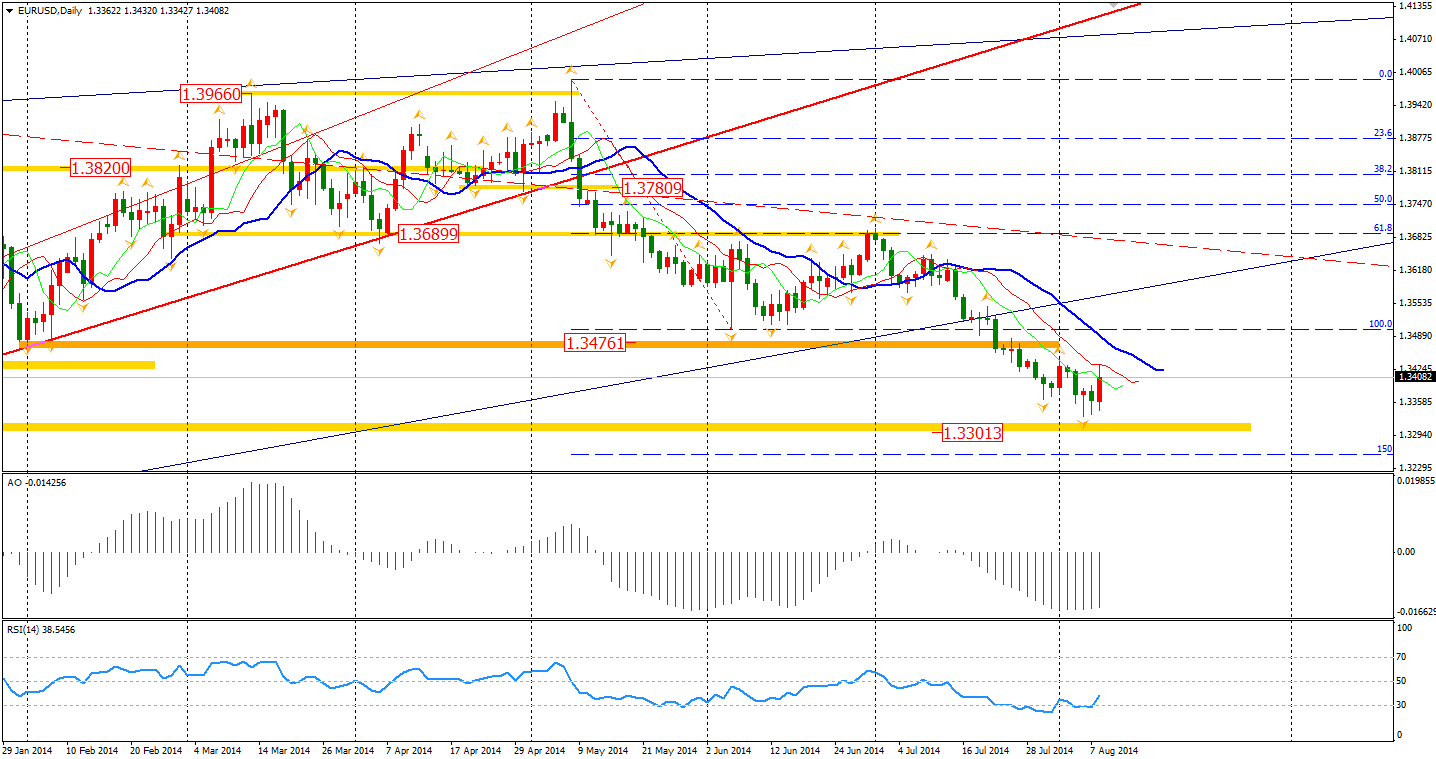

As Russia stopped the military exercise on the Ukraine border, the Euro rebounded 0.36% against the Dollar on Friday, which is its biggest rally since July. A short term bounce may occur this week as the pair has fallen over 2% in one month and gained some support from the 1.33 integer level. However, since the ECB is inclined to introduce further asset purchasing programs and Russia maintains its confrontational stance against NATO members on the Ukrainian situation, a weaker Euro is probably foreseeable in the long run.

