Last night, the economic data agitated the currency market even though the final closes were nearing the opens.

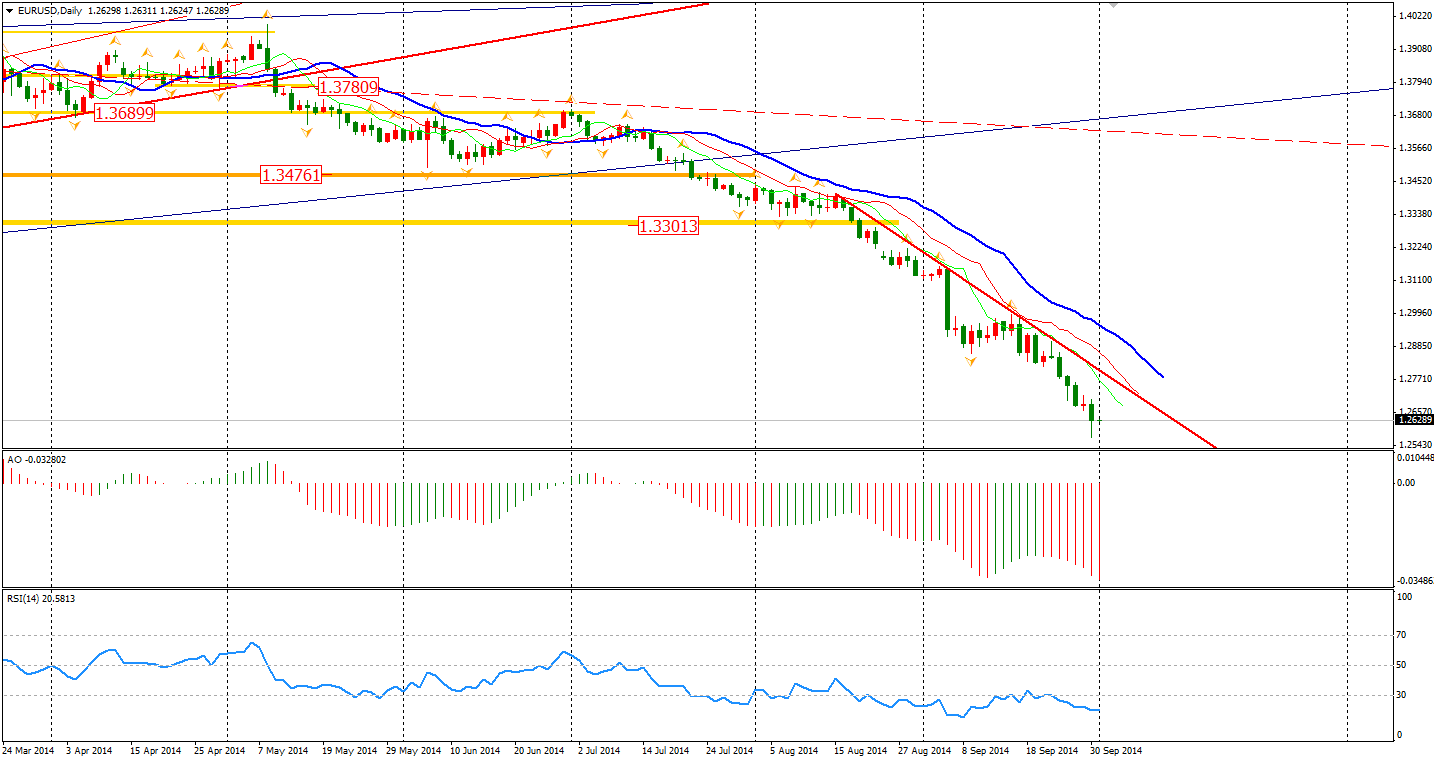

The Eurozone CPI rose by only 0.3% in September – a fresh low since October 2009. The core CPI grew 0.7%, lower than the expected 0.9%. The data most likely will lead the ECB to introduce further stimulus policy. The next ECB meeting will be this Thursday, with the market expecting a scale of 400-500 billion Euro ABS purchasing program to be disclosed. The Euro fell to a two-year low against the Dollar after the release of its CPI dropping as low as 0.6% to 1.3614.

