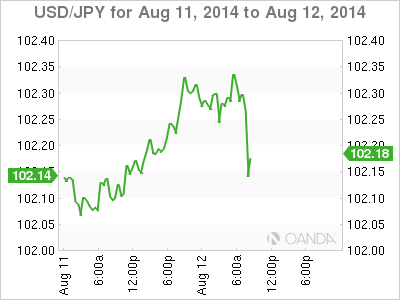

The Japanese yen is flat on Tuesday, as the pair trades slightly above the 102 line late in the European session. In economic news, today's US highlight is JOLTS Job Openings, with the markets expecting a strong reading. In Japan, Revised Industrial Production posted a sharp decline of 3.4%, well short of expectations. Later in the day, we'll get a look at GDP, one of the most important economic indicators, as well as the minutes of the last BOJ policy meeting.

Is the Japanese manufacturing sector in trouble? Japanese manufacturing indicators continue to post declines this week. Tertiary Industry Activity came in at -0.1%, short of the estimate of a 0.2% gain. Revised Industrial Production dropped 3.4% last month, its steepest fall since October 2012. Meanwhile, markets eyes on Japanese GDP, which will be released later on Tuesday. The markets are braced for a decline of 1.7%, in Q2, which would mark the first drop in economic activity since Q4 of 2012. Traders should be prepared for the yen to lose ground if GDP posts a weak reading.

In the US, employment indicators are under the market microscope, as the strength of the labor market is one of the most important factors influencing the Federal Reserve regarding the timing of an interest rate hike. A rate hike is expected by mid-2015, but stronger economic data, especially on the employment front, could hasten a rate move. We'll get a look at JOLTS Jobs Openings later on Tuesday. The indicator has been on an upswing and exceeded the estimate in the past two releases. Another rise is expected in the July release, with the estimate standing at 4.74 million.

USD/JPY 102.17 H: 102.28 L: 102.14

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.