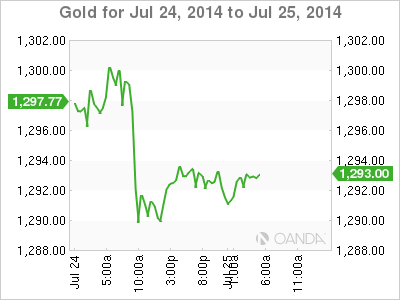

Gold remains under the key level of $1300, as the spot price stands at $1293.13 per ounce late the European session. The metal has now slipped about 2% in the past week. On the release front, it's a quiet day, highlighted by Core Durable Goods Orders. The markets are expecting a healthy gain after a decline in the May release. On Thursday, US Unemployment Claims sparkled but New Home Sales were well short of expectations.

Unemployment Claims tumbled last week, as the key indicator fell to 298 thousand, its lowest level since February 2008. This surprised the markets, which had expected a reading of 301 thousand. The strong release continues a string of solid employment data, and the dollar could get a boost from the good news. As well, good news on the employment front is bound to increase speculation about a rate increase by the Federal Reserve.

US housing data was dismal on Thursday, as New Home Sales slumped to a three-month low. The key indicator fell to 406 thousand, compared to 504 thousand in the previous release. The markets were way off in their forecast, with an estimate of 485 thousand. There was much better news earlier in the week, as Existing Home Sales jumped to 5.04 million, surpassing the estimate of 4.94 million. This was the best showing we've seen since October.

XAU/USD 1293.13 H: 1294.51 L: 1290.80

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.