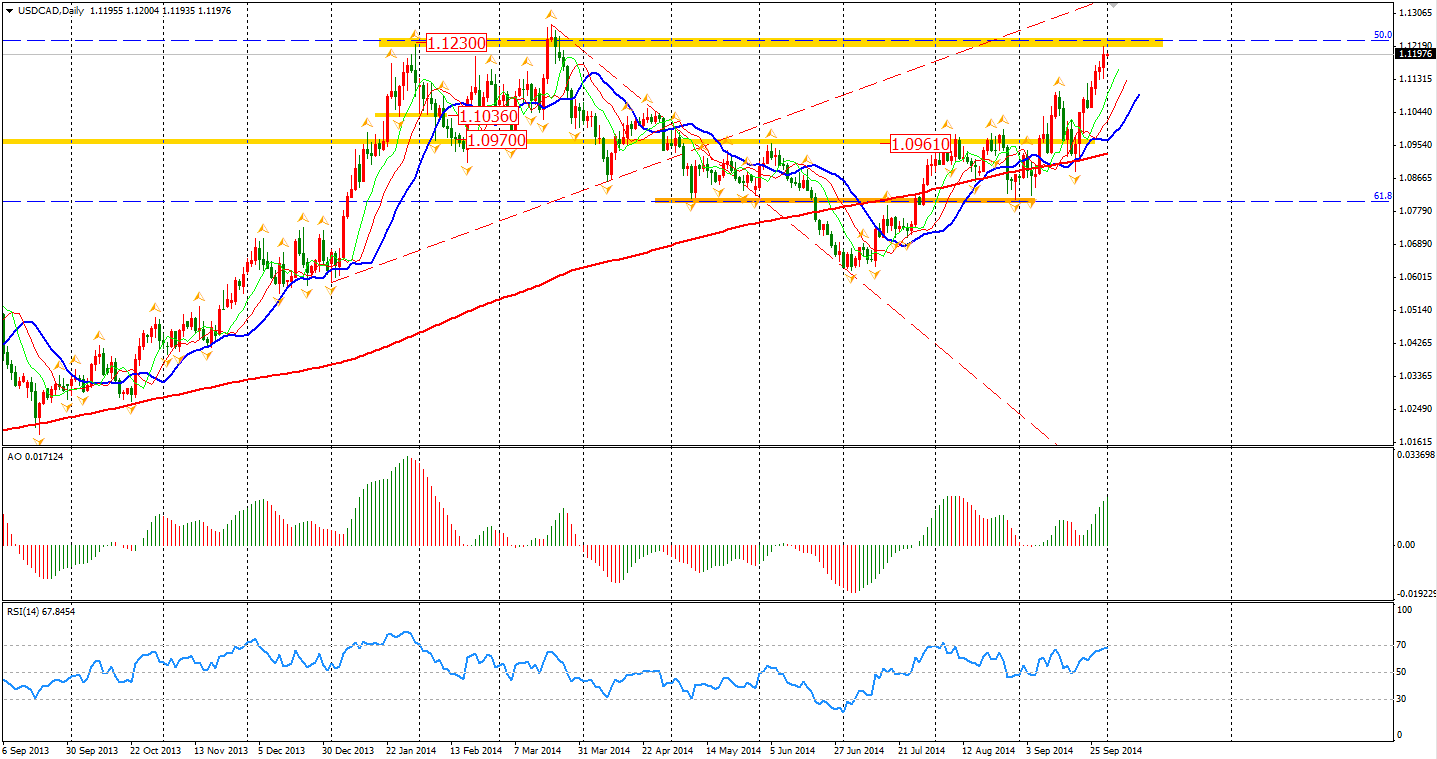

Moving into the American trading hours, the Canadian GDP saw little change in July from the previous month, whilst the expectation was a 0.3% expansion. The Canadian Dollar lost 0.4% and the USDCAD climbed to a new recent high of 1.12.