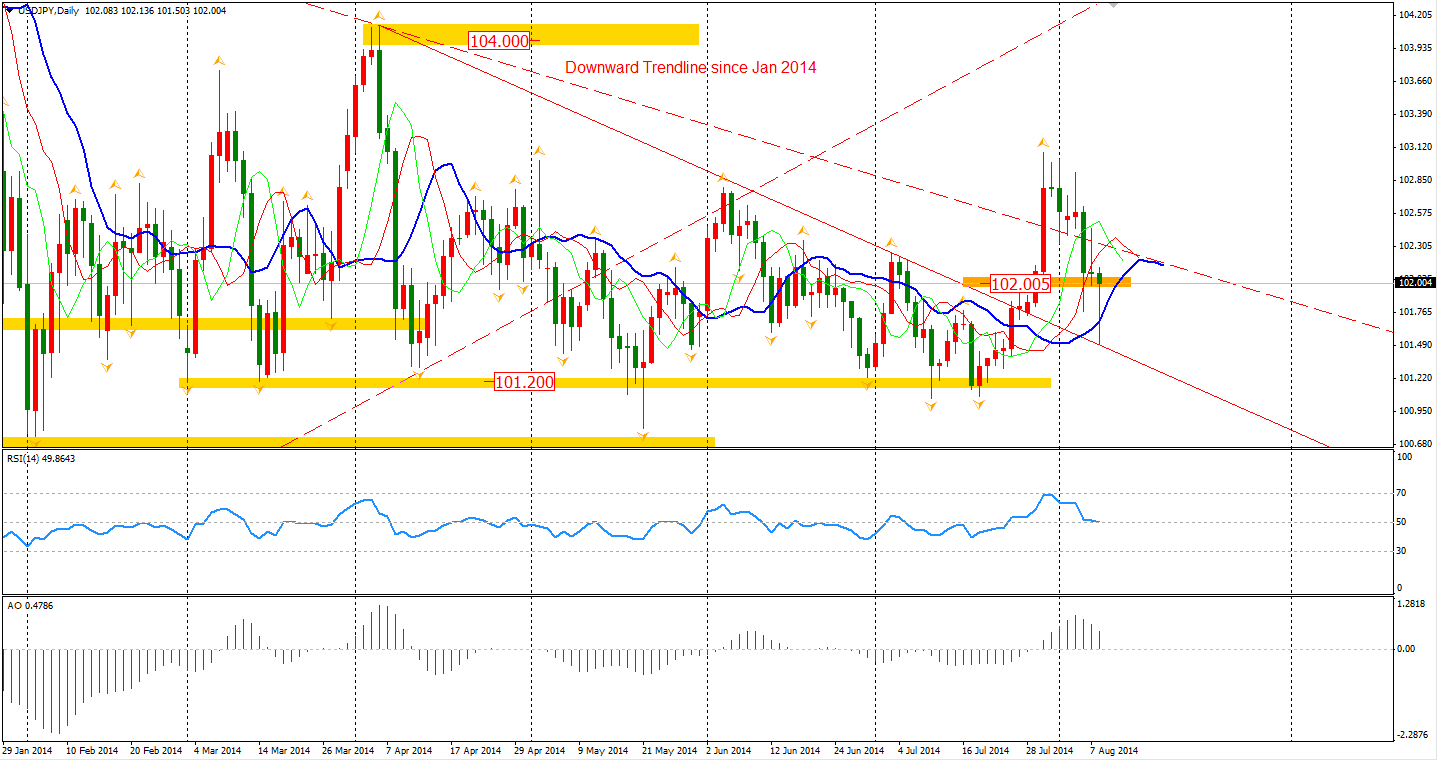

The Yen continued its rally after U.S. President Obama declared they look to conduct airstrikes on Sunni extremists in North Iraq. Dollar/Yen hit the day low of 101.50 during the early European session but recovered most of the loss afterward. It closed at a 102 integer level. The breakout of a triangle since April still supports the currency pair, but further direction depends on the geopolitical issues.

