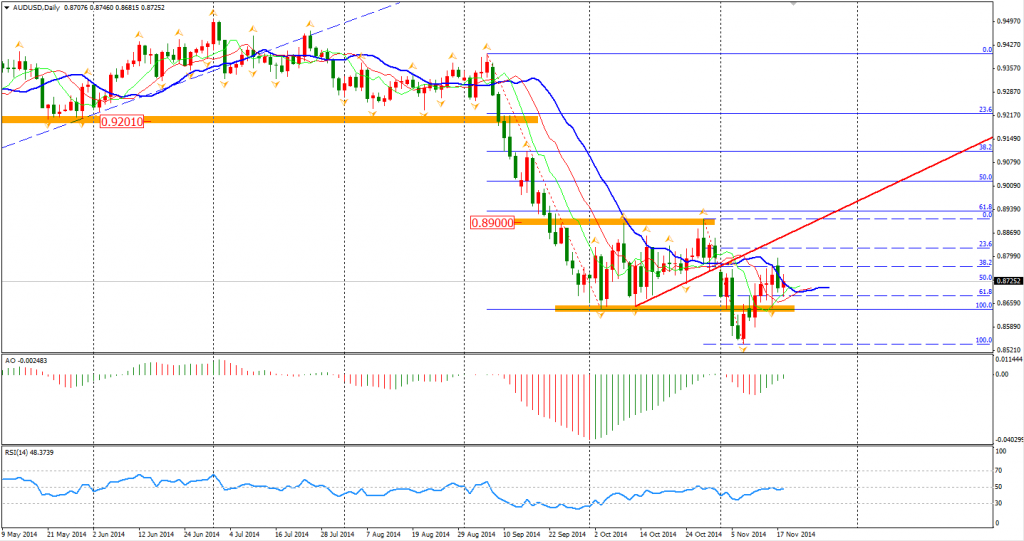

The Aussie/Dollar maintains its sideway movement around 0.8720 as the statement and the Governor’s speech seemed quite boring to the market. The contest between bulls and bears is heated around the 50% retracement level of the last decline, but from a technical aspect, another equal-length fall may be coming in the next two days.

PThe Asian stock markets were inspired by easing expectation, led by the Japanese and Korean market. The Nikkei Stock Average surged 2.18%. The Shanghai Composite retreated 0.71% to 2456. ASX 200 closed 0.24% lower at 5399. In European stock markets, the UK FTSE was up 0.56%, the German DAX rose 1.61% and the French CAC Index gained 0.86%. The US market closed higher after the rise of the European and Japanese market. The S&P 500 climbed 0.51% to 2052. The Dow rose 0.23% to 17699, while the Nasdaq Composite Index gained 0.67% to 4702.

On the data front, policy statements from Bank of Japan and Bank of England will be the focus of the market. Also, US Building Permits will be released at 00:30 AEDST. The FOMC meeting minutes will be the last event of this long trading day. It may give the market new instruction for future direction before the year end.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.