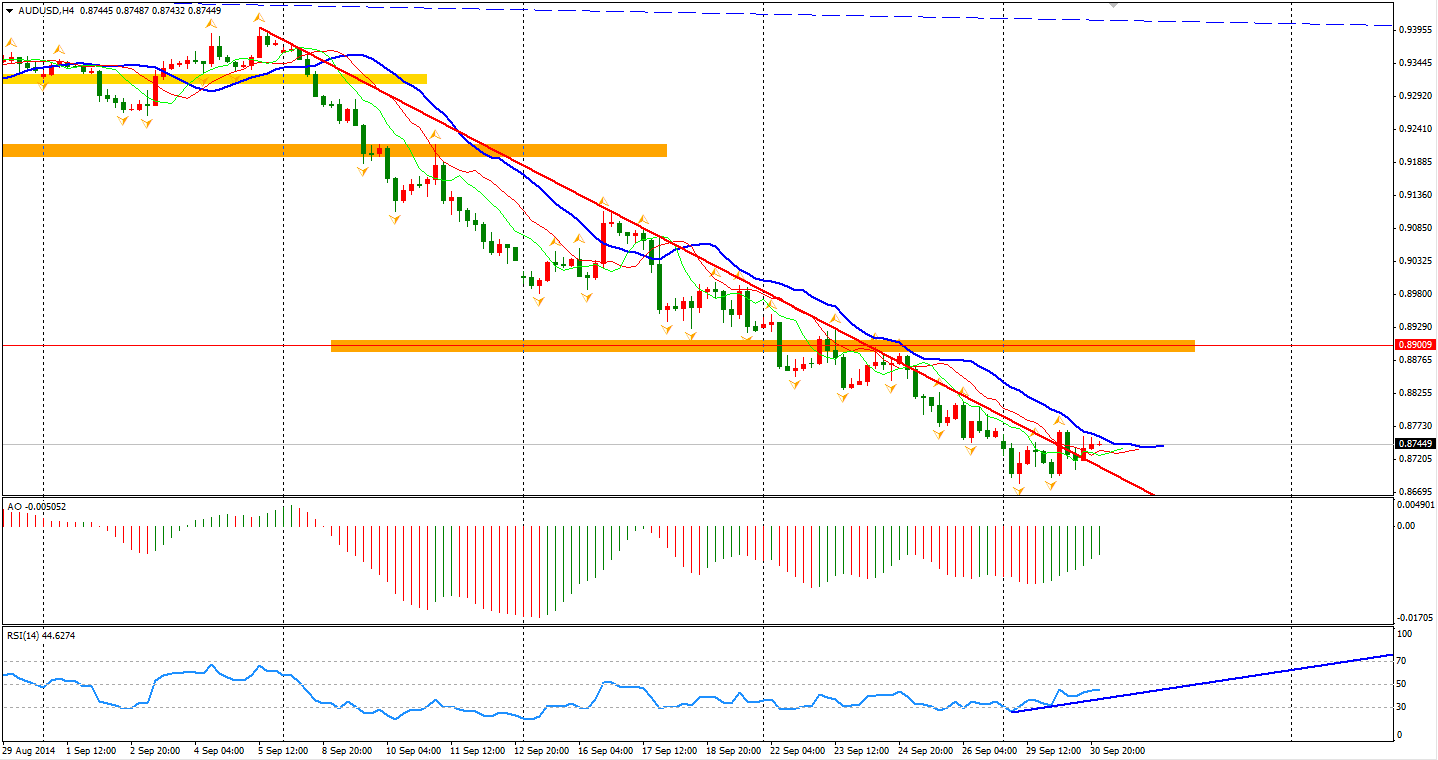

On to the commodity currencies, the Kiwi/Dollar is still weak but the Aussie/Dollar showed some unconfirmed sign of reversal in the 4-hour chart. The Aussie refused to refresh its lows and upwardly broke the steep downtrend from the 0.94 point. The RSI in the 4-hour chart also suggested a sign of a bottom. As previously mentioned, the year low of 0.8650 will be the target for the Aussie and may provide strong support to the currency. Traders now should seriously consider the possibility of a rebound.

The Asian stock markets finished with mixed results yesterday. The Shanghai Composite moved 0.26% up to 2364. The Nikkei Stock Average slumped 0.84%. The ASX 200 bounced 0.54% to 5293. In European stock markets, the UK FTSE was down 0.36%, the German DAX gained 0.55% and the French CAC Index surged 1.33%. U.S. stocks fell slightly. The S&P 500 lost 0.28% to 1972. The Dow edged down 0.17% to 17043, while the Nasdaq Composite Index dropped 0.28% to 4493.

On the data front, the Chinese Manufacturing PMI will be released soon at 11:00 AEST. Australia Retail Sales will soon follow half an hour later. The UK Manufacturing PMI will be at 18:30. At the beginning of US trading hours, US ADP Non-Farm Employment Change and ISM Manufacturing PMI should be closely watched.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.