EUR/USD is showing little movement on Monday, as the pair trades in the low-1.35 range in the European session. Investors are in a cautious mood to start off the week, as tensions rise in the Ukraine and the fighting in Gaza shows no signs of letting up. On the release front, it's a very quiet day, with no US releases on the schedule. In the Eurozone, German PPI continues to look weak, posting a reading of 0.0%. As well, the German central bank releases its monthly report.

International trouble spots are in the headlines, as nervous investors keep an eye on events Ukraine and the Middle East. Last week's downing of a Malaysian Airlines jet, apparently by pro-Russian separatists, has seriously frayed relations between Europe and the US with Russia, which have already been strained since the latter annexed Crimea. The Europeans are threatening stronger sanctions against Russia, and escalating tensions within Europe does not bode well for the euro. Meanwhile, the fighting in Gaza between Hamas and Israel continues. Casualties have been mounting on both sides, as the fighting enters its third week.

On Friday, US Consumer Sentiment remained steady at 81.3 points, but this was well below the estimate of 83.5 points. A day earlier, Unemployment Claims dropped slightly to 302 thousand, beating the estimate of 310 thousand. This figure marks a seven-week low, as the economy continues to churn out impressive employment data. With Janet Yellen telling Congress that a rate hike could be pushed forward if inflation and employment data exceeds expectations, improving employment data will put more pressure on the Fed to raise rates.

Federal Reserve Chair Janet Yellen concluded two days of testimony on Capitol Hill on Wednesday, testifying before the House Financial Services Committee. Yellen declined to answer questions about when the Fed would begin to raise rates, but she did acknowledge that most economists expect the Fed to make a move in the third quarter of 2015. On Tuesday, the dollar moved higher when Yellen said that the economy still required monetary stimulus, but rates could increase sooner than expected if inflation and job numbers improved more quickly than anticipated. The Federal Reserve's asset purchase program (QE) has flooded the economy with over $2 trillion, keeping interest rates at ultra-low levels, but the Fed has been trimming the program since last December, when it stood at $85 billion/month. Currently, the Fed is pumping $45 billion/month into the economy, and the next taper is expected in August, with plans to terminate QE in October.

Eurozone CPI, the primary gauge of consumer inflation, remained unchanged in June, posting a gain of 0.5%. This matched the estimate, and EUR/USD did not react to the reading. Core CPI, which excludes volatile items, looked even better, climbing 0.8%. This also matched the forecast. Meanwhile, German ZEW Economic Sentiment, a highly regarded survey of institutional investors and analysts slipped to 27.1 points, short of the estimate of 28.9 points. The indicator has been falling steadily since last November, when it was above the 60-point level. The June figure is the weakest we've seen since November 2012. Eurozone ZEW Economic Sentiment brought no relief, as it plunged to 48.1 points, down from 58.4 a month earlier. The estimate stood at 62.3 points. These weak numbers have further raised concerns about the health of the German and Eurozone economies, and the euro could lose more ground if the markets don't see an improvement in Eurozone data.

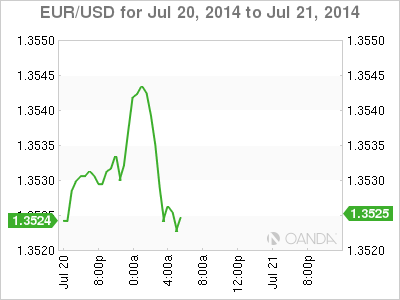

EUR/USD 1.3528 H: 1.3549 L: 1.3519

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.