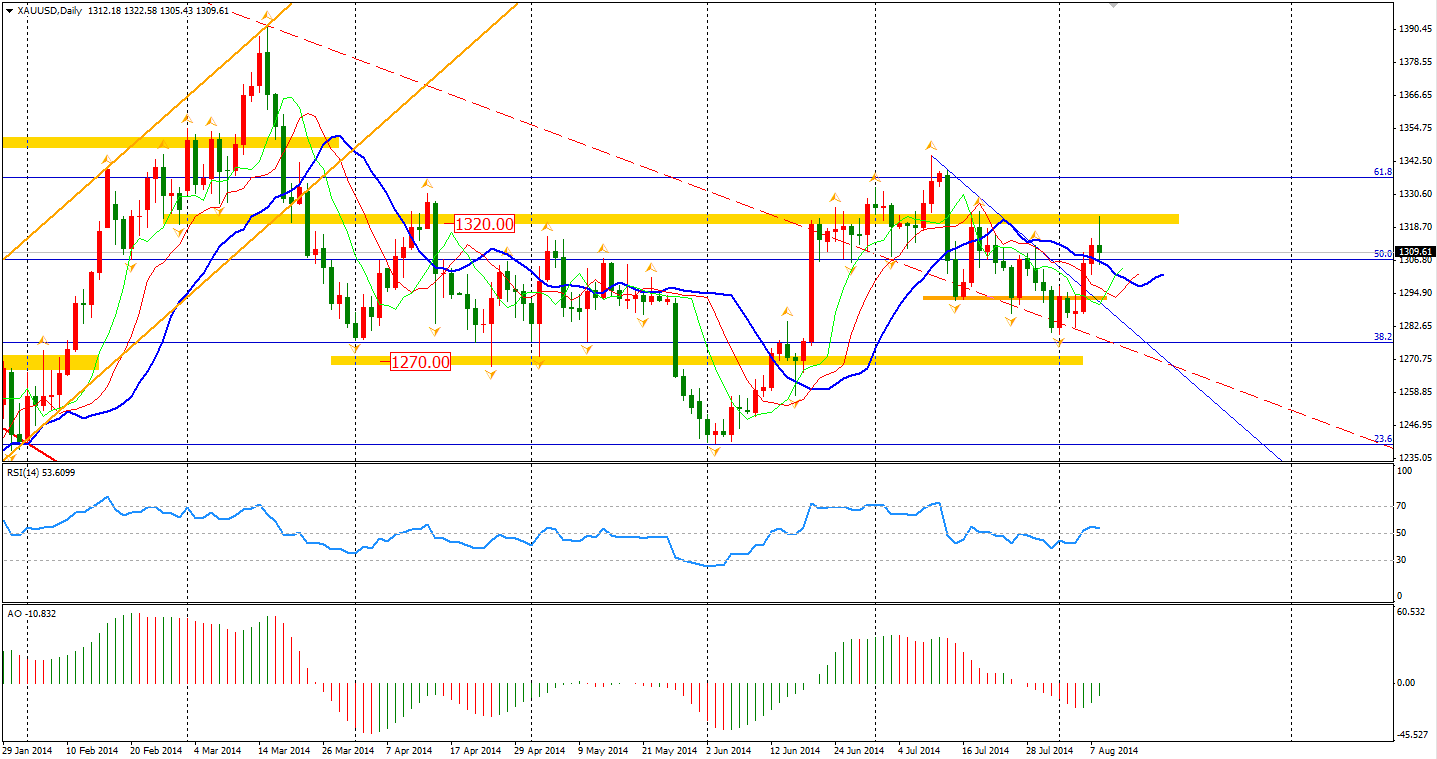

Gold prices rocketed to $1322 per ounce on Friday after Obama’s nod to airstrikes. However, the surge was erased in the U.S. session as investors started to worry about the possibility of sooner-than-expected rise in U.S. interest rates. The prices finally closed at $1310, leaving a long upper shadow in the daily chart. Chances are that the $1320 resistance will be broken if tensions in Ukraine and Iraq escalate.

Most of the Asian stocks markets were under pressure after the U.S. declared airstrikes on North Iraq. The Shanghai Composite bounced 0.31% to 2194. The Nikkei Stock Average plummeted 2.98% for a stronger Yen. The Australian ASX 200 fell 1.34% to 5435 as RBA lowered its economic outlook. In the European stock markets, the FTSE closed 0.45% lower, the German DAX lost 0.33%, and the French CAC Index closed flat. U.S. stocks rebounded with the fears of Ukraine and the troubled Portuguese bank temporarily died down. The Dows surged 1.13% to 16553. The S&P 500 gained 1.15% to 1932, while the Nasdaq Composite Index was up 0.83% to 4371.

Little economic data out today. Switzerland will release its Retail Sales and Canada Housing Starts will be out at 22:15 AEST.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.